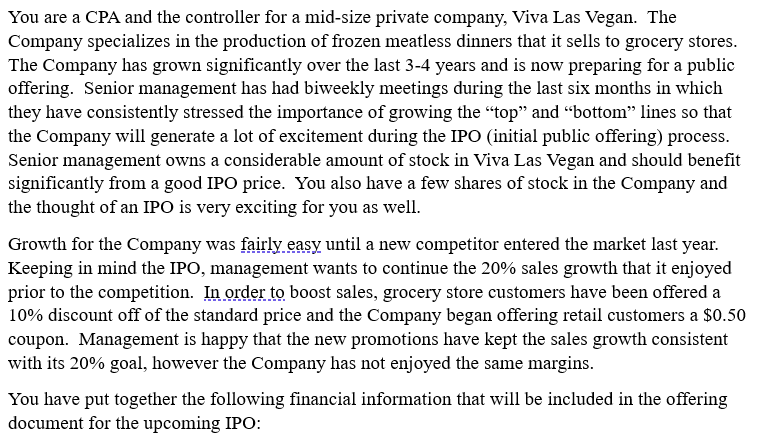

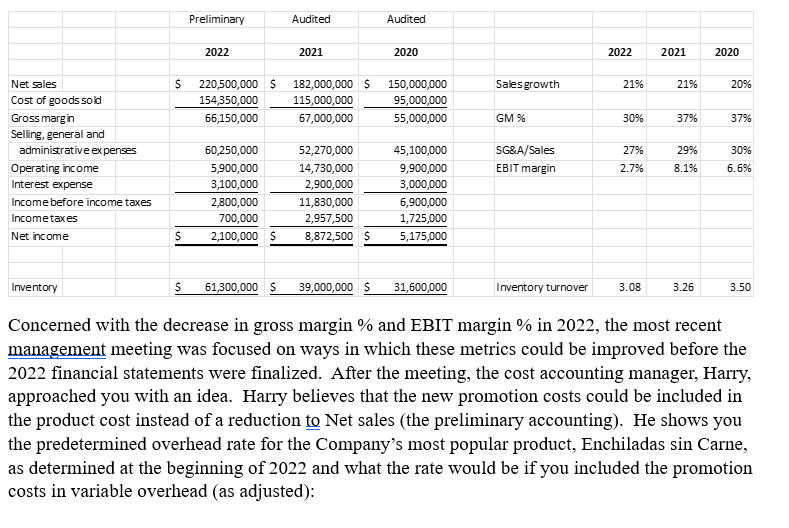

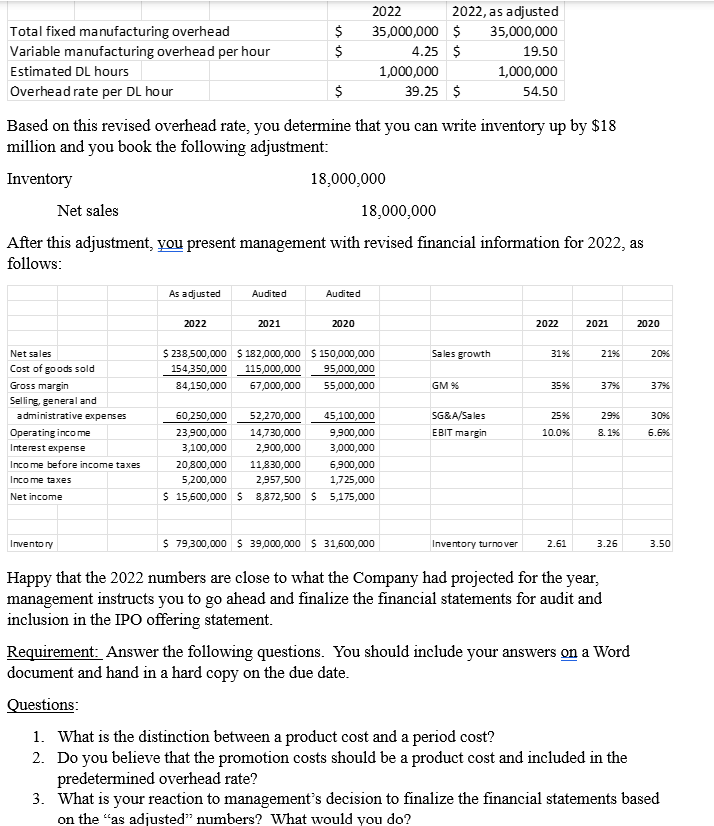

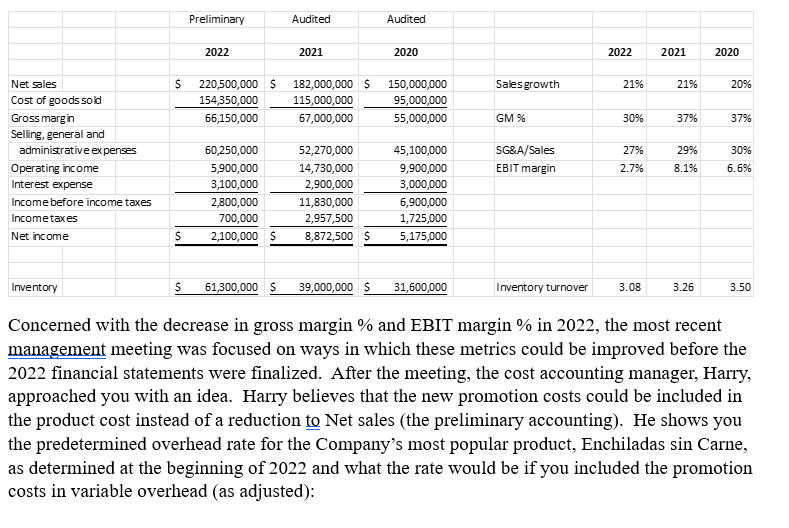

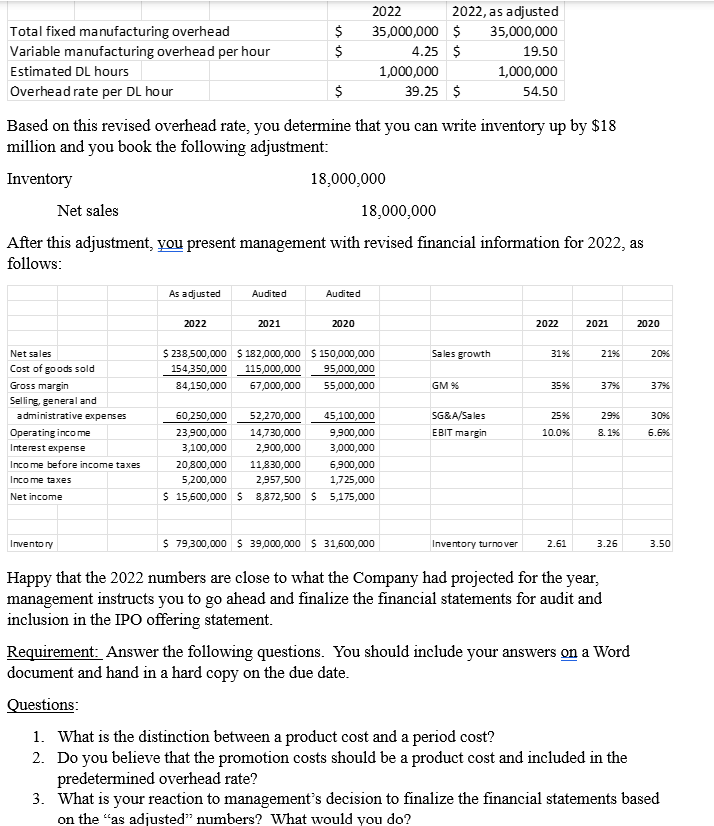

You are a CPA and the controller for a mid-size private company, Viva Las Vegan. The Company specializes in the production of frozen meatless dinners that it sells to grocery stores. The Company has grown significantly over the last 3-4 years and is now preparing for a public offering. Senior management has had biweekly meetings during the last six months in which they have consistently stressed the importance of growing the "top" and "bottom" lines so that the Company will generate a lot of excitement during the IPO (initial public offering) process. Senior management owns a considerable amount of stock in Viva Las Vegan and should benefit significantly from a good IPO price. You also have a few shares of stock in the Company and the thought of an IPO is very exciting for you as well. Growth for the Company was fairly_easy until a new competitor entered the market last year. Keeping in mind the IPO, management wants to continue the 20% sales growth that it enjoyed prior to the competition. In order to boost sales, grocery store customers have been offered a 10% discount off of the standard price and the Company began offering retail customers a $0.50 coupon. Management is happy that the new promotions have kept the sales growth consistent with its 20% goal, however the Company has not enjoyed the same margins. You have put together the following financial information that will be included in the offering document for the upcoming IPO: Concerned with the decrease in gross margin \% and EBIT margin \% in 2022 , the most recent management meeting was focused on ways in which these metrics could be improved before the 2022 financial statements were finalized. After the meeting, the cost accounting manager, Harry, approached you with an idea. Harry believes that the new promotion costs could be included in the product cost instead of a reduction to Net sales (the preliminary accounting). He shows you the predetermined overhead rate for the Company's most popular product, Enchiladas sin Carne, as determined at the beginning of 2022 and what the rate would be if you included the promotion costs in variable overhead (as adjusted): Based on this revised overhead rate, you determine that you can write inventory up by $18 million and you book the following adjustment: Inventory 18,000,000 Net sales 18,000,000 After this adjustment, you present management with revised financial information for 2022 , as follows: Happy that the 2022 numbers are close to what the Company had projected for the year, management instructs you to go ahead and finalize the financial statements for audit and inclusion in the IPO offering statement. Requirement: Answer the following questions. You should include your answers on a Word document and hand in a hard copy on the due date. Questions: 1. What is the distinction between a product cost and a period cost? 2. Do you believe that the promotion costs should be a product cost and included in the predetermined overhead rate? 3. What is your reaction to management's decision to finalize the financial statements based on the "as adjusted" numbers? What would you do