Answered step by step

Verified Expert Solution

Question

1 Approved Answer

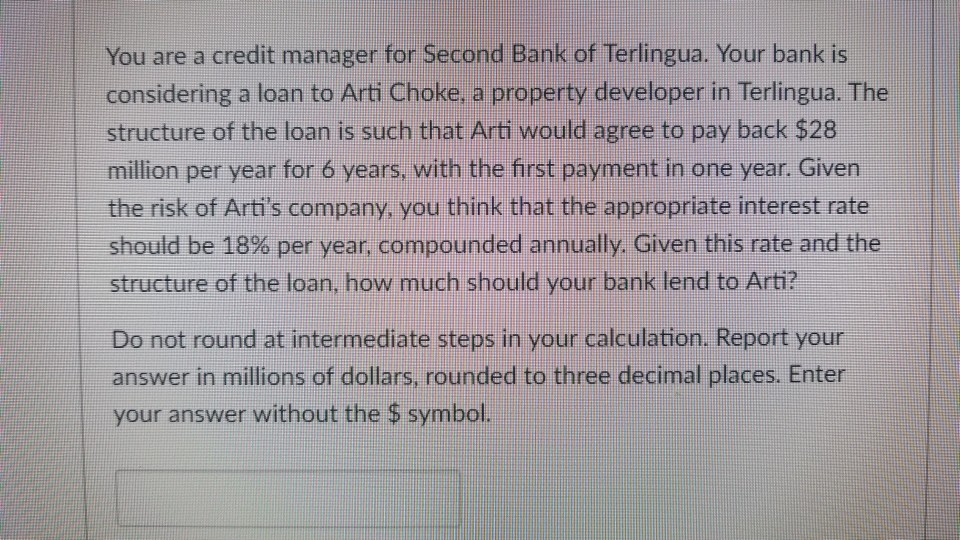

You are a credit manager for Second Bank of Terlingua. Your bank is considering a loan to Arti Choke, a property developer in Terlingua. The

You are a credit manager for Second Bank of Terlingua. Your bank is considering a loan to Arti Choke, a property developer in Terlingua. The structure of the loan is such that Arti would agree to pay back $28 million per year for 6 years, with the first payment in one year. Given the risk of Arti's company, you think that the appropriate interest rate should be 18% per year, compounded annually. Given this rate and the structure of the loan, how much should your bank lend to Arti? Do not round at intermediate steps in your calculation. Report your answer in millions of dollars, rounded to three decimal places. Enter your answer without the $ symbol

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started