Question

You are a manufacturer who uses Commodity X as an input in your manufacturing process. In order to hedge your risk for the next month,

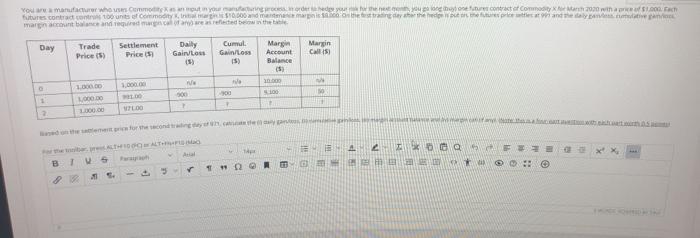

You are a manufacturer who uses Commodity X as an input in your manufacturing process. In order to hedge your risk for the next month, you go long (buy) one futures contract of Commodity X for March 2020 with a price of $1,000. Each futures contract controls 100 units of Commodity X. Initial margin is $10,000 and maintenance margin is $8,000. On the first trading day after the hedge is put on, the futures price settles at 991 and the daily gain/loss, cumulative gain/loss, margin account balance and required margin call (if any) are as reflected below in the table.

| Day | Trade Price ($) | Settlement Price ($) | Daily Gain/Loss ($) | Cumul. Gain/Loss ($) | Margin Account Balance ($) | Margin Call ($) |

| 0 | 1,000.00 | 1,000.00 | n/a | n/a | 10,000 | n/a |

| 1 | 1,000.00 | 991.00 | -900 | -900 | 9,100 | $0 |

| 2 | 1,000.00 | 971.00 | ? | ? | ? | ? |

Based on the settlement price for the second trading day of 971, calculate the (i) daily gain/loss, (ii) cumulative gain/loss, (iii) margin account balance and (iv) margin call (if any).

You are manufacturer who was commin your hour contract of Commodity Motovt.co. futures contract contre toutes et commodity 10.000 de leite estrate the home for protestante de man ant balance and corrected with Day Trade Prices Settlement Price Daily Gairloss Cumul Gain/Loss Margir Account Balance (5) Margin CS) 1.000.00 w we 1.000.00 0000 1 1 TO w the price for contra RO x x B 8 You are manufacturer who was commin your hour contract of Commodity Motovt.co. futures contract contre toutes et commodity 10.000 de leite estrate the home for protestante de man ant balance and corrected with Day Trade Prices Settlement Price Daily Gairloss Cumul Gain/Loss Margir Account Balance (5) Margin CS) 1.000.00 w we 1.000.00 0000 1 1 TO w the price for contra RO x x B 8Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started