Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a partner in a small bakery that sells a variety of bread, rolls, cookies, and donuts. After reading Onward by Howard Schultz, you

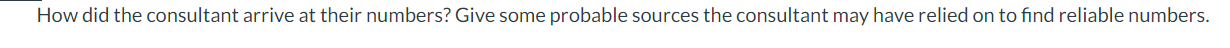

You are a partner in a small bakery that sells a variety of bread, rolls, cookies, and donuts. After reading Onward by Howard Schultz, you fall in love the idea of making the bakery more than just a store. Instead, you want the bakery to be a place where people gather and build community. To do this, you look into the option of adding indoor and outdoor seating as well as a commercial coffee machine. You pitch the idea to the other partners and insist that it will likely be good for business as well. The partners want to see some numbers before they agree. They agree to let you use $1,500 to hire a consultant to help you put the numbers together. The partners expect a 12% return on investment (Cost of Capital). Since this is a partnership, we will not worry about Taxes and Depreciation. Here are the other relevant numbers: - Cost of commercial coffee maker =$5,000; Cost of adding seating =$10,000 - Life span is on average 10 years with no salvage value - No opportunity costs but will complement current products. Estimated $2,500 increase in cash flows from sale of bakery items each year. - Expect to Sell 15,000 cups of coffee in year 1. This should grow to 18,000 in year 2; 21,000 in year 3, and plateau at 24,000 in year 4. - In year 1 , a cup of coffee will sell for $2.00 with the expectation of increasing the price by 3% per year. - In year 1, the cost to the bakery of a cup of coffee is estimated at 40$/ cup with the expectation of a 3% increase in the cost per year. - Staffing will need to be increased. This is a fixed cost and estimated at \$30,000 for year 1 with a 3% increase per year. - Working Capital as a percent of next year's sales is estimated at 10%. You plug all the numbers into a handy spreadsheet (click here to download and use Mini Case sheets) and see the the MIRR is 20.76% with an NPV of $24,443.45. You are very happy with the results, but your partners have questions. How did the consultant arrive at their numbers? Give some probable sources the consultant may have relied on to find reliable numbers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started