Question

You are a Product Manager for your company. Your VP of Sales requested that you drop the price for your product by 20%. This is

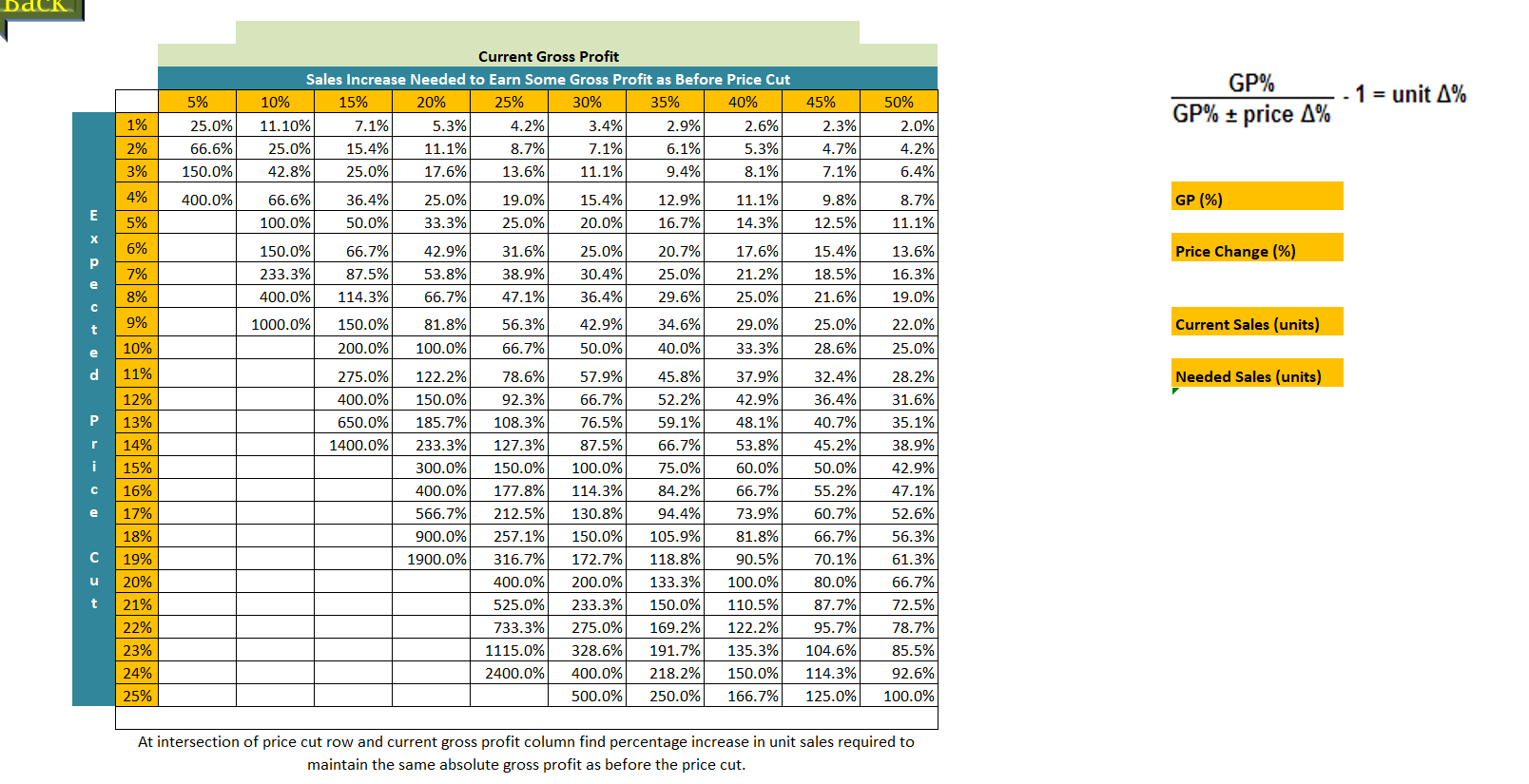

You are a Product Manager for your company. Your VP of Sales requested that you drop the price for your product by 20%. This is necessary, according to your VP, to combat a new competitor entering your market. The long standing policy of your firm is that any price reductions have to be Gross Profit ($) neutral. In other words, they cannot affect the $ value of the Gross Profit. The current Gross Margin is 50%.

Gross Margin = (Revenue - Cost of Goods Sold)/Revenue

The most recent market research shows that your company has 50% market share. The remaining share is equally divided between two other competitors. It also estimates that the market for your products grows at the rate of 10% per year.

Currently, your manufacturing plant works at 80% of capacity. That is, it produces 120,000 units per year. All units that are produced are sold.

1. Should you comply with your VPs request? Why or why not? Support your answer using numerical values.

2. From the table 1: the required increase in unit sales is____________

3. The company has to sell _______units to justify the proposed price drop.

4. The total production capacity is ___________ units at 100% utilization.

5. There is a need to produce _________ more/less units.

Table 1:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started