Answered step by step

Verified Expert Solution

Question

1 Approved Answer

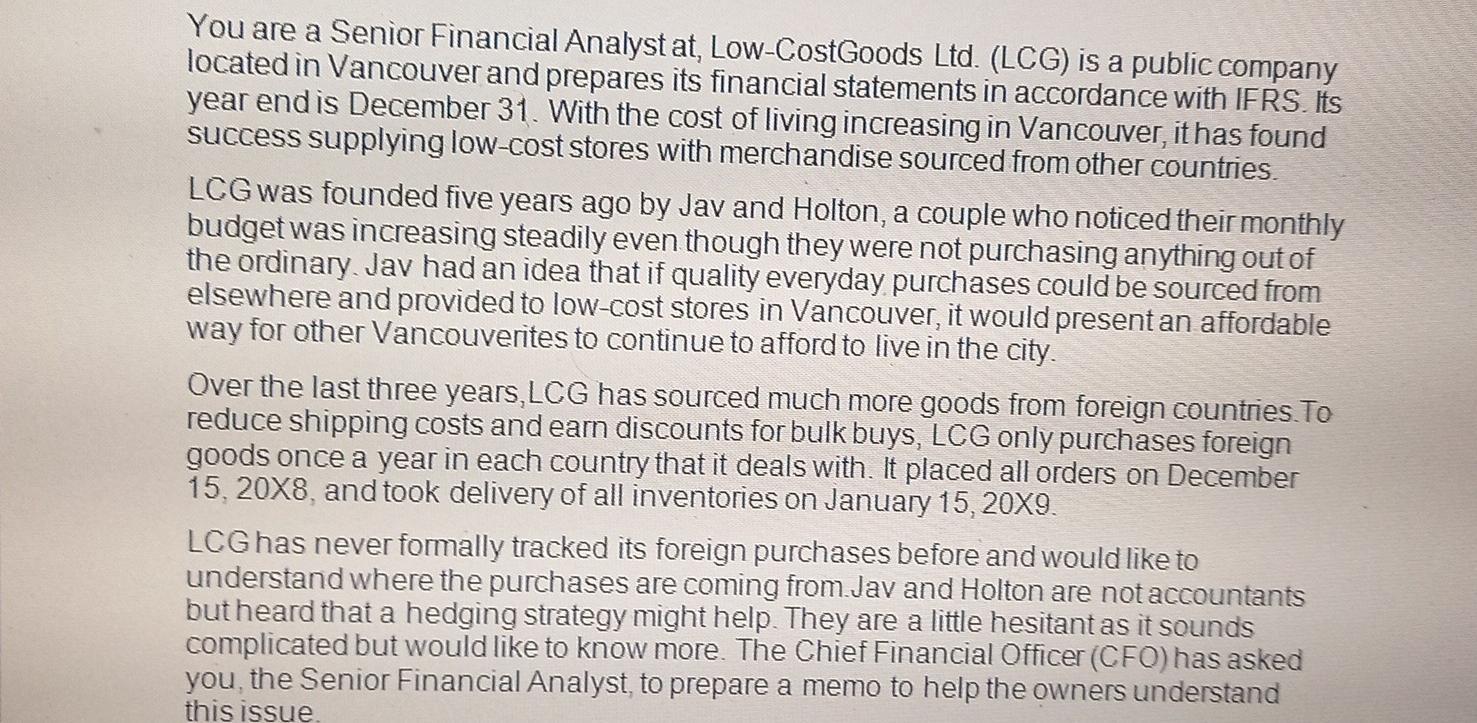

You are a Senior Financial Analyst at, Low-CostGoods Ltd. (LCG) is a public company located in Vancouver and prepares its financial statements in accordance

You are a Senior Financial Analyst at, Low-CostGoods Ltd. (LCG) is a public company located in Vancouver and prepares its financial statements in accordance with IFRS. Its year end is December 31. With the cost of living increasing in Vancouver, it has found success supplying low-cost stores with merchandise sourced from other countries. LCG was founded five years ago by Jav and Holton, a couple who noticed their monthly budget was increasing steadily even though they were not purchasing anything out of the ordinary. Jav had an idea that if quality everyday purchases could be sourced from elsewhere and provided to low-cost stores in Vancouver, it would present an affordable way for other Vancouverites to continue to afford to live in the city. Over the last three years, LCG has sourced much more goods from foreign countries. To reduce shipping costs and earn discounts for bulk buys, LCG only purchases foreign goods once a year in each country that it deals with. It placed all orders on December 15, 20X8, and took delivery of all inventories on January 15, 20X9. LCG has never formally tracked its foreign purchases before and would like to understand where the purchases are coming from Jav and Holton are not accountants but heard that a hedging strategy might help. They are a little hesitant as it sounds complicated but would like to know more. The Chief Financial Officer (CFO) has asked you, the Senior Financial Analyst, to prepare a memo to help the owners understand this issue. ions. a. Summarizethe business transactions you've analyzed for Jav and Holton, they wanted to understand where the purchases are coming from. Remember to explain risks associated with foreign currency transactions, and how that might impact financial statements (be specific, which financial statements). b. Explain a hedging strategy to Jav and Holton, what instrument(s) they could use. You have provided them with a table showing the difference between spot rate and settlement rate, but remember they are not accountants so remember you'll need to explain items like this. You can use the data you have as an example. c. Identify the currency you believe to be the highest priority for Jav and Holton to attempt hedging and explain why. Recipient names Whoever You Are Recipient names To: From: CC: Date: Date Subject: Topic of Memo MEMO TEMPLATE This is the content of your memo. You can break up the subject that you are addressing using headers.

Step by Step Solution

★★★★★

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

To Jav and Holton From Senior Financial Analyst CC Chief Financial Officer Date Subject Hedging Strategy for Foreign Currency Transactions Jav and Holton This memo is in response to the request to und...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started