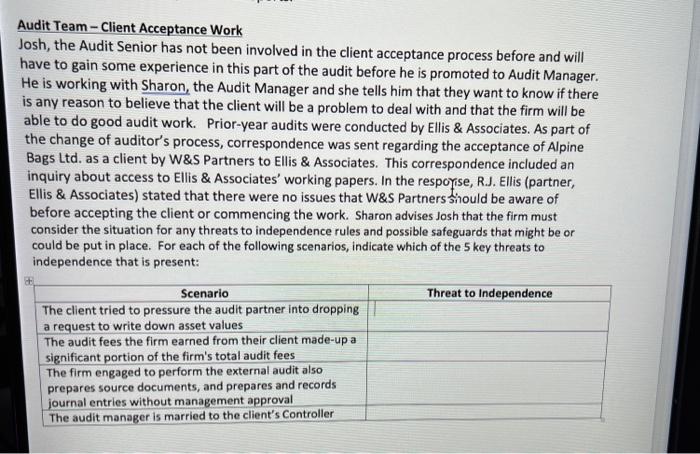

You are an accounting graduate working for W\&S Partners, a Canadian accounting firm with offices located in each of the major Canadian cities. W\&S Partners has recently been approached to perform the external audit work for Alpine Bags Ltd. The audit team assigned to the client is: Partner, J.M. Wadley; Audit Manager, Sharon Gallagher; Audit Senior, Josh Thomas; and IT Audit Manager, Mark Batten. Alpine Bags - Company Background: Founded in 1980 by Ron McLellan, the Toronto-based company was a manufacturer and retailer of rugged, durable backpacks designed for active climbers. In 1993, Alpine Bags Inc. (a publicly listed Canadian company) purchased the original company from Ron McLellan and renamed it Alpine Bags Ltd. As part of the sale agreement, Ron McLellan was appointed to the Alpine Bags Ltd. board of directors. The parent company, Alpine Bags Inc., has wholly owned subsidiaries in the United States, the United Kingdom (UK), Germany, China, and Brazil, and has built a reputation around the fact that its bags are both stylish and durable. The company promotes itself using its well-known tagline "Our bags are so durable, it's the only one you'll ever need." Alpine Bags Ltd. is primarily a wholesaler of backpacks to its main customers: David Jones, Myer, Foot Locker, and Rebel Sports. Audit Team - Client Acceptance Work Josh, the Audit Senior has not been involved in the client acceptance process before and will have to gain some experience in this part of the audit before he is promoted to Audit Manager. He is working with Sharon, the Audit Manager and she tells him that they want to know if there is any reason to believe that the client will be a problem to deal with and that the firm will be able to do good audit work. Prior-year audits were conducted by Ellis \& Associates. As part of the change of auditor's process, correspondence was sent regarding the acceptance of Alpine Bags Ltd. as a client by W\&S Partners to Ellis \& Associates. This correspondence included an inquiry about access to Ellis \& Associates' working papers. In the respoyise, R.J. Ellis (partner, Ellis \& Associates) stated that there were no issues that W\&S Partners sitould be aware of before accepting the client or commencing the work. Sharon advises Josh that the firm must consider the situation for any threats to independence rules and possible safeguards that might be or could be put in place. For each of the following scenarios, indicate which of the 5 key threats to independence that is present