Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are an Audit Senior at Audit 4 U Limited ( Audit 4 U ) , which provides various assurance services to clients, such as

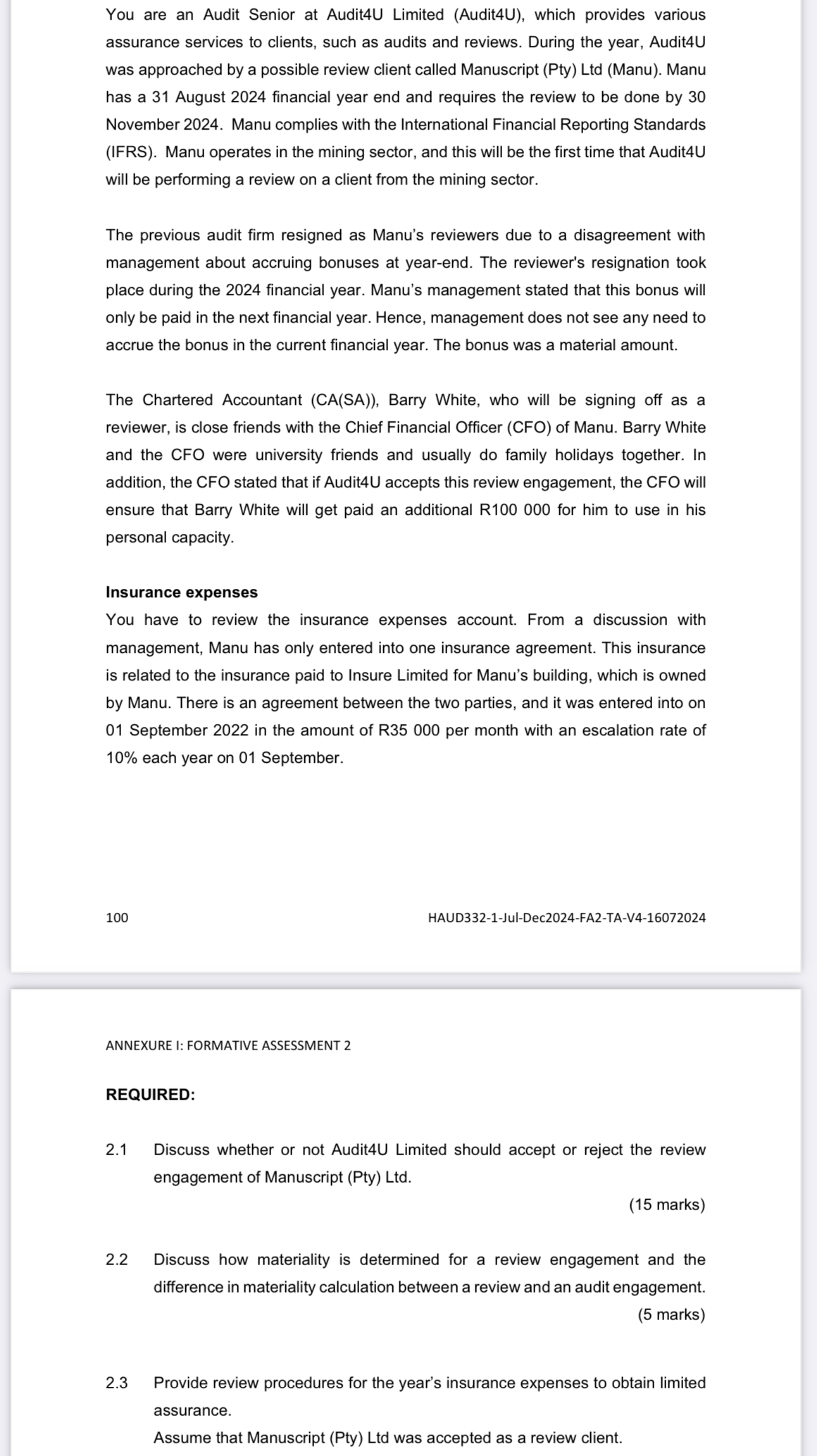

You are an Audit Senior at AuditU Limited AuditU which provides various

assurance services to clients, such as audits and reviews. During the year, AuditU

was approached by a possible review client called Manuscript Pty Ltd Manu Manu

has a August financial year end and requires the review to be done by

November Manu complies with the International Financial Reporting Standards

IFRS Manu operates in the mining sector, and this will be the first time that AuditU

will be performing a review on a client from the mining sector.

The previous audit firm resigned as Manu's reviewers due to a disagreement with

management about accruing bonuses at yearend. The reviewer's resignation took

place during the financial year. Manu's management stated that this bonus will

only be paid in the next financial year. Hence, management does not see any need to

accrue the bonus in the current financial year. The bonus was a material amount.

The Chartered Accountant CASA Barry White, who will be signing off as a

reviewer, is close friends with the Chief Financial Officer CFO of Manu. Barry White

and the CFO were university friends and usually do family holidays together. In

addition, the CFO stated that if AuditU accepts this review engagement, the CFO will

ensure that Barry White will get paid an additional R for him to use in his

personal capacity.

Insurance expenses

You have to review the insurance expenses account. From a discussion with

management, Manu has only entered into one insurance agreement. This insurance

is related to the insurance paid to Insure Limited for Manu's building, which is owned

by Manu. There is an agreement between the two parties, and it was entered into on

September in the amount of R per month with an escalation rate of

each year on September.

REQUIRED:

Discuss whether or not AuditU Limited should accept or reject the review

engagement of Manuscript Pty Ltd

Discuss how materiality is determined for a review engagement and the

difference in materiality calculation between a review and an audit engagement.

Provide review procedures for the year's insurance expenses to obtain limited

assurance.

Assume that Manuscript Pty Ltd was accepted as a review client.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started