Question

You are an up-and-coming tax associate at the Einstein accounting firm in Los Altos, California. Recently, your partner, Thomas Edison asked you to prepare the

You are an up-and-coming tax associate at the Einstein accounting firm in Los Altos, California. Recently, your partner, Thomas Edison asked you to prepare the Federal tax return for a company founded by an old friend ‐ Einsteins Firm

Einsteins Firm was formed in 1992 by Steve Jobs and Stephen Wozniak. Steve and Stephen officially incorporated their business on April 1, 1976. Einsteins Firm sells miniature architectural models, blue French horns, and the Sensory Deprivation 5000 (as seen on Shark Tank). Steve owns 60% of the outstanding common stock of Einsteins Firm and Stephen owns the remaining 40%.

Einsteins Firm is located at One Infinite Loop, Cupertino, CA 95014. Its employer identification number is 12‐34567 and its business activity code is 453990 ‐ Miscellaneous Retailer. Einsteins Firm uses the accrual method of accounting and has a calendar yearend.

The officers of Einsteins Firm and their social security numbers are:

Name Title SS number

Steve Jobs CEO/President 535‐45‐7892

Stephen Wozniak Executive VP 789‐36‐1277

Ronald Wayne VP 321‐78‐9844

Tim Cook Secretary 411‐65‐7833

1. Interest income includes:

From a City of New York bond of $7,500

From a U.S. Treasury bond $9,375

From a money market account $5,625

2. Miscellaneous expenses include parking fines issued by the City of New York $300

3. Einstein's Firm dividend income came from Goliath National Bank (GNB). Einsteins Firm owned 25,000 shares of the stock in Cardinal at the beginning of the year. This

represented 95% of GNB's outstanding stock.

4. On July 22, 2021 Einsteins Firm sold 2,500 shares of its GNB stock.

Selling price $50,000

Einsteins Firm originally purchased these shares on April 24, 2015, for $61,000

5. Accounts receivable written off by Einsteins Firm during the year were $52,500

6. Warranty claims actually paid during the year are $41,000

7. The corporation uses MACRS depreciation for tax purposes.

The corporation purchased all of its equipment on July 1, 2016.

Einsteins Firm took the maximum amount of §179 depreciation available in 2016

(no bonus depreciation). The equipment is all 7-year property.

Cost of the equipment $1,125,000

8. During the year, Einsteins Firm sold some equipment.

Selling price $18,000

Original purchase price $16,500

Total book depreciation on the equipment $5,550

Total tax depreciation on the equipment is $7,800

9. On December 1, 2021 Einsteins Firm paid a dividend to its shareholders of $120,000

10. Wages to non‐officers are $900,000

11. The corporation paid the following compensation to its officers:

Steve Jobs $337,500

Stephen Wozniak $322,500

Ronald Wayne $217,500

Tim Cook $172,500

12. Einsteins Firm made four equal estimated tax payments: If it has overpaid its federal tax liability, Einsteins Firm would like to receive a refund. $57,750

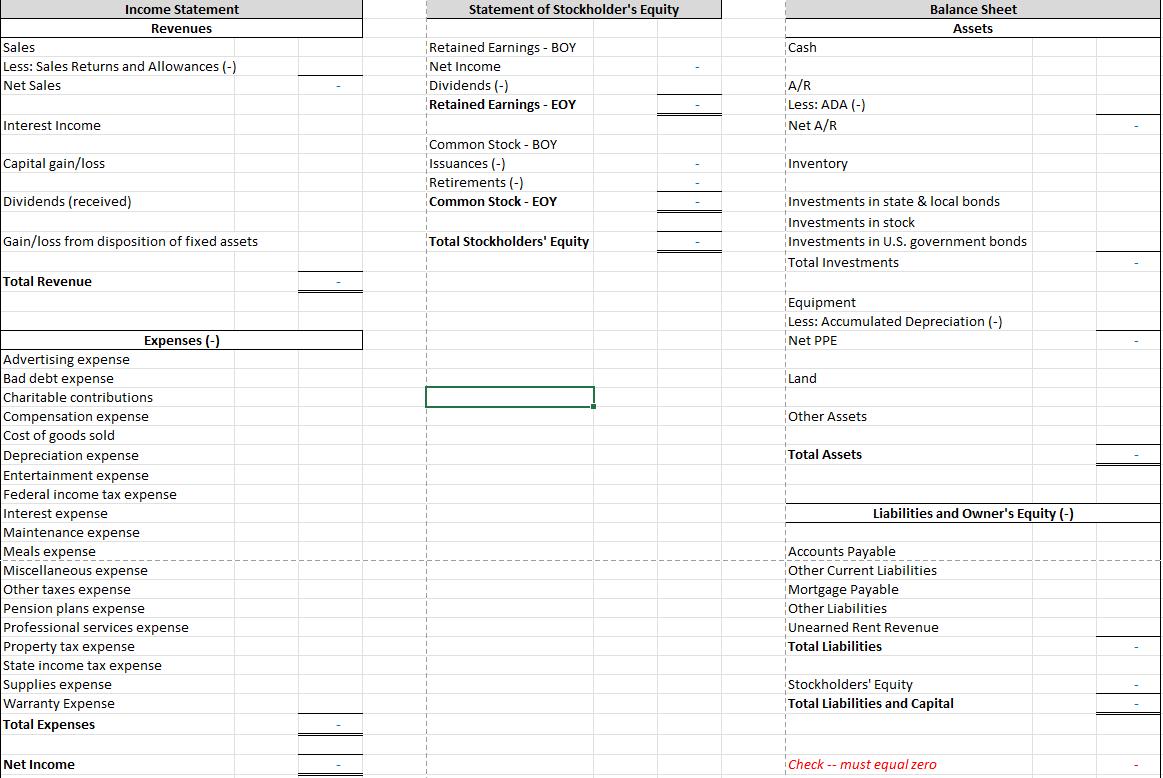

Income Statement Revenues Sales Less: Sales Returns and Allowances (-) Net Sales Interest Income Capital gain/loss Dividends (received) Gain/loss from disposition of fixed assets Total Revenue Expenses (-) Advertising expense Bad debt expense Charitable contributions Compensation expense Cost of goods sold Depreciation expense Entertainment expense Federal income tax expense Interest expense Maintenance expense Meals expense Miscellaneous expense Other taxes expense Pension plans expense Professional services expense Property tax expense State income tax expense Supplies expense Warranty Expense Total Expenses Net Income Statement of Stockholder's Equity Retained Earnings - BOY Net Income Dividends (-) Retained Earnings - EOY Common Stock - BOY Issuances (-) Retirements (-) Common Stock - EOY Total Stockholders' Equity Balance Sheet Assets Cash A/R Less: ADA (-) Net A/R Inventory Investments in state & local bonds Investments in stock Investments in U.S. government bonds Total Investments Equipment Less: Accumulated Depreciation (-) Net PPE Land Other Assets Total Assets Accounts Payable Other Current Liabilities. Mortgage Payable Other Liabilities Unearned Rent Revenue Total Liabilities Stockholders' Equity Total Liabilities and Capital Check -- must equal zero Liabilities and Owner's Equity (-)

Step by Step Solution

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

income statement interest revenue interest on bond 7500 interest on treasury stock 9375 interest ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started