Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are analyzing three hypothetical companies: SOONER Inc., and AZUSED Co. At the beginning of Year 1, each company buys an identical piece of

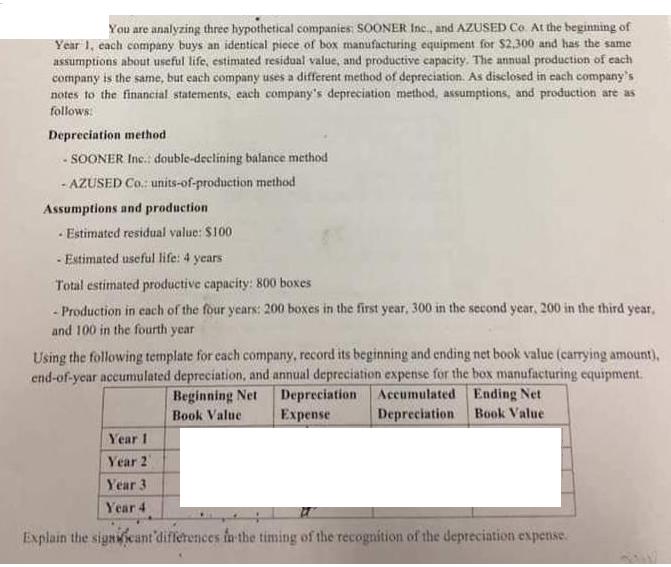

You are analyzing three hypothetical companies: SOONER Inc., and AZUSED Co. At the beginning of Year 1, each company buys an identical piece of box manufacturing equipment for $2,300 and has the same assumptions about useful life, estimated residual value, and productive capacity. The annual production of each company is the same, but each company uses a different method of depreciation. As disclosed in each company's notes to the financial statements, each company's depreciation method, assumptions, and production are as follows: Depreciation method. - SOONER Inc.: double-declining balance method -AZUSED Co.: units-of-production method Assumptions and production - Estimated residual value: $100 - Estimated useful life: 4 years Total estimated productive capacity: 800 boxes - Production in each of the four years: 200 boxes in the first year, 300 in the second year. 200 in the third year, and 100 in the fourth year Using the following template for each company, record its beginning and ending net book value (carrying amount), end-of-year accumulated depreciation, and annual depreciation expense for the box manufacturing equipment. Depreciation Accumulated Ending Net Expense Book Value Beginning Net Book Value Depreciation Year 1 Year 2 Year 3 Year 4 Explain the significant differences in the timing of the recognition of the depreciation expense.

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Step 11 SOONER Inc Beginning Net Book Value 2300 Depreciation Expense Year 1 40 Accumulated Deprecia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started