Question

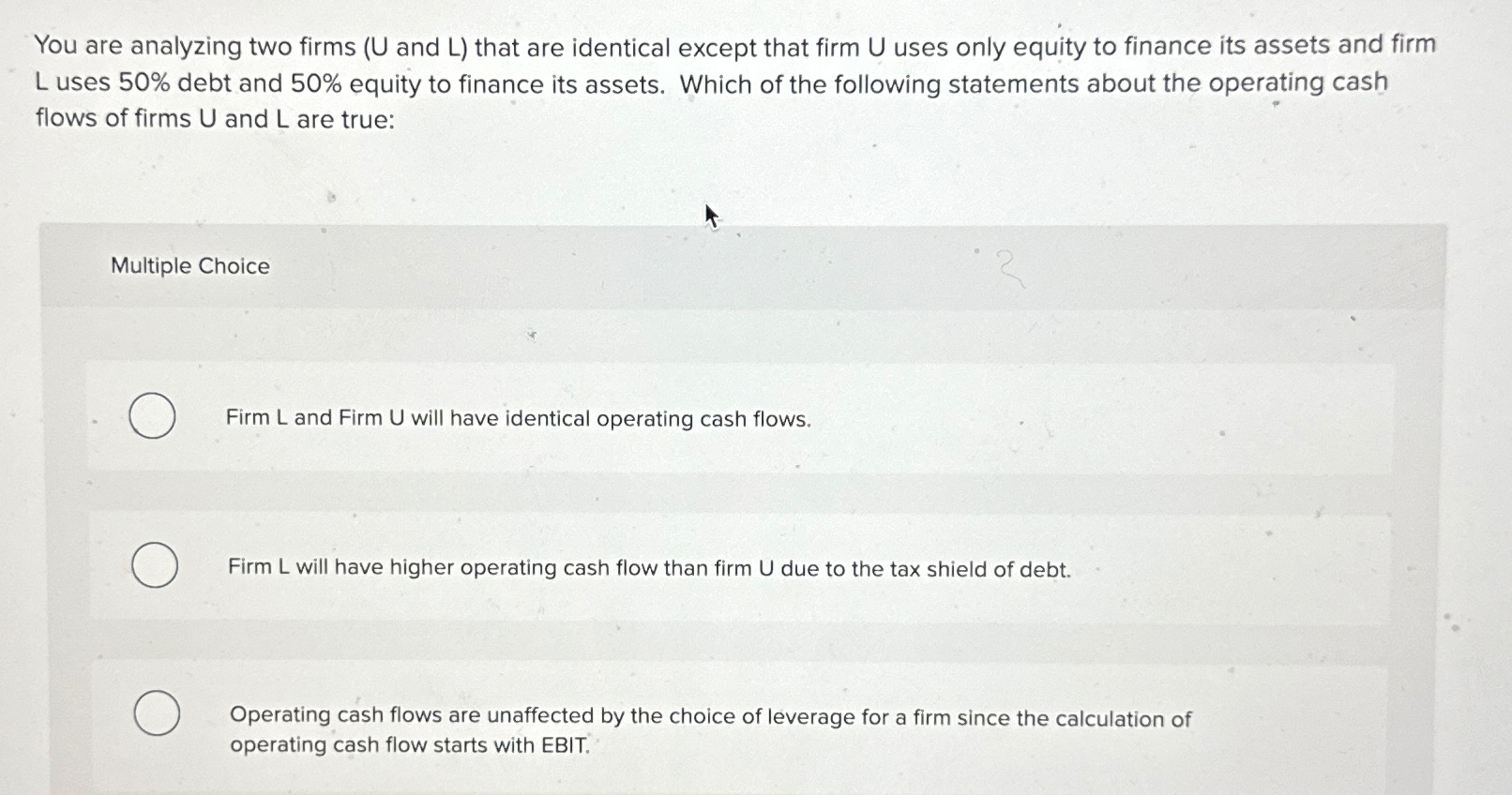

You are analyzing two firms and L that are identical except that firm U uses only equity to finance its assets and firm L uses

You are analyzing two firms and

Lthat are identical except that firm

Uuses only equity to finance its assets and firm L uses

50%debt and

50%equity to finance its assets. Which of the following statements about the operating cash flows of firms

Uand

Lare true:\ Multiple Choice\ Firm

Land Firm

Uwill have identical operating cash flows.\ Firm

Lwill have higher operating cash flow than firm

Udue to the tax shield of debt.\ Operating cash flows are unaffected by the choice of leverage for a firm since the calculation of operating cash flow starts with EBIT.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started