Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are appointed as the financial planning officer of MC manufacturing company. The vice president for finance requested you to prepare the master's budget of

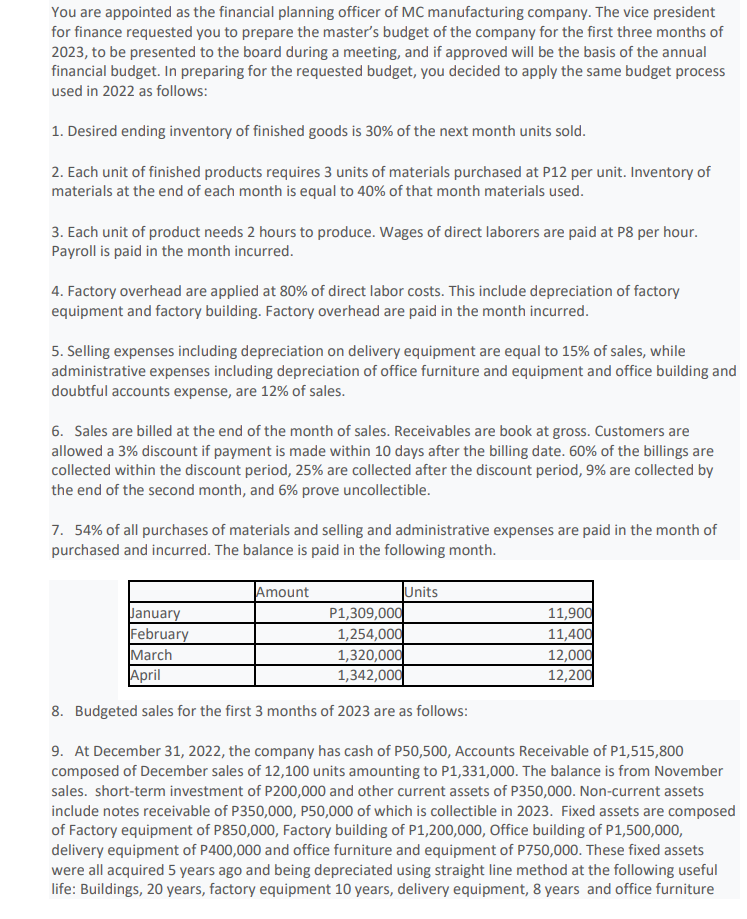

You are appointed as the financial planning officer of MC manufacturing company. The vice president for finance requested you to prepare the master's budget of the company for the first three months of 2023 , to be presented to the board during a meeting, and if approved will be the basis of the annual financial budget. In preparing for the requested budget, you decided to apply the same budget process used in 2022 as follows: 1. Desired ending inventory of finished goods is 30% of the next month units sold. 2. Each unit of finished products requires 3 units of materials purchased at P12 per unit. Inventory of materials at the end of each month is equal to 40% of that month materials used. 3. Each unit of product needs 2 hours to produce. Wages of direct laborers are paid at P8 per hour. Payroll is paid in the month incurred. 4. Factory overhead are applied at 80% of direct labor costs. This include depreciation of factory equipment and factory building. Factory overhead are paid in the month incurred. 5. Selling expenses including depreciation on delivery equipment are equal to 15% of sales, while administrative expenses including depreciation of office furniture and equipment and office building and doubtful accounts expense, are 12% of sales. 6. Sales are billed at the end of the month of sales. Receivables are book at gross. Customers are allowed a 3% discount if payment is made within 10 days after the billing date. 60% of the billings are collected within the discount period, 25% are collected after the discount period, 9% are collected by the end of the second month, and 6% prove uncollectible. 7. 54% of all purchases of materials and selling and administrative expenses are paid in the month of purchased and incurred. The balance is paid in the following month. 8. Budgeted sales for the first 3 months of 2023 are as follows: 9. At December 31, 2022, the company has cash of P50,500, Accounts Receivable of P1,515,800 composed of December sales of 12,100 units amounting to P1,331,000. The balance is from November sales. short-term investment of P200,000 and other current assets of P350,000. Non-current assets include notes receivable of P350,000,P50,000 of which is collectible in 2023. Fixed assets are composed of Factory equipment of P850,000, Factory building of P1,200,000, Office building of P1,500,000, delivery equipment of P400,000 and office furniture and equipment of P750,000. These fixed assets were all acquired 5 years ago and being depreciated using straight line method at the following useful life: Buildings, 20 years, factory equipment 10 years, delivery equipment, 8 years and office furniture and equipment, 10 years. Accounts payable at December 31, 2022 amounted to P133,055. Other current liabilities amount to P180,000. Long-term liabilities totaled P680,000, of which P180,000 is due in 2023. Shares of stock amounted to P2,500,000 at December 31,2022 . The balance of the Shareholders' equity represents Retained Earnings. 10. The vice president for finance sent you a handwritten note asking you to include in the budget a bank loan the proceeds of which will be released in March in the amount of P250,000. Cash dividends of P150,000 is also expected to be paid in February. Required: The master's budget you are going to prepare is composed of the operating budget and the financial budget. 1. Operating Budget 1.1 Sales budget 1.2 Production budget 1.3 Materials Purchase Budget 1.4 Direct labor budget 1.5 Overhead budget 1.6 Operating Expenses budget 1.7 Budgeted cost of goods sold 1.8 Budgeted Income Statement 2. Financial Budget 2.1 Cash Budget 2.2 Budgeted Balance Sheet. Note: As reference in the preparation of the master's budget, you have to prepare first the January 2023 statement of financial position. Make retained earnings as your balancing figure

You are appointed as the financial planning officer of MC manufacturing company. The vice president for finance requested you to prepare the master's budget of the company for the first three months of 2023 , to be presented to the board during a meeting, and if approved will be the basis of the annual financial budget. In preparing for the requested budget, you decided to apply the same budget process used in 2022 as follows: 1. Desired ending inventory of finished goods is 30% of the next month units sold. 2. Each unit of finished products requires 3 units of materials purchased at P12 per unit. Inventory of materials at the end of each month is equal to 40% of that month materials used. 3. Each unit of product needs 2 hours to produce. Wages of direct laborers are paid at P8 per hour. Payroll is paid in the month incurred. 4. Factory overhead are applied at 80% of direct labor costs. This include depreciation of factory equipment and factory building. Factory overhead are paid in the month incurred. 5. Selling expenses including depreciation on delivery equipment are equal to 15% of sales, while administrative expenses including depreciation of office furniture and equipment and office building and doubtful accounts expense, are 12% of sales. 6. Sales are billed at the end of the month of sales. Receivables are book at gross. Customers are allowed a 3% discount if payment is made within 10 days after the billing date. 60% of the billings are collected within the discount period, 25% are collected after the discount period, 9% are collected by the end of the second month, and 6% prove uncollectible. 7. 54% of all purchases of materials and selling and administrative expenses are paid in the month of purchased and incurred. The balance is paid in the following month. 8. Budgeted sales for the first 3 months of 2023 are as follows: 9. At December 31, 2022, the company has cash of P50,500, Accounts Receivable of P1,515,800 composed of December sales of 12,100 units amounting to P1,331,000. The balance is from November sales. short-term investment of P200,000 and other current assets of P350,000. Non-current assets include notes receivable of P350,000,P50,000 of which is collectible in 2023. Fixed assets are composed of Factory equipment of P850,000, Factory building of P1,200,000, Office building of P1,500,000, delivery equipment of P400,000 and office furniture and equipment of P750,000. These fixed assets were all acquired 5 years ago and being depreciated using straight line method at the following useful life: Buildings, 20 years, factory equipment 10 years, delivery equipment, 8 years and office furniture and equipment, 10 years. Accounts payable at December 31, 2022 amounted to P133,055. Other current liabilities amount to P180,000. Long-term liabilities totaled P680,000, of which P180,000 is due in 2023. Shares of stock amounted to P2,500,000 at December 31,2022 . The balance of the Shareholders' equity represents Retained Earnings. 10. The vice president for finance sent you a handwritten note asking you to include in the budget a bank loan the proceeds of which will be released in March in the amount of P250,000. Cash dividends of P150,000 is also expected to be paid in February. Required: The master's budget you are going to prepare is composed of the operating budget and the financial budget. 1. Operating Budget 1.1 Sales budget 1.2 Production budget 1.3 Materials Purchase Budget 1.4 Direct labor budget 1.5 Overhead budget 1.6 Operating Expenses budget 1.7 Budgeted cost of goods sold 1.8 Budgeted Income Statement 2. Financial Budget 2.1 Cash Budget 2.2 Budgeted Balance Sheet. Note: As reference in the preparation of the master's budget, you have to prepare first the January 2023 statement of financial position. Make retained earnings as your balancing figure Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started