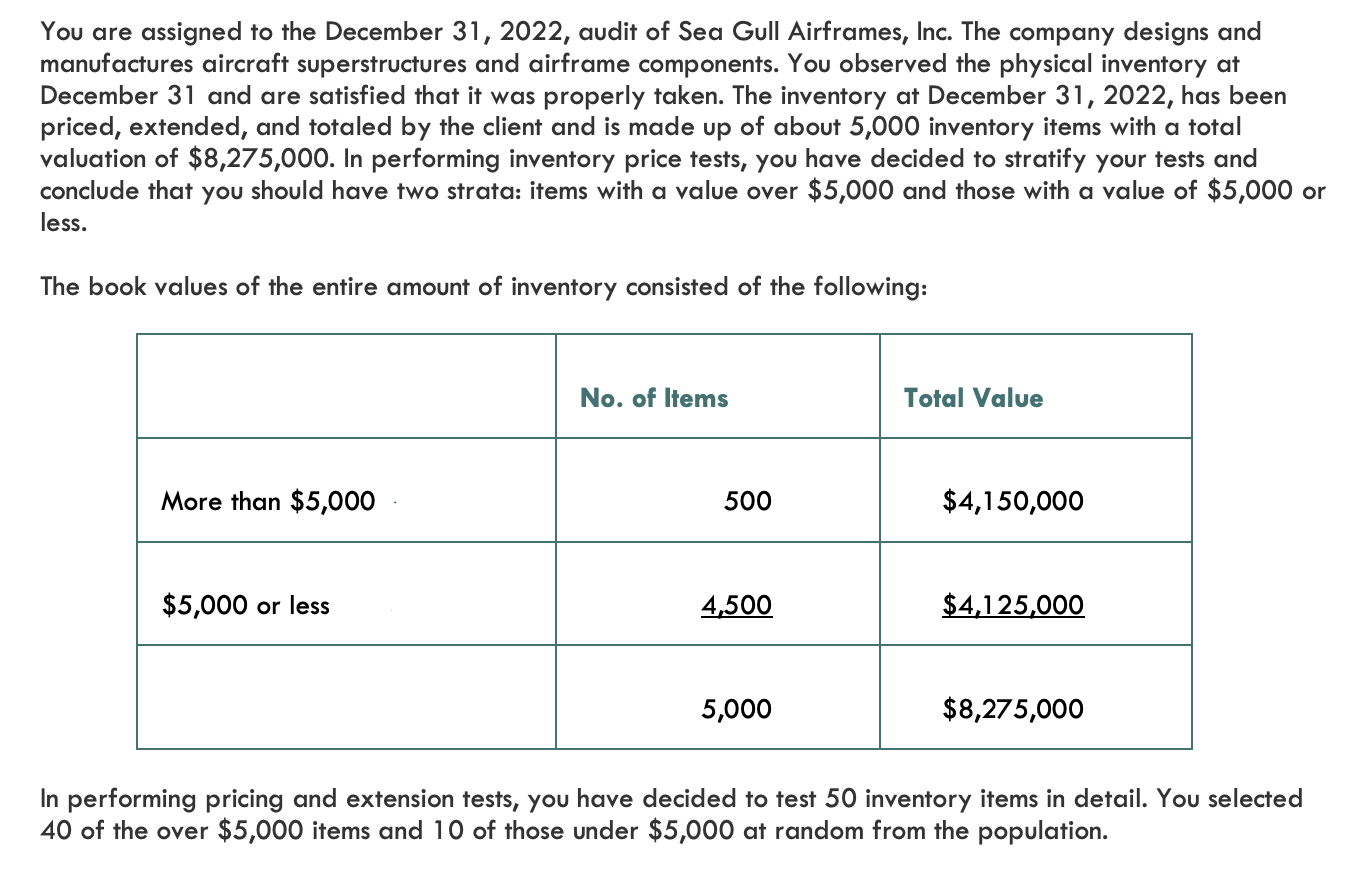

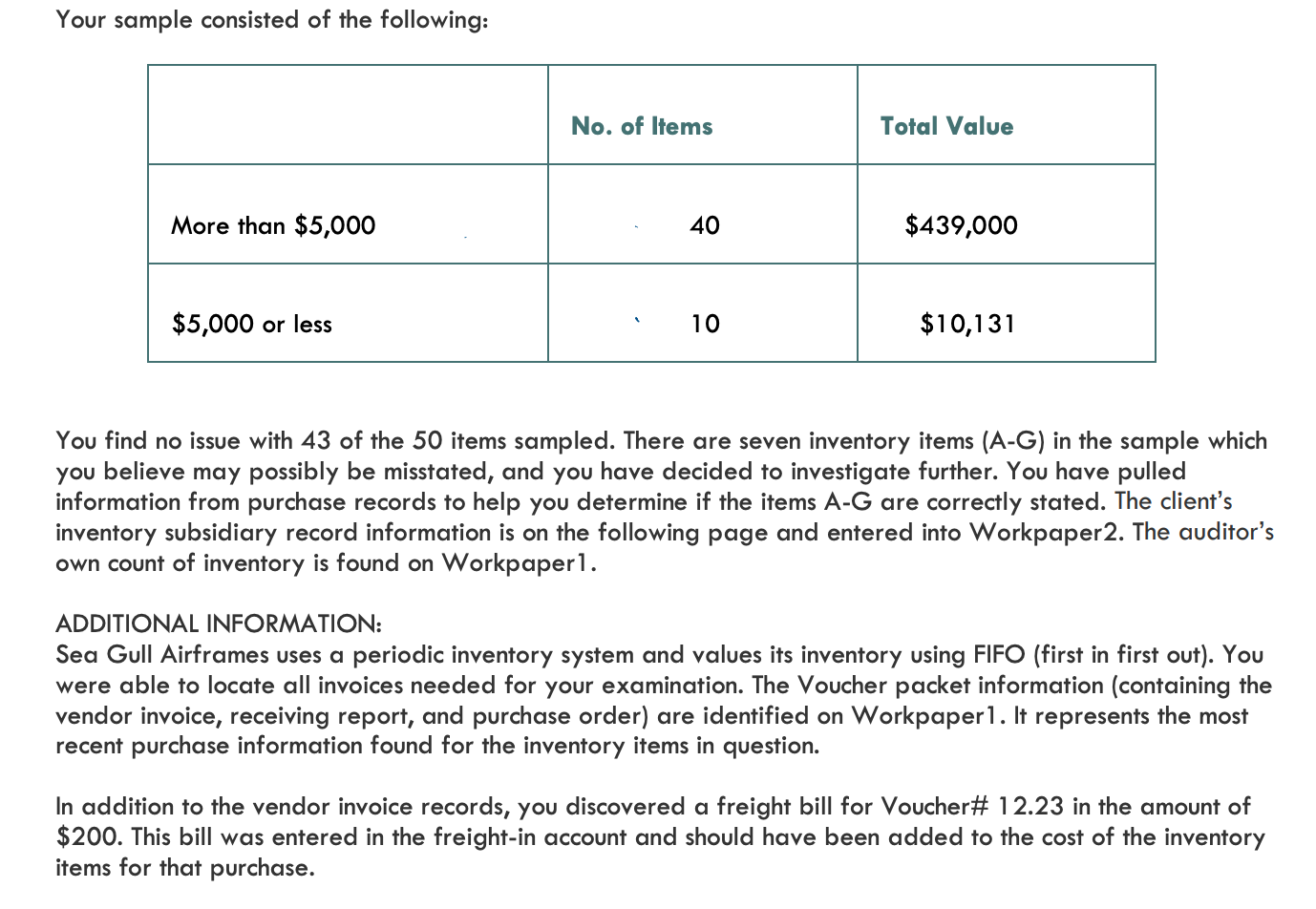

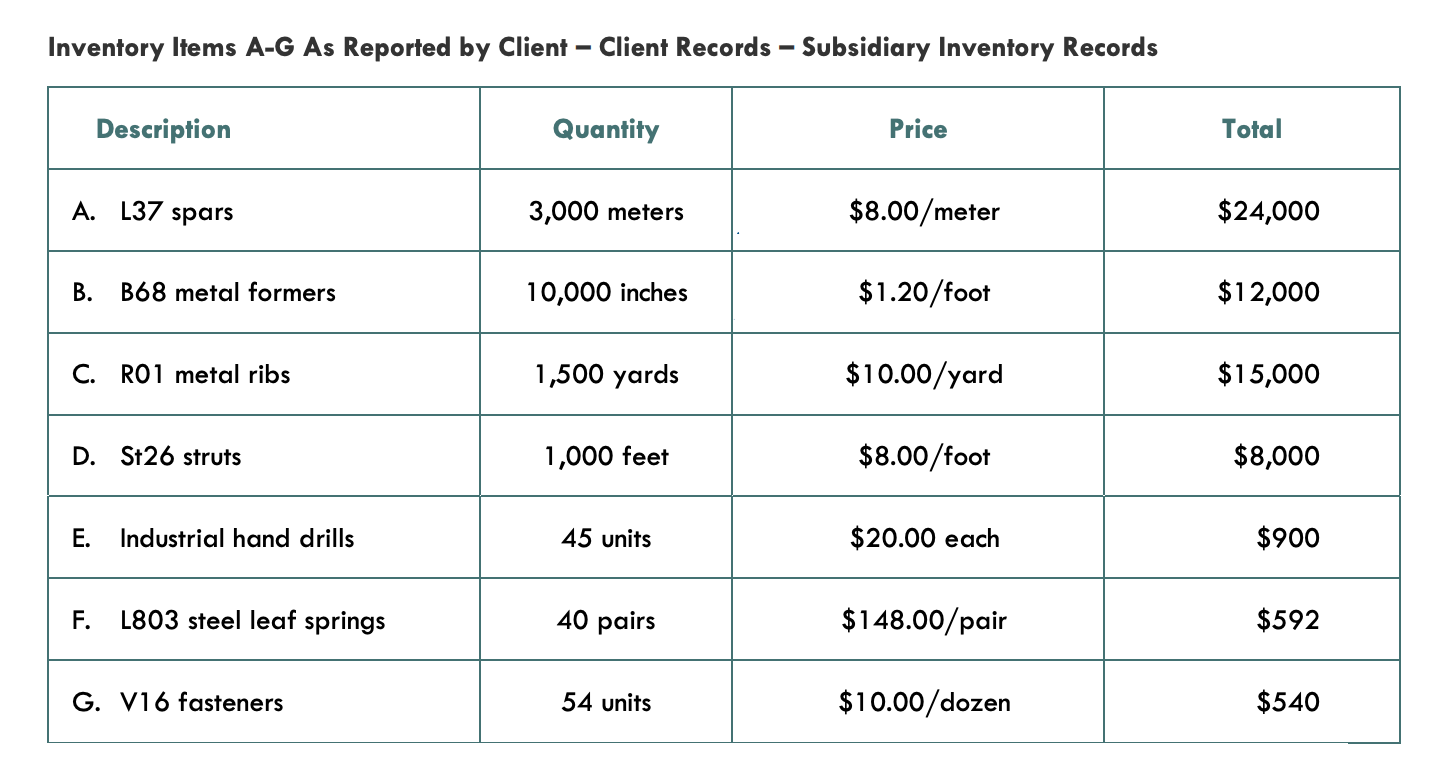

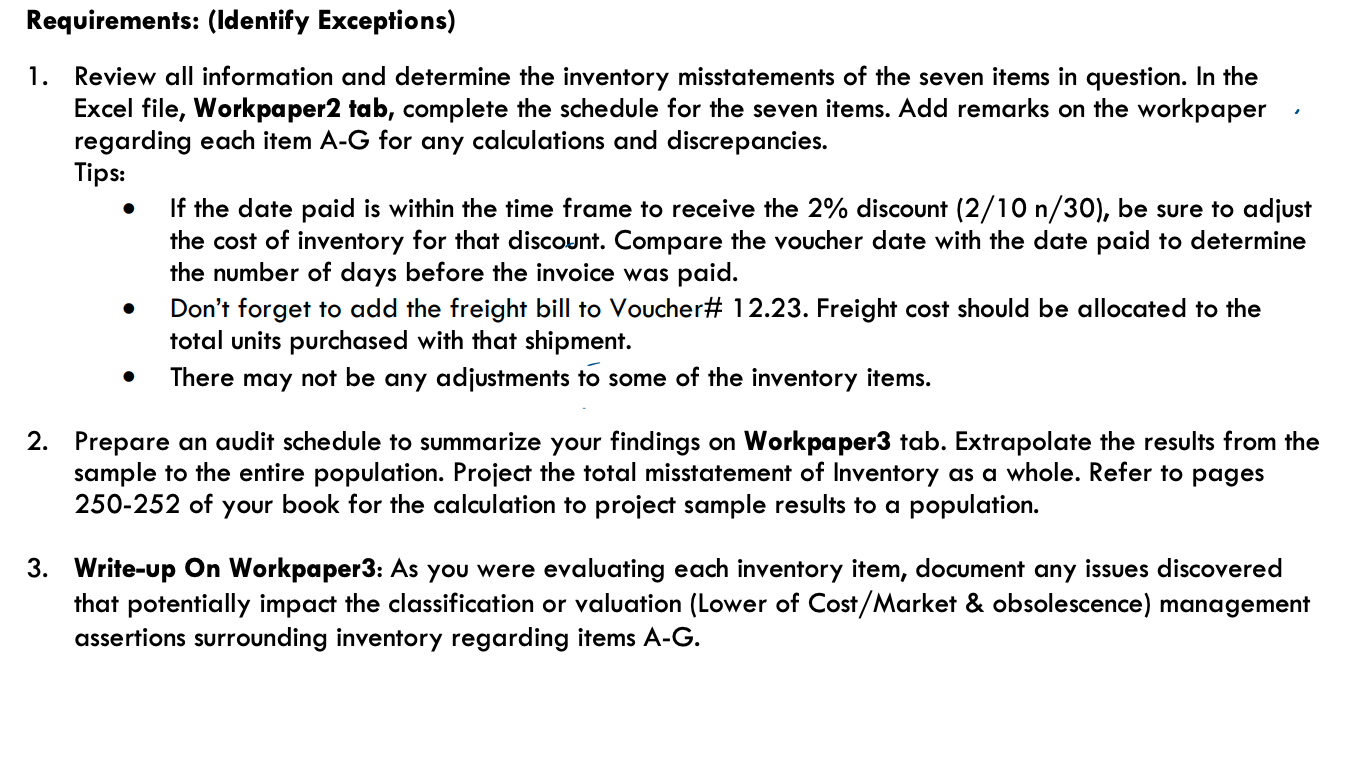

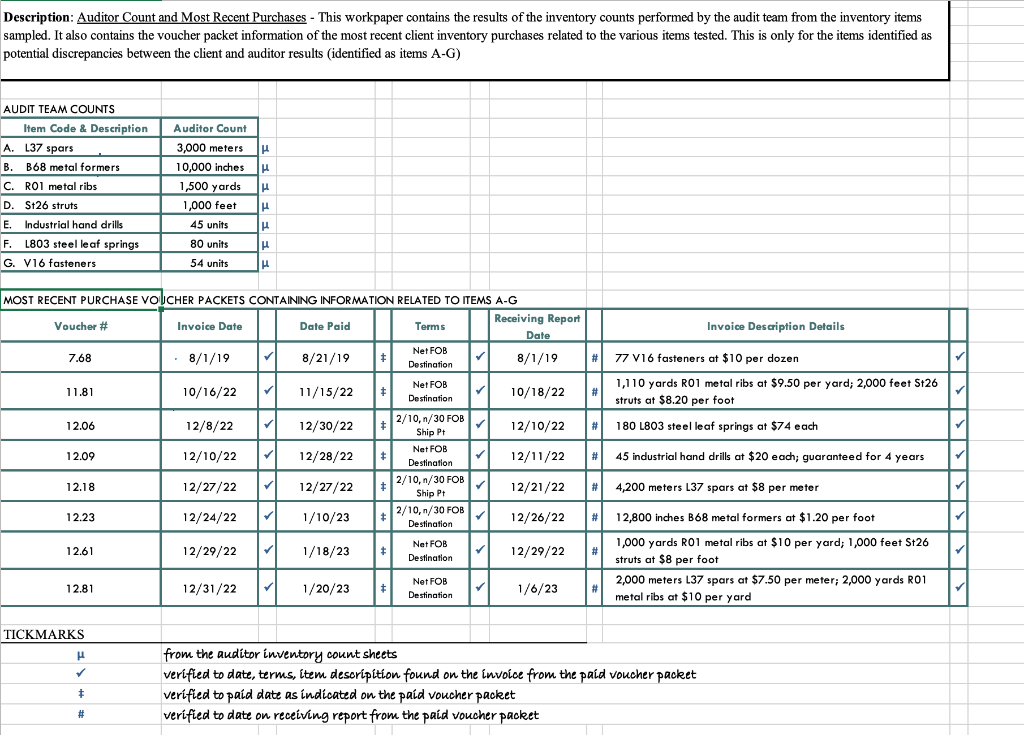

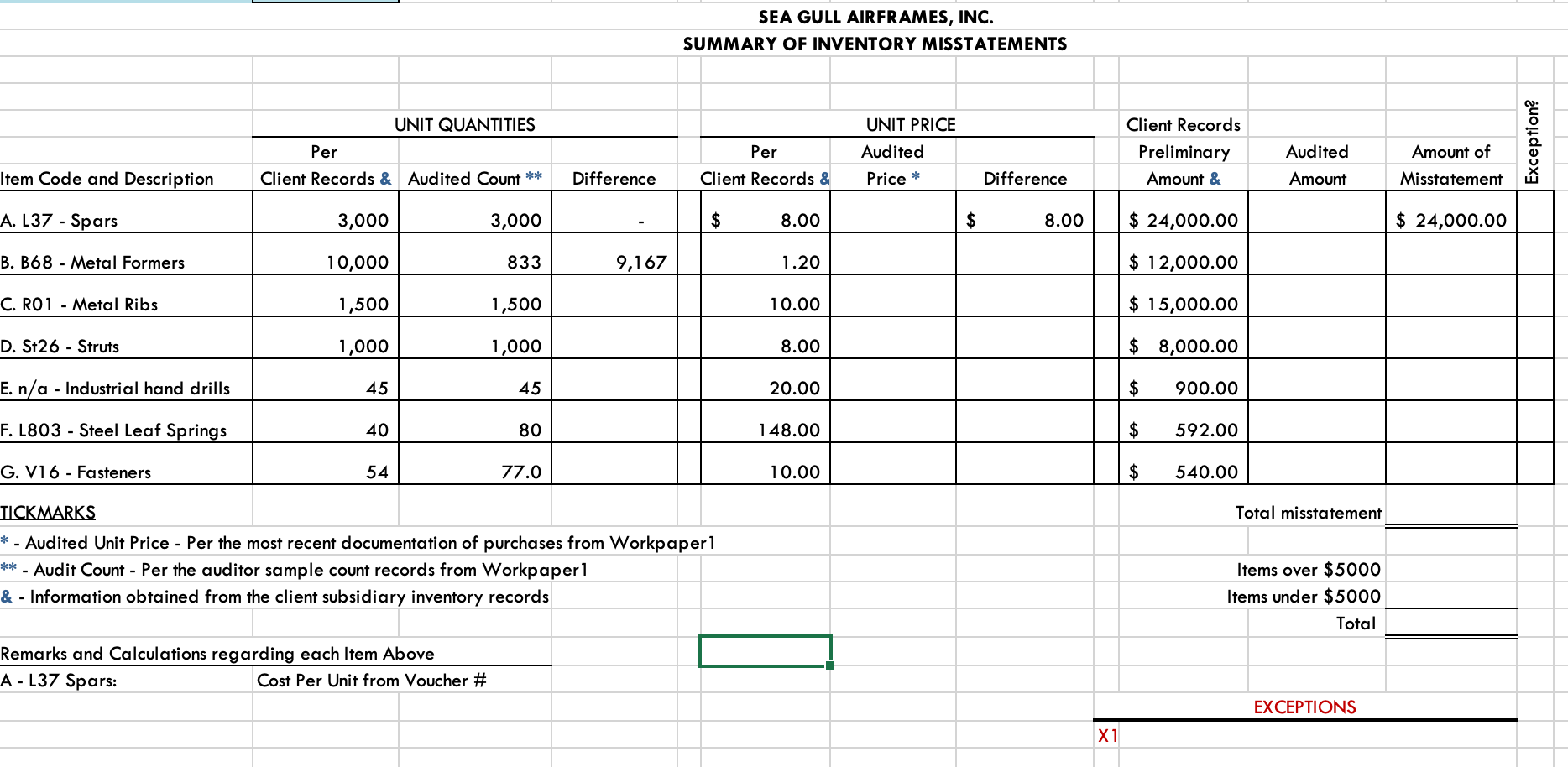

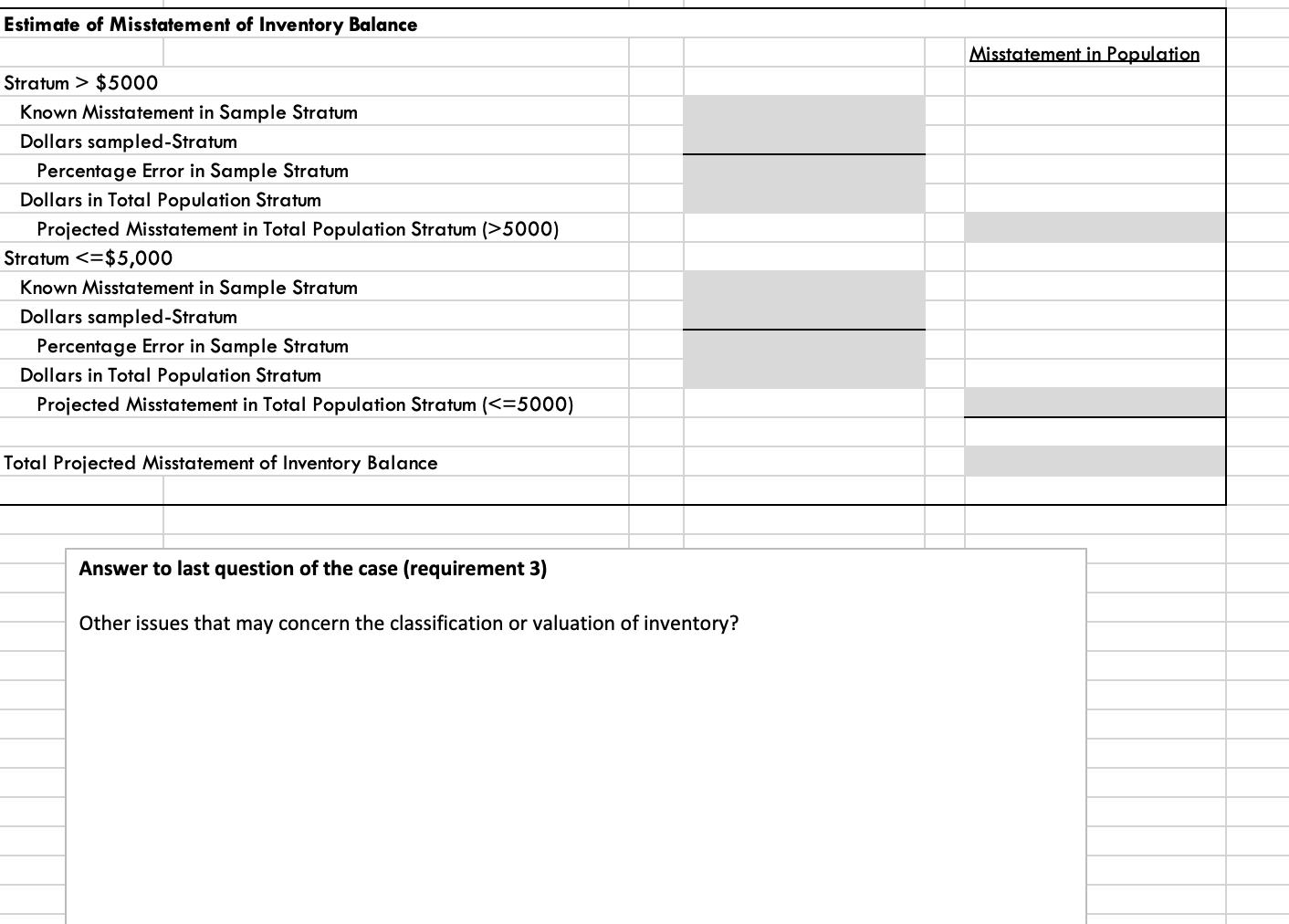

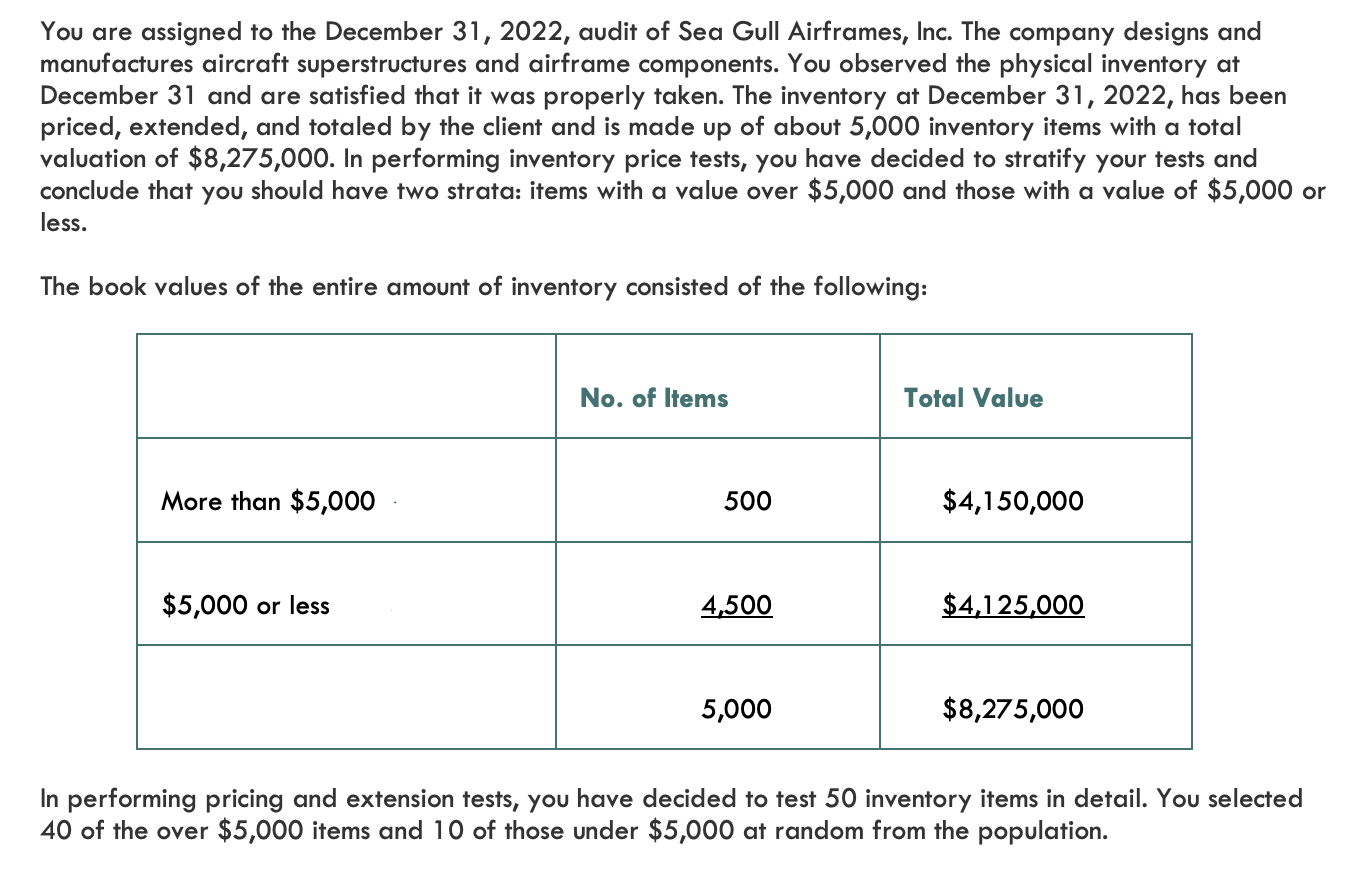

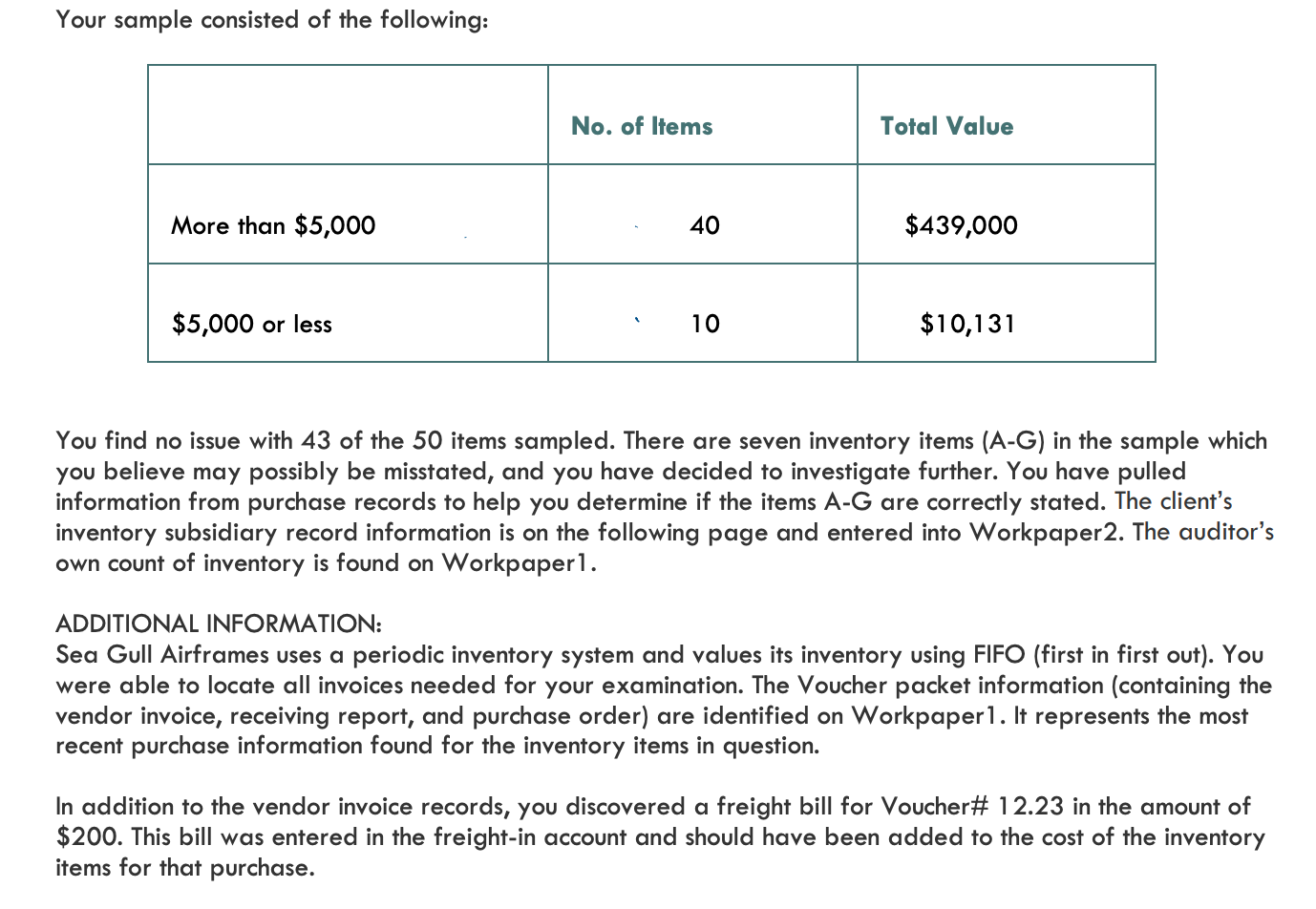

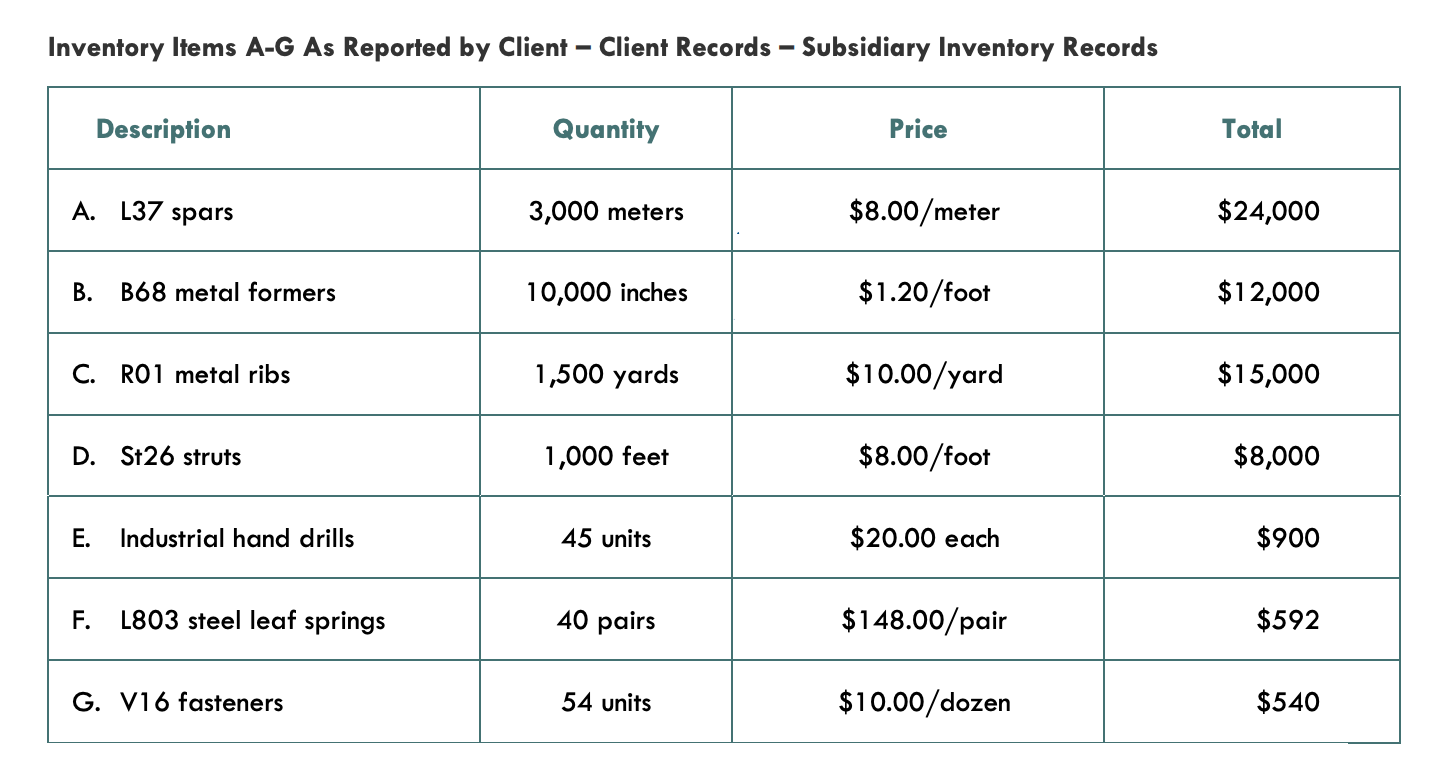

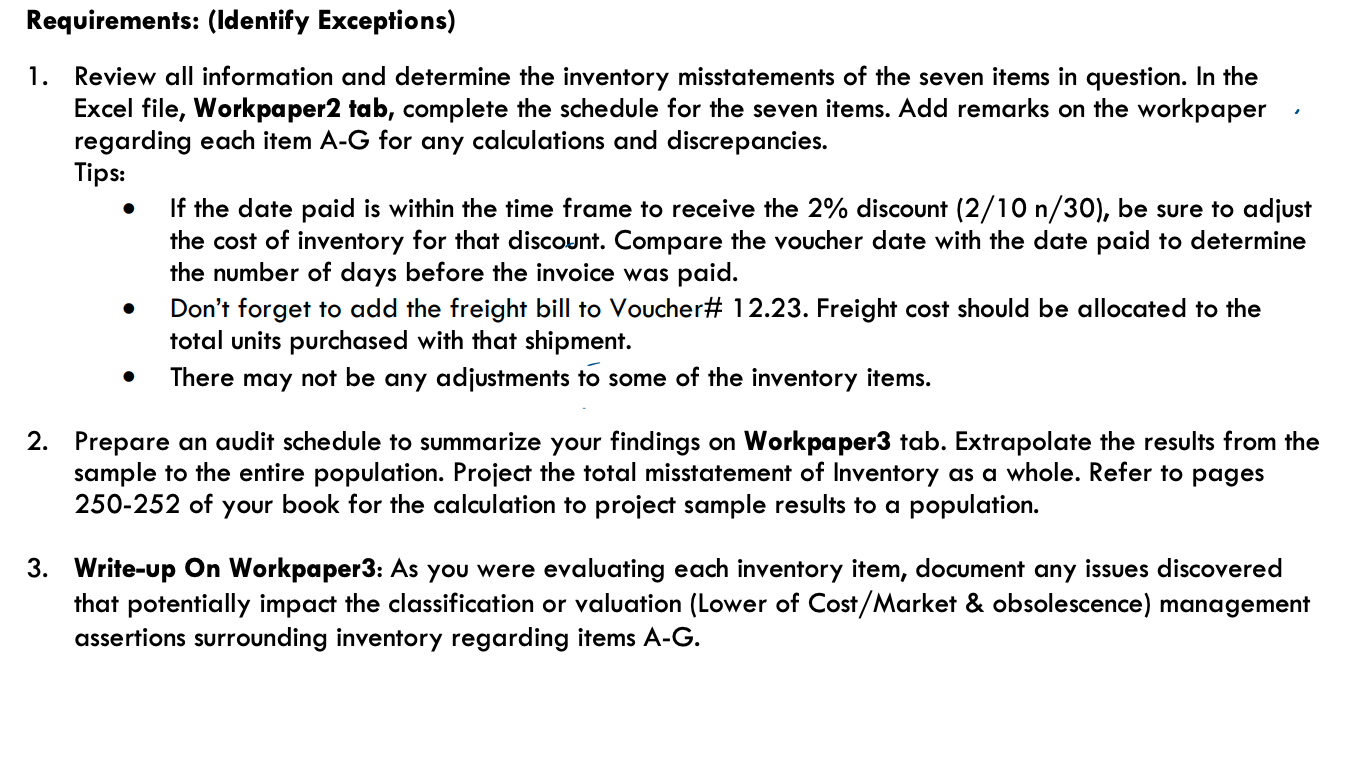

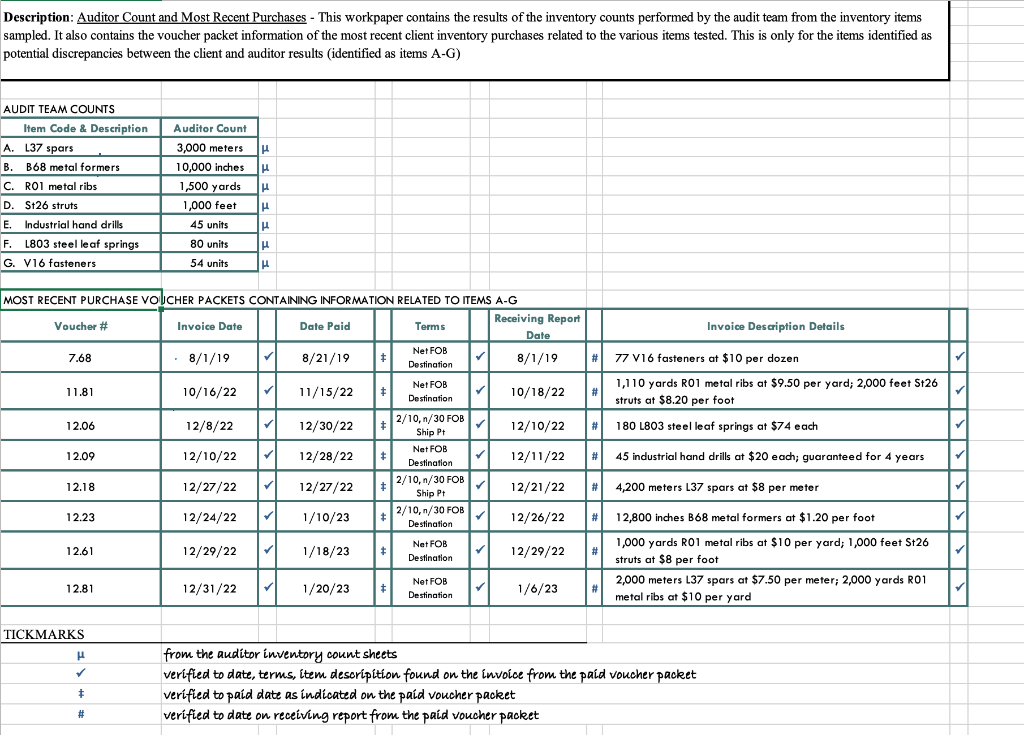

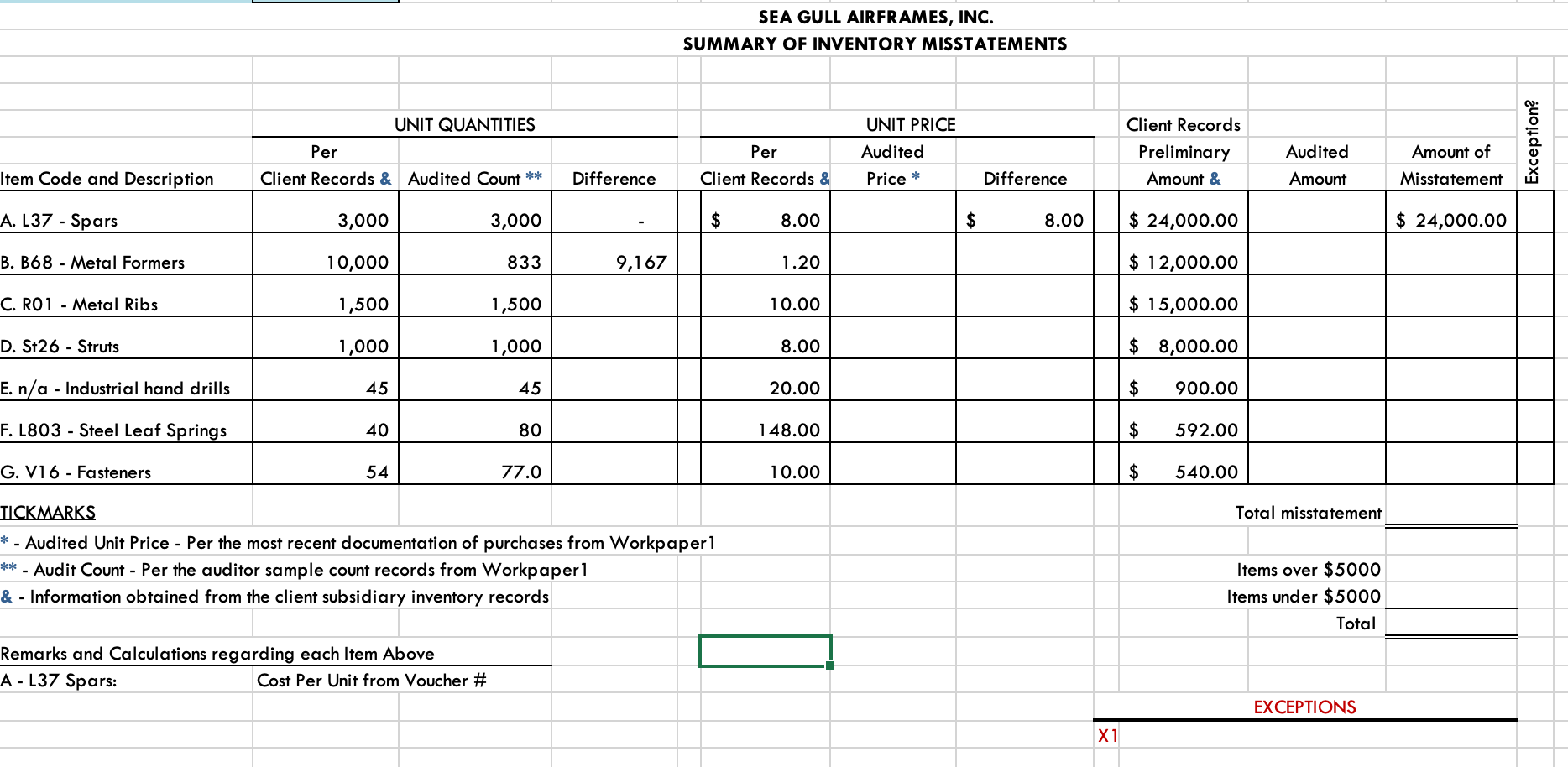

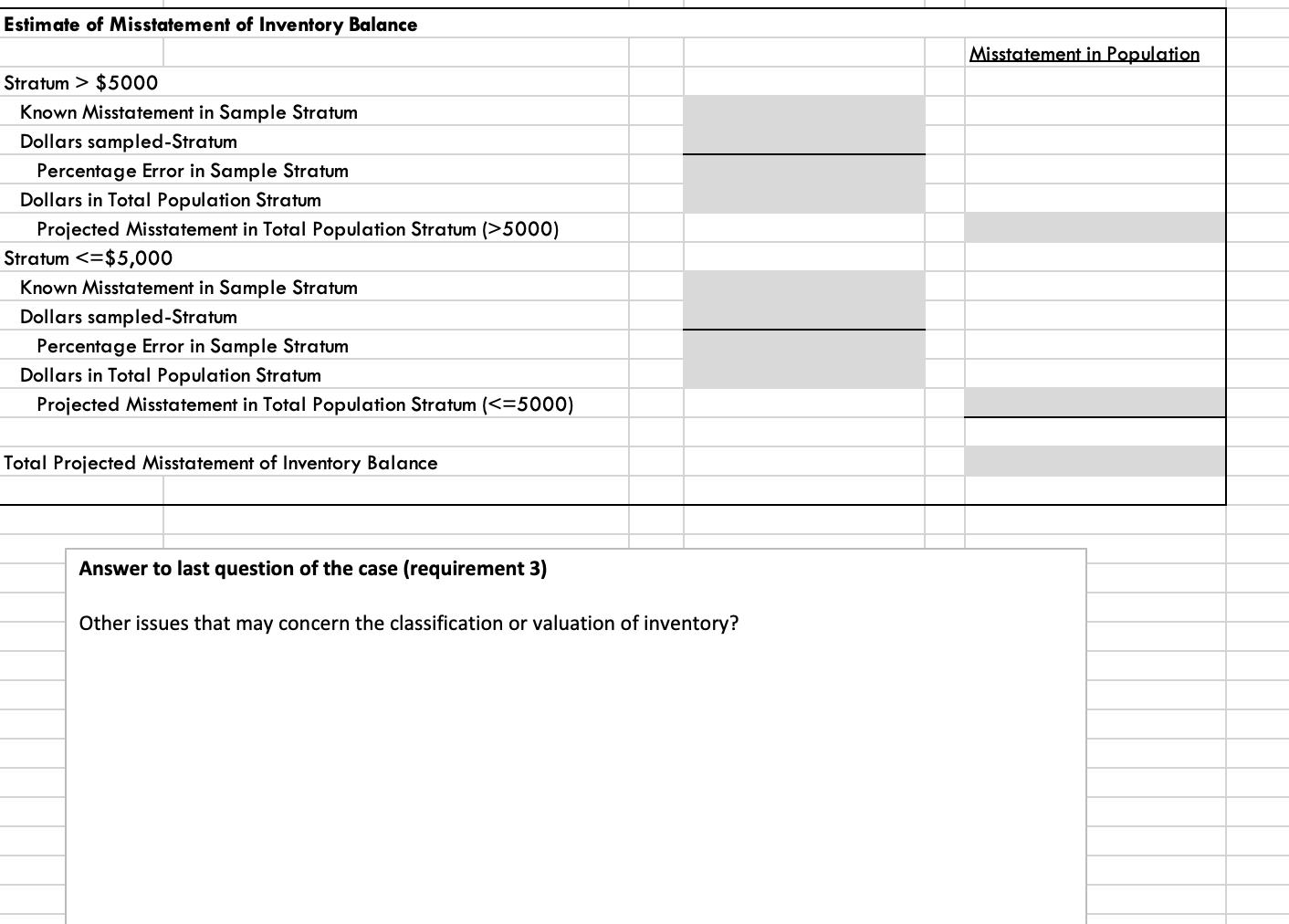

You are assigned to the December 31, 2022, audit of Sea Gull Airframes, Inc. The company designs and manufactures aircraft superstructures and airframe components. You observed the physical inventory at December 31 and are satisfied that it was properly taken. The inventory at December 31,2022 , has been priced, extended, and totaled by the client and is made up of about 5,000 inventory items with a total valuation of $8,275,000. In performing inventory price tests, you have decided to stratify your tests and conclude that you should have two strata: items with a value over $5,000 and those with a value of $5,000 or less. The book values of the entire amount of inventory consisted of the following: In performing pricing and extension tests, you have decided to test 50 inventory items in detail. You selected 40 of the over $5,000 items and 10 of those under $5,000 at random from the population. Your sample consisted of the following: You find no issue with 43 of the 50 items sampled. There are seven inventory items (A-G) in the sample which you believe may possibly be misstated, and you have decided to investigate further. You have pulled information from purchase records to help you determine if the items A-G are correctly stated. The client's inventory subsidiary record information is on the following page and entered into Workpaper2. The auditor's own count of inventory is found on Workpaper 1. ADDITIONAL INFORMATION: Sea Gull Airframes uses a periodic inventory system and values its inventory using FIFO (first in first out). You were able to locate all invoices needed for your examination. The Voucher packet information (containing the vendor invoice, receiving report, and purchase order) are identified on Workpaper 1 . It represents the most recent purchase information found for the inventory items in question. In addition to the vendor invoice records, you discovered a freight bill for Voucher\# 12.23 in the amount of \$200. This bill was entered in the freight-in account and should have been added to the cost of the inventory items for that purchase. Inventory ltems A-G As Reported by Client - Client Records - Subsidiary Inventory Records Requirements: (Identify Exceptions) 1. Review all information and determine the inventory misstatements of the seven items in question. In the Excel file, Workpaper2 tab, complete the schedule for the seven items. Add remarks on the workpaper . regarding each item AG for any calculations and discrepancies. Tips: - If the date paid is within the time frame to receive the 2% discount (2/10n/30), be sure to adjust the cost of inventory for that discount. Compare the voucher date with the date paid to determine the number of days before the invoice was paid. - Don't forget to add the freight bill to Voucher\# 1 2.23. Freight cost should be allocated to the total units purchased with that shipment. - There may not be any adjustments to some of the inventory items. 2. Prepare an audit schedule to summarize your findings on Workpaper3 tab. Extrapolate the results from the sample to the entire population. Project the total misstatement of Inventory as a whole. Refer to pages 250-252 of your book for the calculation to project sample results to a population. 3. Write-up On Workpaper3: As you were evaluating each inventory item, document any issues discovered that potentially impact the classification or valuation (Lower of Cost/Market \& obsolescence) management assertions surrounding inventory regarding items A-G. Description: Auditor Count and Most Recent Purchases - This workpaper contains the results of the inventory counts performed by the audit team from the inventory items SEA GULL AIRFRAMES, INC. SUMMARY OF INVENTORY MISSTATEMENTS TICKMARKS Total misstatement * - Audited Unit Price - Per the most recent documentation of purchases from Workpaper 1 ** - Audit Count - Per the auditor sample count records from Workpaper 1 Items over $5000 \& - Information obtained from the client subsidiary inventory records Items under $5000 Remarks and Calculations regarding each Item Above A - L37 Spars: Cost Per Unit from Voucher \# EXCEPTIONS X1 Estimate of Misstatement of Inventory Balance Misstatement in Population Stratum >$5000 Known Misstatement in Sample Stratum Dollars sampled-Stratum Percentage Error in Sample Stratum Dollars in Total Population Stratum Projected Misstatement in Total Population Stratum (>5000) Stratum $5000 Known Misstatement in Sample Stratum Dollars sampled-Stratum Percentage Error in Sample Stratum Dollars in Total Population Stratum Projected Misstatement in Total Population Stratum (>5000) Stratum