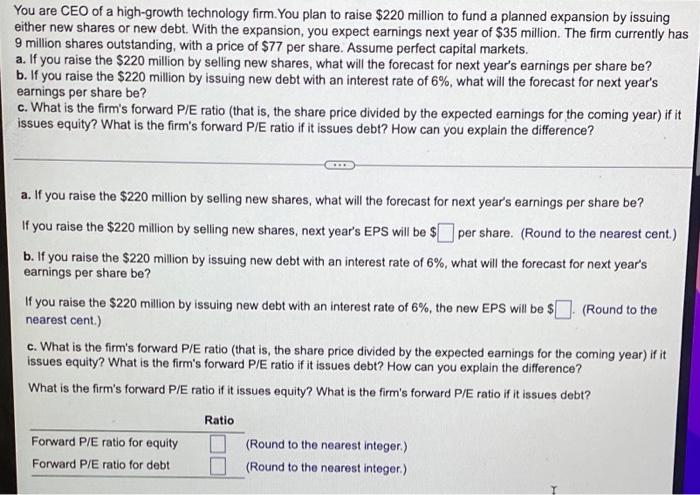

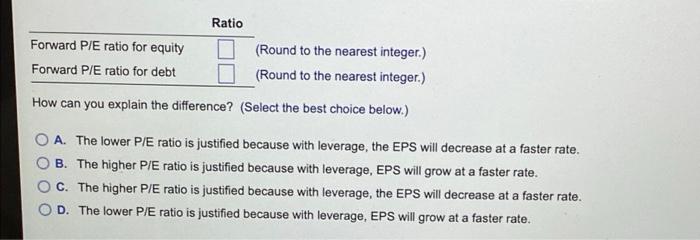

You are CEO of a high-growth technology firm. You plan to raise $220 million to fund a planned expansion by issuing either new shares or new debt. With the expansion, you expect earnings next year of $35 million. The firm currently has 9 million shares outstanding, with a price of $77 per share. Assume perfect capital markets. a. If you raise the $220 million by selling new shares, what will the forecast for next year's earnings per share be? b. If you raise the $220 million by issuing new debt with an interest rate of 6%, what will the forecast for next year's earnings per share be? c. What is the firm's forward P/E ratio (that is, the share price divided by the expected earnings for the coming year) if it issues equity? What is the firm's forward P/E ratio if it issues debt? How can you explain the difference? a. If you raise the $220 million by selling new shares, what will the forecast for next year's earnings per share be? If you raise the $220 million by selling new shares, next year's EPS will be $ per share. (Round to the nearest cent.) b. If you raise the $220 million by issuing new debt with an interest rate of 6%, what will the forecast for next year's earnings per share be? If you raise the $220 million by issuing new debt with an interest rate of 6%, the new EPS will be $ (Round to the nearest cent.) c. What is the firm's forward P/E ratio (that is, the share price divided by the expected earnings for the coming year) if it issues equity? What is the firm's forward P/E ratio if it issues debt? How can you explain the difference? What is the firm's forward P/E ratio if it issues equity? What is the firm's forward P/E ratio if it issues debt? Ratio Forward P/E ratio for equity Forward P/E ratio for debt (Round to the nearest Integer.) (Round to the nearest Integer.) Ratio Forward P/E ratio for equity (Round to the nearest integer.) Forward P/E ratio for debt (Round to the nearest integer.) How can you explain the difference? (Select the best choice below.) A. The lower P/E ratio is justified because with leverage, the EPS will decrease at a faster rate. B. The higher P/E ratio is justified because with leverage, EPS will grow at a faster rate. C. The higher P/E ratio is justified because with leverage, the EPS will decrease at a faster rate. D. The lower P/E ratio is justified because with leverage, EPS will grow at a faster rate