Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are considering investing in the following stock: expected dividends next year (t=1) are D = 50, which are expected to grow at a

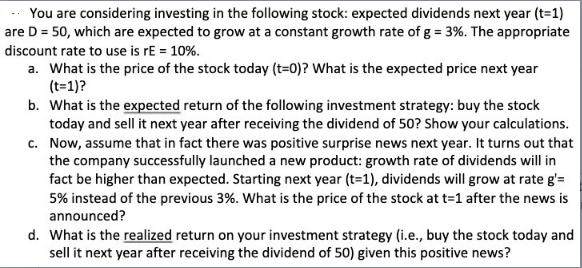

You are considering investing in the following stock: expected dividends next year (t=1) are D = 50, which are expected to grow at a constant growth rate of g = 3%. The appropriate discount rate to use is rE = 10%. a. What is the price of the stock today (t=0)? What is the expected price next year (t=1)? b. What is the expected return of the following investment strategy: buy the stock today and sell it next year after receiving the dividend of 50? Show your calculations. Now, assume that in fact there was positive surprise news next year. It turns out that the company successfully launched a new product: growth rate of dividends will in fact be higher than expected. Starting next year (t-1), dividends will grow at rate g'= c. 5% instead of the previous 3%. What is the price of the stock at t=1 after the news is announced? d. What is the realized return on your investment strategy (i.e., buy the stock today and sell it next year after receiving the dividend of 50) given this positive news?

Step by Step Solution

★★★★★

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Price today t0 Using the dividend growth model P0 D1 rE g 50 010 003 50 007 71429 Price next year ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started