Question

You are considering investing in two umbrella manufacturers (Justdry and Keepdry) that each produce different types of umbrellas. The returns of each firm are random

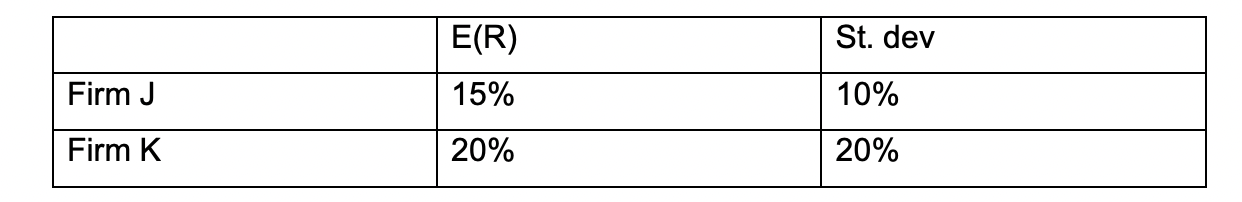

You are considering investing in two umbrella manufacturers (Justdry and Keepdry) that each produce different types of umbrellas. The returns of each firm are random depending on the weather conditions. The expected returns and standard deviations of returns are given in the table:

a) If the correlation of returns between the two firms is 0.4, what is the expected return and standard deviation of an equally-weighted portfolio (P2)?

b) What is the expected return and standard deviation of a portfolio (P3) which has weights of 25% of your wealth invested in Firm J and 75% of your wealth invested in Firm K?

c) Summarise the expected returns and standard deviations of FOUR portfolios with weights: P1 (100%, 0%); P2 (50%, 50%); P3 (25%, 75%); P4 (0%, 100%), and plot in mean-standard deviation space the efficiency frontier for portfolios between Firm J and Firm K, and identify these four portfolios.

d) Firm K decides to diversify into producing and selling ice-creams, and the new correlation between these two firms returns changes to -0.6 Explain why the correlation between the two firms has become negative.

e) If the other parameters remain the same, what will be the new expected return and standard deviation of an equally-weighted portfolio?

f) Draw a diagram in mean-standard deviation space to illustrate the effect of a change in the diversification strategy of Firm K, on the shape of the efficiency frontier.

g) Explain the term efficiency frontier?

h) Explain what happens to the efficiency frontier plotted in part (c) if a risk-free asset is available with a return of 4%.

E(R) St. dev Firm J 15% 10% Firm K 20% 20% E(R) St. dev Firm J 15% 10% Firm K 20% 20%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started