Question

You are currently holding 100 shares of Apple stock, which you purchased at $135. (purchased : premium for 13.3) You decided to sell a covered

You are currently holding 100 shares of Apple stock, which you purchased at $135. (purchased : premium for 13.3)

You decided to sell a covered call on your entire Apple stock holding at strike $140 for expiry 17 June 2022. (Note: 1 contract is equal to 100 shares) (selling for 11.1)

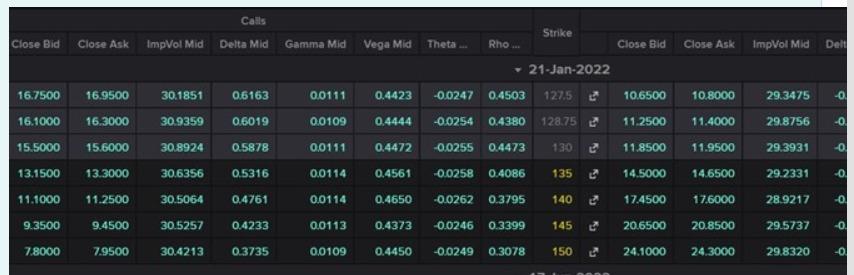

Please refer to image for preminum rate and call option details of apple

a) How many contracts do you sell to cover your existing position? (2 marks)

b) What is the total premium you receive by selling this call? (3 marks)

c) What is your new breakeven cost of holding these shares (after you incorporate the premium received from the covered call)? (3 marks)

d) If at maturity, the stock is trading at 135, does the option get exercised or does it expire worthless? (2 marks)

Cails Strike Close Bid Close Ask ImpVol Mid Delta Mid Gamma Mid Vega Mid Theta Rho. Close Bid Close Ask ImpVol Mid Dell - 21-Jan-2022 16.7500 16.9500 30.1851 06163 0.0111 0.4423 -0.0247 0.4503 127.5 10.6500 10.8000 29.3475 -0 . 16.1000 16.3000 30.9359 0.6019 0.0109 0.4444 -0.0254 0.4380 128.75 11.2500 11.4000 29.8756 -0. 15.5000 15.6000 30.8924 0.5878 0,0111 0.4472 -0.0255 0.4473 130 5 11.8500 11.9500 29.3931 -0 13.1500 13.3000 30.6356 0.5316 0.0114 0.4561 -0.0258 0.4086 135 2 14.5000 14.6500 29.2331 -0. 11.1000 11.2500 30.5064 0.4761 0.0114 0.4650 -0.0262 0.3795 140 2 17.4500 17.6000 28.9217 -0. . . 9.3500 9.4500 30.5257 0.4233 0.0113 0.4373 -0.0246 0.3399 145 20.6500 20.8500 29.5737 -0. 7.8000 7.9500 30.4213 0.3735 0.0109 0.4450 -0.0249 0.3078 150 5 24.1000 24.3000 29.8320 -0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started