Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are deciding between two mutually exclusive investment opportunities. Both require the same initial investment of $10.2 million. Investment A will generate $1.93 million

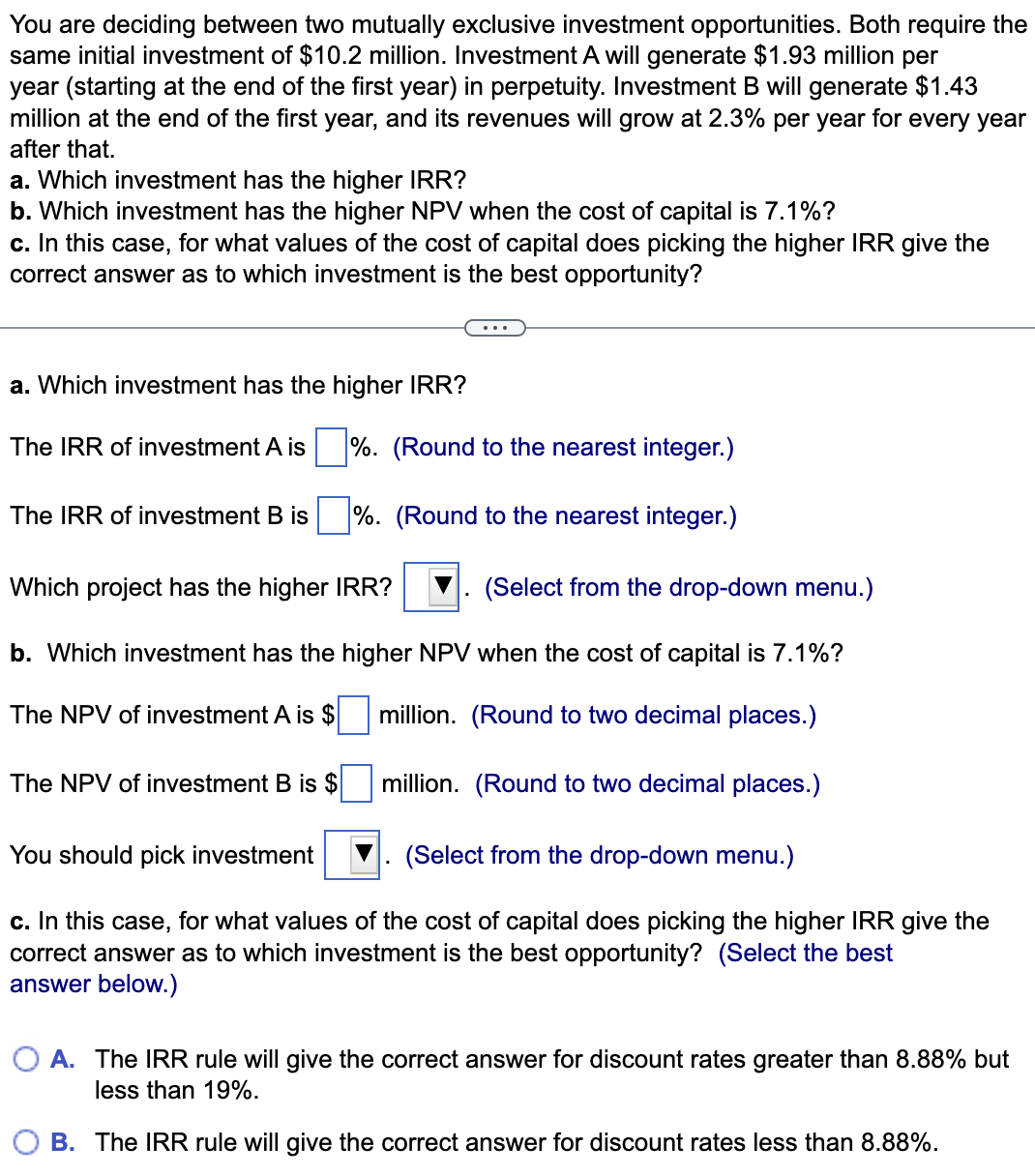

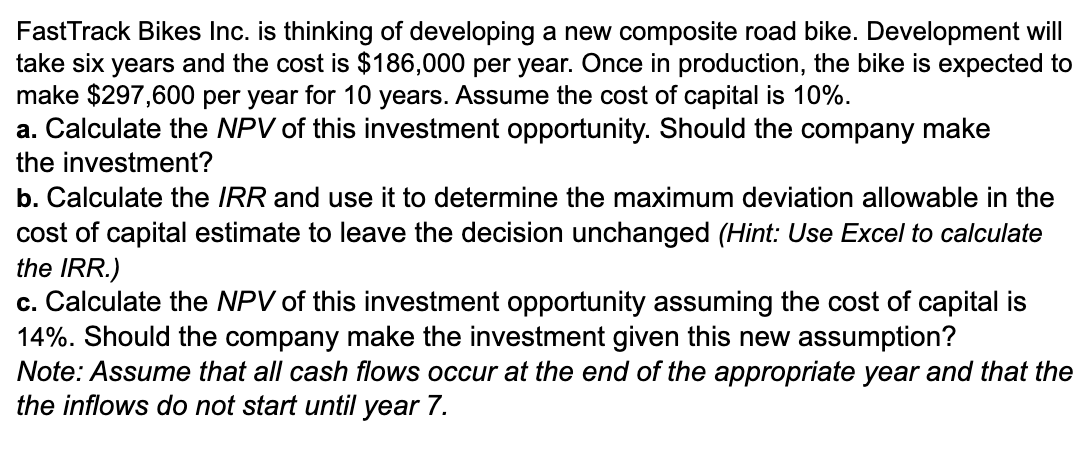

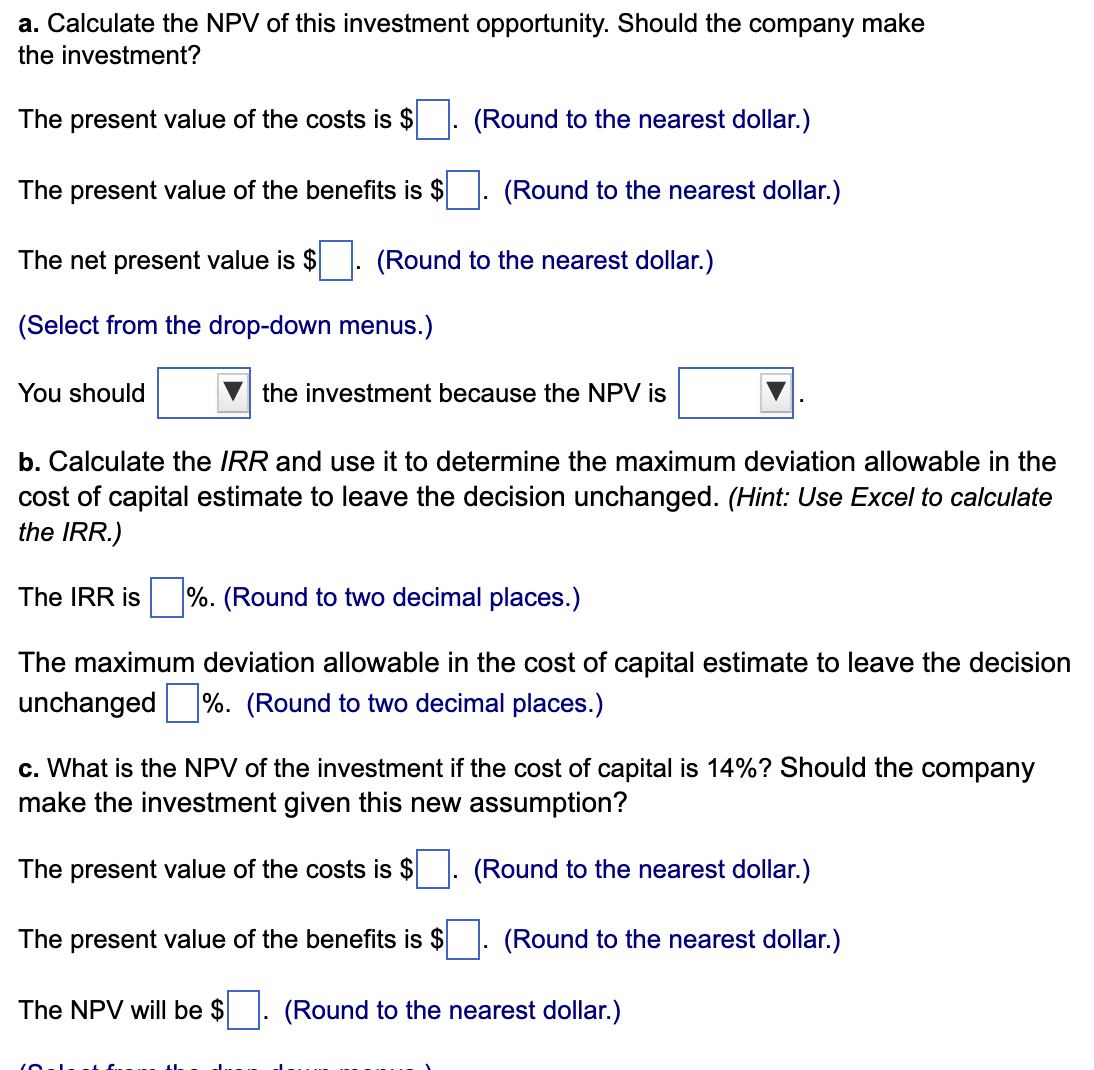

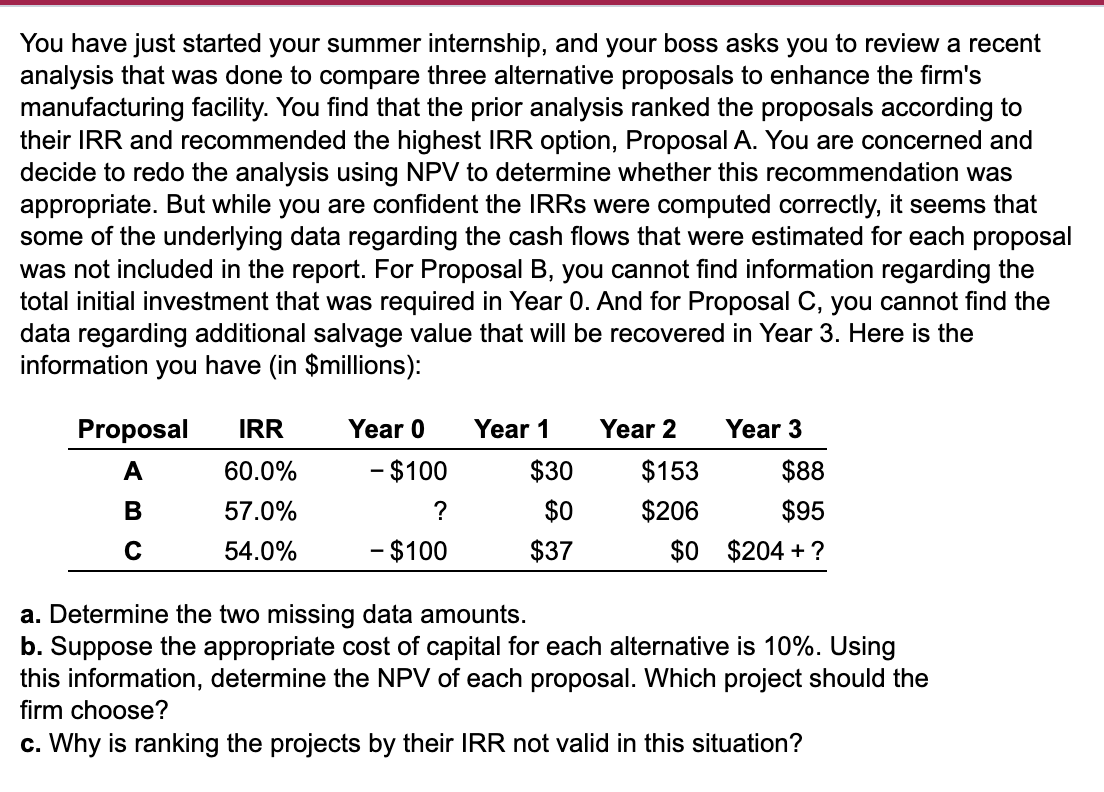

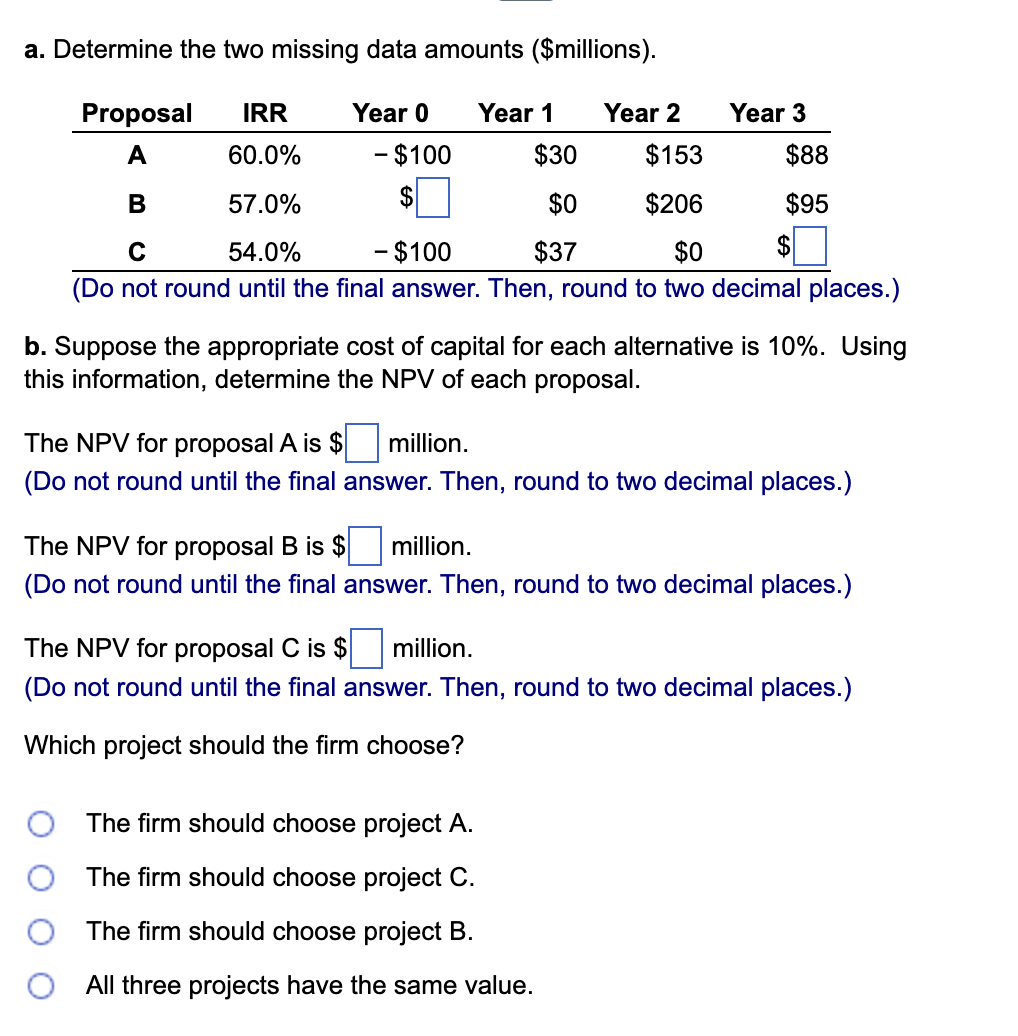

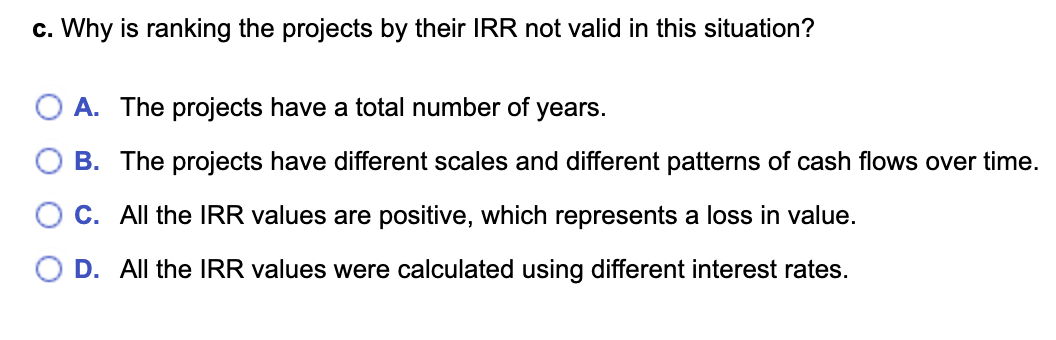

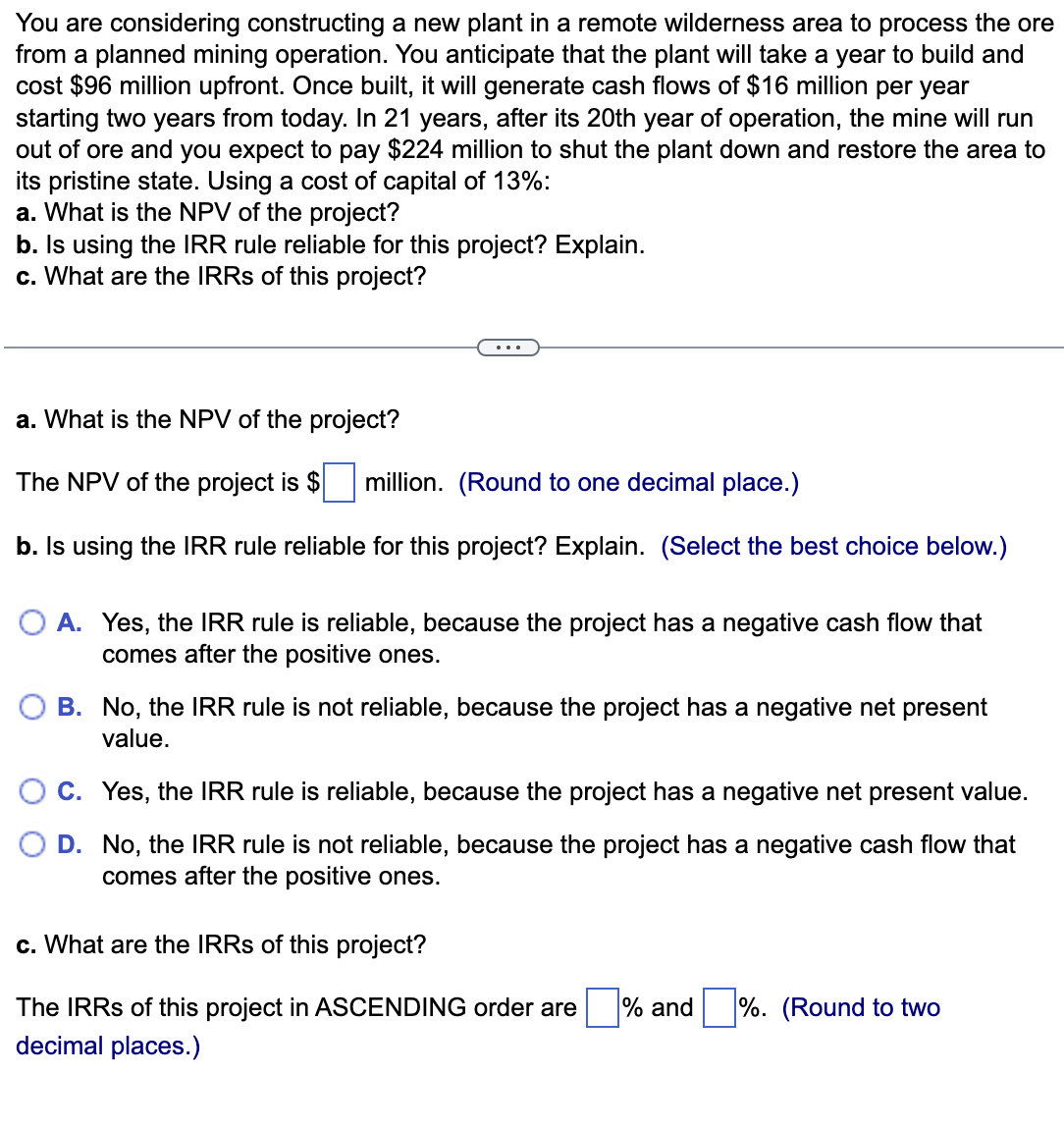

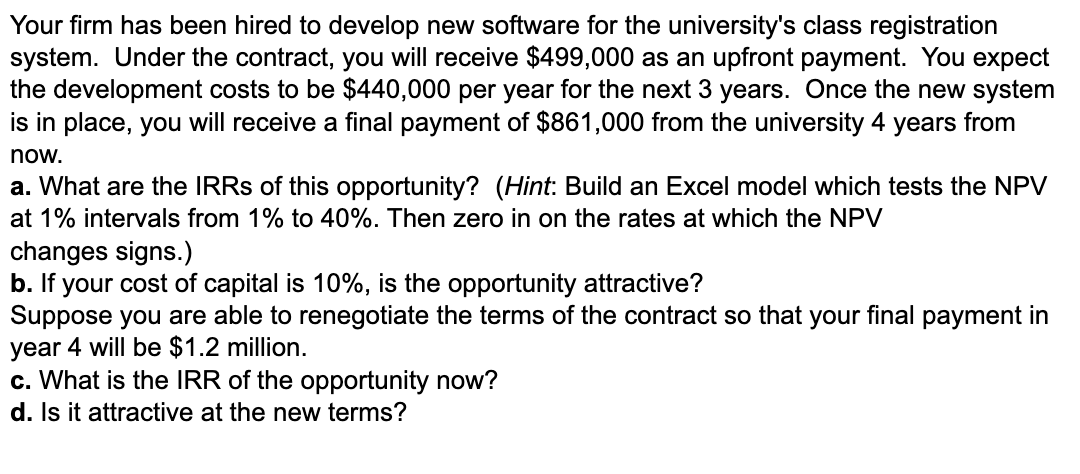

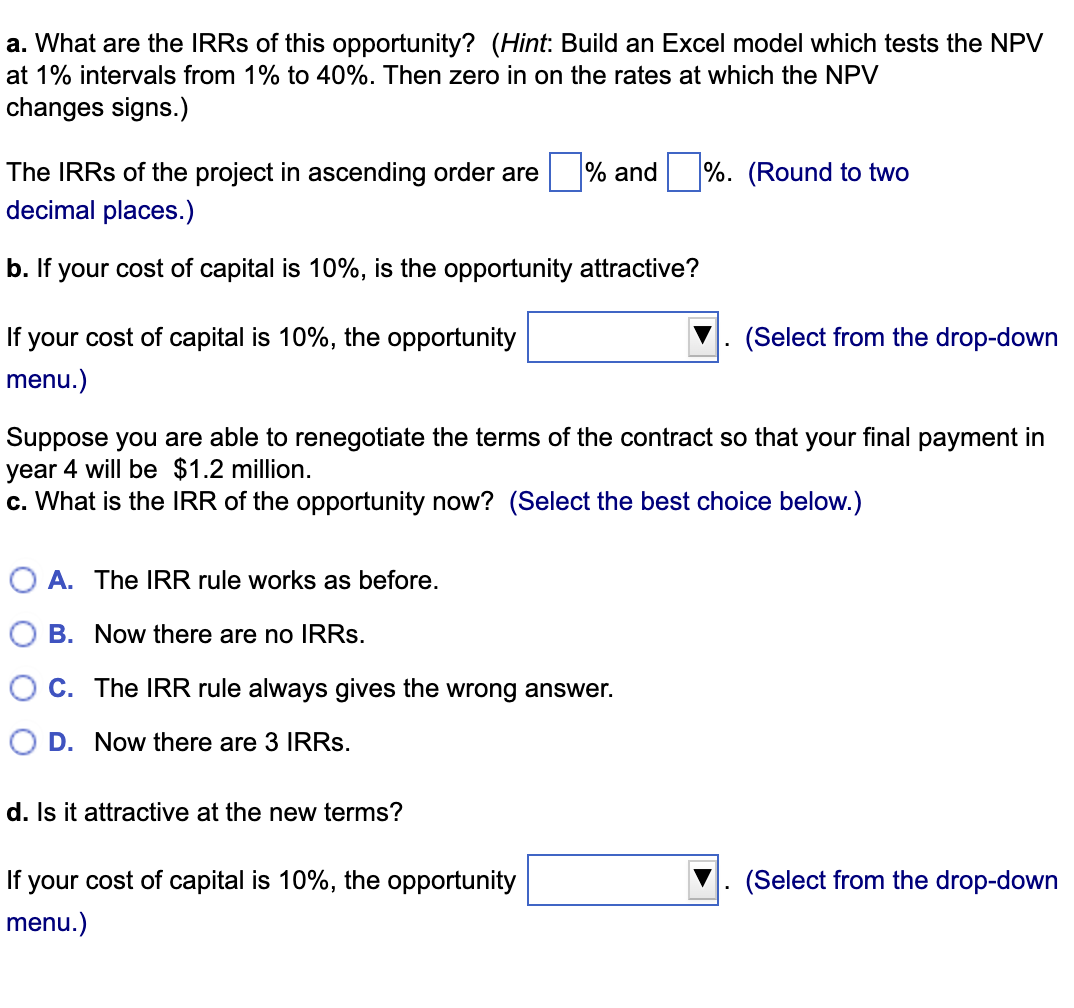

You are deciding between two mutually exclusive investment opportunities. Both require the same initial investment of $10.2 million. Investment A will generate $1.93 million per year (starting at the end of the first year) in perpetuity. Investment B will generate $1.43 million at the end of the first year, and its revenues will grow at 2.3% per year for every year after that. a. Which investment has the higher IRR? b. Which investment has the higher NPV when the cost of capital is 7.1%? c. In this case, for what values of the cost of capital does picking the higher IRR give the correct answer as to which investment is the best opportunity? a. Which investment has the higher IRR? The IRR of investment A is The IRR of investment B is ... The NPV of investment B is $ %. (Round the nearest integer.) %. (Round to the nearest integer.) Which project has the higher IRR? (Select from the drop-down menu.) b. Which investment has the higher NPV when the cost of capital is 7.1%? The NPV of investment A is $ million. (Round to two decimal places.) million. (Round to two decimal places.) You should pick investment (Select from the drop-down menu.) c. In this case, for what values of the cost of capital does picking the higher IRR give the correct answer as to which investment is the best opportunity? (Select the best answer below.) O A. The IRR rule will give the correct answer for discount rates greater than 8.88% but less than 19%. B. The IRR rule will give the correct answer for discount rates less than 8.88%. FastTrack Bikes Inc. is thinking of developing a new composite road bike. Development will take six years and the cost is $186,000 per year. Once in production, the bike is expected to make $297,600 per year for 10 years. Assume the cost of capital is 10%. a. Calculate the NPV of this investment opportunity. Should the company make the investment? b. Calculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged (Hint: Use Excel to calculate the IRR.) c. Calculate the NPV of this investment opportunity assuming the cost of capital is 14%. Should the company make the investment given this new assumption? Note: Assume that all cash flows occur at the end of the appropriate year and that the the inflows do not start until year 7. a. Calculate the NPV of this investment opportunity. Should the company make the investment? The present value of the costs is $ The present value of the benefits is $ The net present value is $ (Round to the nearest dollar.) (Select from the drop-down menus.) You should (Round to the nearest dollar.) (Round to the nearest dollar.) the investment because the NPV is b. Calculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged. (Hint: Use Excel to calculate the IRR.) The IRR is %. (Round to two decimal places.) The maximum deviation allowable in the cost of capital estimate to leave the decision unchanged %. (Round to two decimal places.) The NPV will be $ c. What is the NPV of the investment if the cost of capital is 14%? Should the company make the investment given this new assumption? The present value of the costs is $ . (Round to the nearest dollar.) The present value of the benefits is $ (Round to the nearest dollar.) (Round to the nearest dollar.) You should the investment because the NPV is You have just started your summer internship, and your boss asks you to review a recent analysis that was done to compare three alternative proposals to enhance the firm's manufacturing facility. You find that the prior analysis ranked the proposals according to their IRR and recommended the highest IRR option, Proposal A. You are concerned and decide to redo the analysis using NPV to determine whether this recommendation was appropriate. But while you are confident the IRRs were computed correctly, it seems that some of the underlying data regarding the cash flows that were estimated for each proposal was not included in the report. For Proposal B, you cannot find information regarding the total initial investment that was required in Year 0. And for Proposal C, you cannot find the data regarding additional salvage value that will be recovered in Year 3. Here is the information you have (in $millions): Proposal IRR A 60.0% B 57.0% C 54.0% Year 0 - $100 ? - $100 Year 1 $30 $0 $37 Year 2 $153 $206 Year 3 $88 $95 $0 $204+? a. Determine the two missing data amounts. b. Suppose the appropriate cost of capital for each alternative is 10%. Using this information, determine the NPV of each proposal. Which project should the firm choose? c. Why is ranking the projects by their IRR not valid in this situation? a. Determine the two missing data amounts ($millions). Proposal IRR A 60.0% $153 B 57.0% $206 C 54.0% - $100 $0 (Do not round until the final answer. Then, round to two decimal places.) Year 0 - $100 $ Year 1 $30 $0 $37 Year 2 Year 3 $88 $95 $ b. Suppose the appropriate cost of capital for each alternative is 10%. Using this information, determine the NPV of each proposal. The firm should choose project A. The firm should choose project C. The firm should choose project B. All three projects have the same value. The NPV for proposal A is $ million. (Do not round until the final answer. Then, round to two decimal places.) The NPV for proposal B is $ million. (Do not round until the final answer. Then, round to two decimal places.) The NPV for proposal C is $ million. (Do not round until the final answer. Then, round to two decimal places.) Which project should the firm choose? c. Why is ranking the projects by their IRR not valid in this situation? A. The projects have a total number of years. B. The projects have different scales and different patterns of cash flows over time. C. All the IRR values are positive, which represents a loss in value. D. All the IRR values were calculated using different interest rates. You are considering constructing a new plant in a remote wilderness area to process the ore from a planned mining operation. You anticipate that the plant will take a year to build and cost $96 million upfront. Once built, it will generate cash flows of $16 million per year starting two years from today. In 21 years, after its 20th year of operation, the mine will run out of ore and you expect to pay $224 million to shut the plant down and restore the area to its pristine state. Using a cost of capital of 13%: a. What is the NPV of the project? b. Is using the IRR rule reliable for this project? Explain. c. What are the IRRs of this project? a. What is the NPV of the project? The NPV of the project is $ million. (Round to one decimal place.) b. Is using the IRR rule reliable for this project? Explain. (Select the best choice below.) A. Yes, the IRR rule is reliable, because the project has a negative cash flow that comes after the positive ones. B. No, the IRR rule is not reliable, because the project has a negative net present value. C. Yes, the IRR rule is reliable, because the project has a negative net present value. D. No, the IRR rule is not reliable, because the project has a negative cash flow that comes after the positive ones. c. What are the IRRs of this project? The IRRs of this project in ASCENDING order are decimal places.) % and %. (Round to two Your firm has been hired to develop new software for the university's class registration system. Under the contract, you will receive $499,000 as an upfront payment. You expect the development costs to be $440,000 per year for the next 3 years. Once the new system is in place, you will receive a final payment of $861,000 from the university 4 years from now. a. What are the IRRs of this opportunity? (Hint: Build an Excel model which tests the NPV at 1% intervals from 1% to 40%. Then zero in on the rates at which the NPV changes signs.) b. If your cost of capital is 10%, is the opportunity attractive? Suppose you are able to renegotiate the terms of the contract so that your final payment in year 4 will be $1.2 million. c. What is the IRR of the opportunity now? d. Is it attractive at the new terms? a. What are the IRRs of this opportunity? (Hint: Build an Excel model which tests the NPV at 1% intervals from 1% to 40%. Then zero in on the rates at which the NPV changes signs.) The IRRs of the project in ascending order are % and %. (Round to two decimal places.) b. If your cost of capital is 10%, is the opportunity attractive? If your cost of capital is 10%, the opportunity menu.) Suppose you are able to renegotiate the terms of the contract so that your final payment in year 4 will be $1.2 million. c. What is the IRR of the opportunity now? (Select the best choice below.) OA. The IRR rule works as before. B. Now there are no IRRs. C. The IRR rule always gives the wrong answer. O D. Now there are 3 IRRs. d. Is it attractive at the new terms? (Select from the drop-down If your cost of capital is 10%, the opportunity menu.) (Select from the drop-down

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To determine which investment has the higher Internal Rate of Return IRR we can calculate the IRR for each investment and compare them The IRR of investment A can be calculated by solving the follow...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started