You are employed by Lily Co, a firm that is a producer of components for electronic devices. You are on the corporate staff as

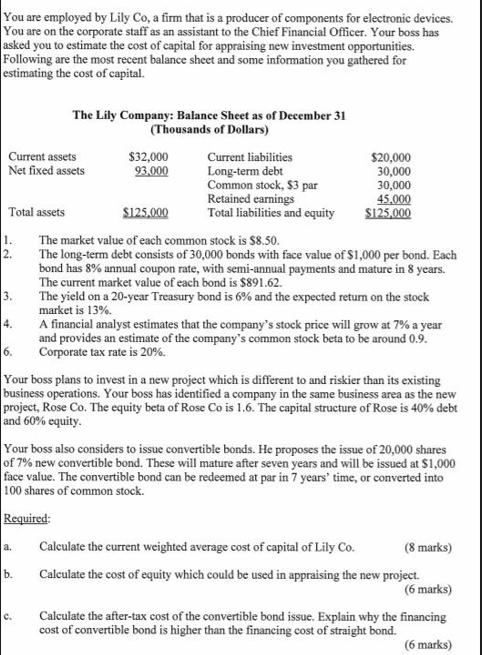

You are employed by Lily Co, a firm that is a producer of components for electronic devices. You are on the corporate staff as an assistant to the Chief Financial Officer. Your boss has asked you to estimate the cost of capital for appraising new investment opportunities. Following are the most recent balance sheet and some information you gathered for estimating the cost of capital. Current assets Net fixed assets Total assets 1. 2. 3. 6. The Lily Company: Balance Sheet as of December 31 (Thousands of Dollars) a. b. $32,000 93,000 C. Current liabilities Long-term debt Common stock, $3 par Retained earnings Total liabilities and equity $20,000 30,000 30,000 45,000 $125,000 $125,000 The market value of each common stock is $8.50. The long-term debt consists of 30,000 bonds with face value of $1,000 per bond. Each bond has 8% annual coupon rate, with semi-annual payments and mature in 8 years. The current market value of each bond is $891.62. The yield on a 20-year Treasury bond is 6% and the expected return on the stock market is 13%. Your boss plans to invest in a new project which is different to and riskier than its existing business operations. Your boss has identified a company in the same business area as the new project, Rose Co. The equity beta of Rose Co is 1.6. The capital structure of Rose is 40% debt and 60% equity. Your boss also considers to issue convertible bonds. He proposes the issue of 20,000 shares of 7% new convertible bond. These will mature after seven years and will be issued at $1,000 face value. The convertible bond can be redeemed at par in 7 years' time, or converted into 100 shares of common stock. Required: A financial analyst estimates that the company's stock price will grow at 7% a year and provides an estimate of the company's common stock beta to be around 0.9. Corporate tax rate is 20%. Calculate the current weighted average cost of capital of Lily Co. (8 marks) Calculate the cost of equity which could be used in appraising the new project. (6 marks) Calculate the after-tax cost of the convertible bond issue. Explain why the financing cost of convertible bond is higher than the financing cost of straight bond. (6 marks)

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a To calculate the current weighted average cost of capital WACC of Lily Co we need to determine the cost of equity the cost of debt and the weights of equity and debt in the capital structur...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started