Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are evaluating two passive equity funds Vanguard Small-growth ETF (VBK) and Invesco Trust (QQQ). Both funds' objective is to track the performance of

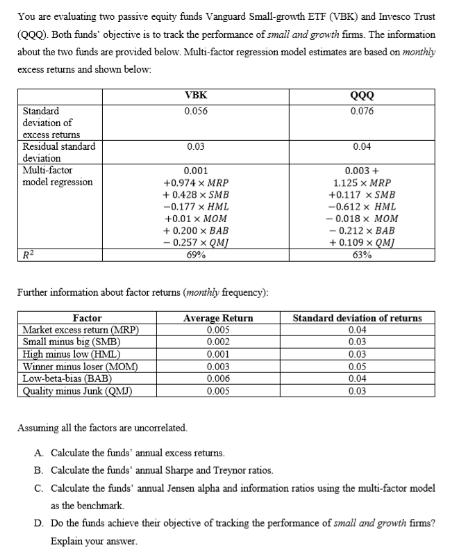

You are evaluating two passive equity funds Vanguard Small-growth ETF (VBK) and Invesco Trust (QQQ). Both funds' objective is to track the performance of small and growth firms. The information about the two funds are provided below. Multi-factor regression model estimates are based on monthly excess returns and shown below: Standard deviation of excess returns Residual standard deviation Multi-factor model regression R VBK 0.056 Factor Market excess return (MRP) Small minus big (SMB) High minus low (HML) Winner minus loser (MOM) Low-beta-bias (BAB) Quality minus Junk (QMJ) 0.03 0.001 +0.974 x MRP +0.428 x SMB -0.177 X HML +0.01 x MOM +0.200 x BAB -0.257 x QMJ 69% Further information about factor returns (monthly frequency): Average Return 0.005 0.002 0.001 0.003 0.006 0.005 Assuming all the factors are uncorrelated. A. Calculate the funds annual excess returns B. Calculate the funds annual Sharpe and Treynor ratios. QQQ 0.076 0.04 0.003 + 1125 x MRP +0.117 SMB -0.612 x HML -0.018 x MOM -0.212 x BAB +0.109 x QM) 63% Standard deviation of returns 0.04 0.03 0.03 0.05 0.04 0.03 C. Calculate the funds' annual Jensen alpha and information ratios using the multi-factor model as the benchmark. D. Do the funds achieve their objective of tracking the performance of small and growth firms? Explain your answer.

Step by Step Solution

★★★★★

3.34 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Answer A To calculate the funds annual excess returns we need to first calculate the expected excess return for each fund using the multifactor regres...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started