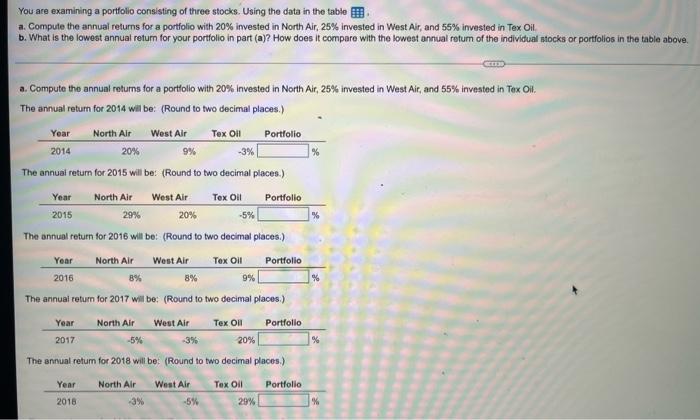

You are examining a portfolio consisting of three stocks. Using the data in the table a. Compute the annual returns for a portfolio with 20% invested in North Air, 25% invested in West Air, and 55% invested in Tex Oil. b. What is the lowest annual return for your portfolio in part (a)? How does it compare with the lowest annual return of the individual stocks or portfolios in the table above. a. Compute the annual returns for a portfolio with 20% invested in North Air, 25% invested in West Air, and 55% invested in Tex Oil. The annual return for 2014 will be: (Round to two decimal places.) North Air West Air Tex Oil Year 2014 Portfolio % 20% 9% -3% The annual return for 2015 will be: (Round to two decimal places.) North Air Year 2015 West Air Tex Oil 20% Portfolio % 29% -5% The annual return for 2016 will be: (Round to two decimal places.) North Air Tex Oil Year 2016 West Air 8% 8% Portfolio % 9% The annual return for 2017 will be: (Round to two decimal places.) West Air Tex Oil Year North Air 2017 Portfolio % -5% -3% 20% The annual return for 2018 will be: (Round to two decimal places.) North Air West Air Tex Oil Portfolio Year 2018 -3% -5% 29% % You are examining a portfolio consisting of three stocks. Using the data in the table a. Compute the annual returns for a portfolio with 20% invested in North Air, 25% invested in West Air, and 55% invested in Tex Oil. b. What is the lowest annual return for your portfolio in part (a)? How does it compare with the lowest annual return of the individual stocks or portfolios in the table above. a. Compute the annual returns for a portfolio with 20% invested in North Air, 25% invested in West Air, and 55% invested in Tex Oil. The annual return for 2014 will be: (Round to two decimal places.) North Air West Air Tex Oil Year 2014 Portfolio % 20% 9% -3% The annual return for 2015 will be: (Round to two decimal places.) North Air Year 2015 West Air Tex Oil 20% Portfolio % 29% -5% The annual return for 2016 will be: (Round to two decimal places.) North Air Tex Oil Year 2016 West Air 8% 8% Portfolio % 9% The annual return for 2017 will be: (Round to two decimal places.) West Air Tex Oil Year North Air 2017 Portfolio % -5% -3% 20% The annual return for 2018 will be: (Round to two decimal places.) North Air West Air Tex Oil Portfolio Year 2018 -3% -5% 29% %