Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are finally ready to stop paying rent. You found the house of your dreams but financing it can be tricky. You apply for a

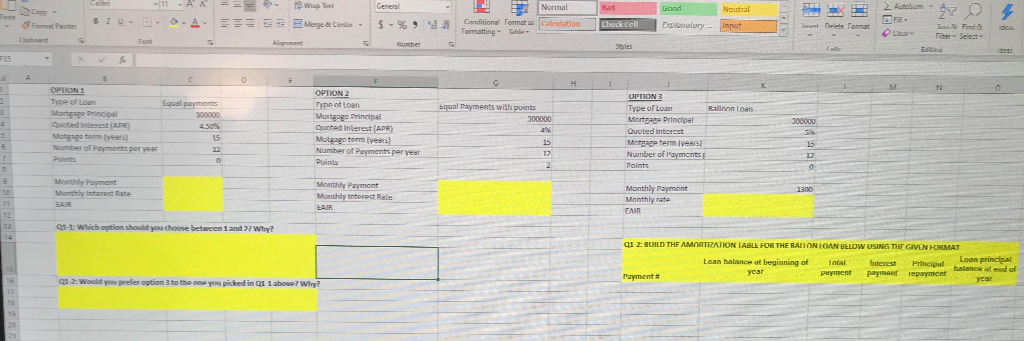

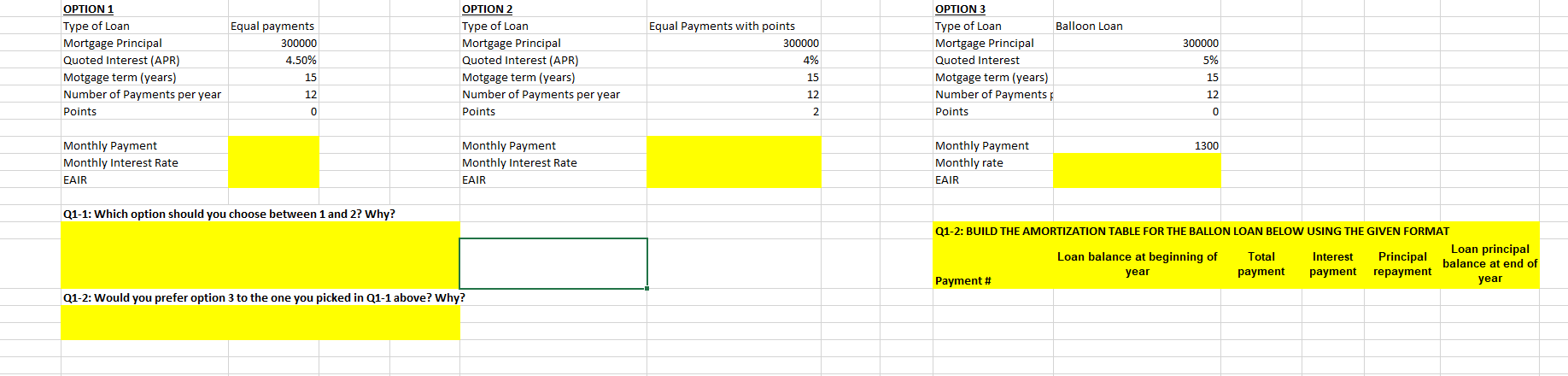

You are finally ready to stop paying rent. You found the house of your dreams but financing it can be tricky. You apply for a $300,000, 15-year mortgage loan (monthly payments). The bank offers the following options:

You are finally ready to stop paying rent. You found the house of your dreams but financing it can be tricky. You apply for a $300,000, 15-year mortgage loan (monthly payments). The bank offers the following options:

- 4.5% APR with no points equal payments loan.

- 4% APR with 2 points equal payments loan.

- Calculate the Effective Annual Interest Rate (EAR) for each one of the options above. Which option should you choose?

- You complain to the bank that the monthly payment for the two options above is a little too high for you right now (although you are certain you will be able to make much larger payments in the future, once you become CEO at your firm). In response, the bank offers you a 4%, 15-year balloon loan with a monthly payment of only $1,300. Can you build the amortization schedule for this loan? Would you prefer this option to the one you picked in point 1 above? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started