Answered step by step

Verified Expert Solution

Question

1 Approved Answer

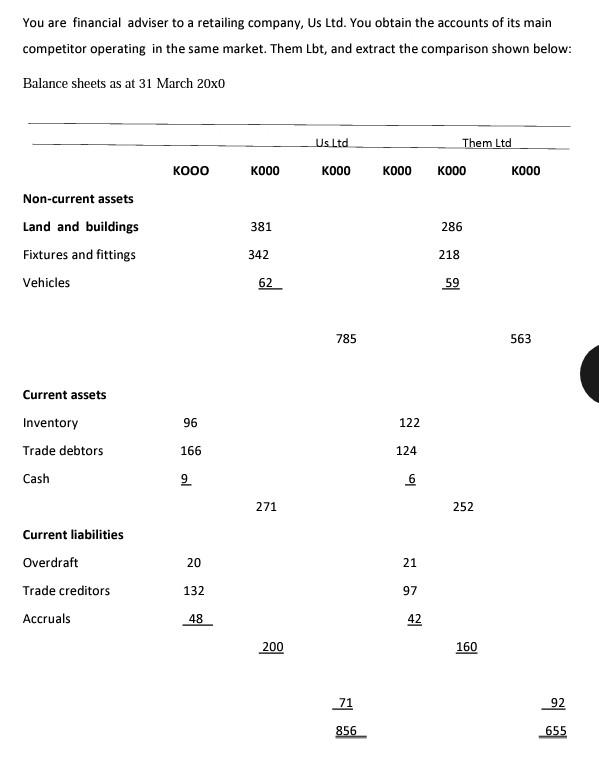

You are financial adviser to a retailing company, Us Ltd. You obtain the accounts of its main competitor operating in the same market. Them Lbt,

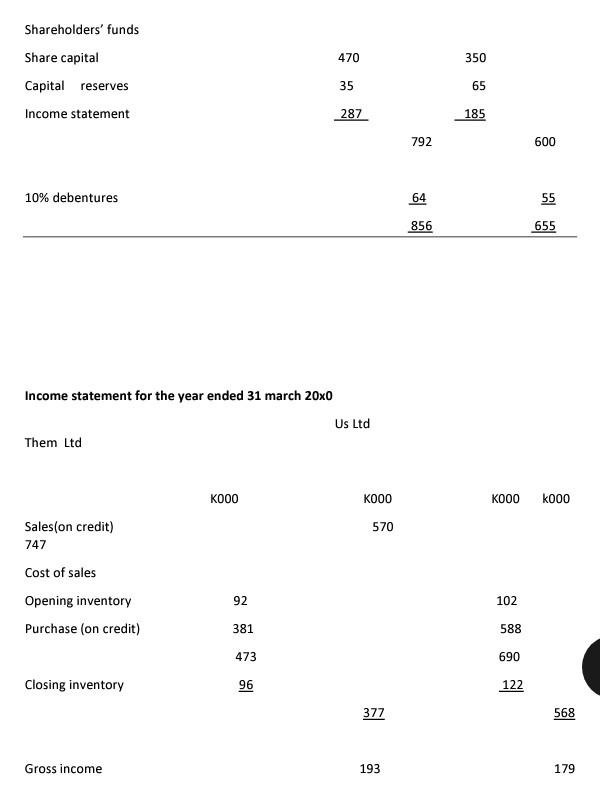

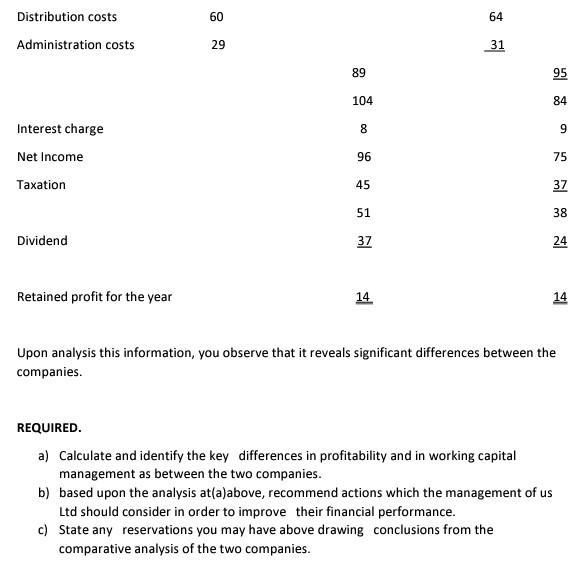

You are financial adviser to a retailing company, Us Ltd. You obtain the accounts of its main competitor operating in the same market. Them Lbt, and extract the comparison shown below: Balance sheets as at 31 March 20x0 Us Ltd Them Ltd KOOO K000 K000 K000 K000 K000 381 286 Non-current assets Land and buildings Fixtures and fittings Vehicles 342 218 62 59 785 563 Current assets Inventory Trade debtors 96 122 166 124 Cash al 9 6 271 252 Current liabilities Overdraft 20 21 Trade creditors 132 97 Accruals 48 42 200 160 71 92 856 655 Shareholders' funds 470 350 Share capital Capital reserves Income statement 35 65 287 185 792 600 10% debentures 64 55 856 655 Income statement for the year ended 31 march 20x0 Us Ltd Them Ltd K000 K000 KOOO k000 570 Sales(on credit) 747 Cost of sales Opening inventory Purchase (on credit) 92 102 381 588 473 690 Closing inventory 96 122 377 568 Gross income 193 179 60 64 Distribution costs Administration costs 29 31 89 95 104 84 8 9 Interest charge Net Income Taxation 96 75 45 37 51 38 Dividend 37 24 Retained profit for the year 14 14 Upon analysis this information, you observe that it reveals significant differences between the companies. REQUIRED. a) Calculate and identify the key differences in profitability and in working capital management as between the two companies. b) based upon the analysis at(a)above, recommend actions which the management of us Ltd should consider in order to improve their financial performance. c) State any reservations you may have above drawing conclusions from the comparative analysis of the two companies. Distribution costs 60 64 Administration costs 29 31 89 95 104 84 8 9 Interest charge Net Income Taxation 96 75 45 37 51 38 Dividend 37 24 Retained profit for the year 14. 14 Upon analysis this information, you observe that it reveals significant differences between the companies REQUIRED. a) Calculate and identify the key differences in profitability and in working capital management as between the two companies. b) based upon the analysis at(a)above, recommend actions which the management of us Ltd should consider in order to improve their financial performance. c) State any reservations you may have above drawing conclusions from the comparative analysis of the two companies

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started