Question

You are given the duty of valuing your company shares. Expected net income of the next year (year 1) is 2,5 million TL, expected

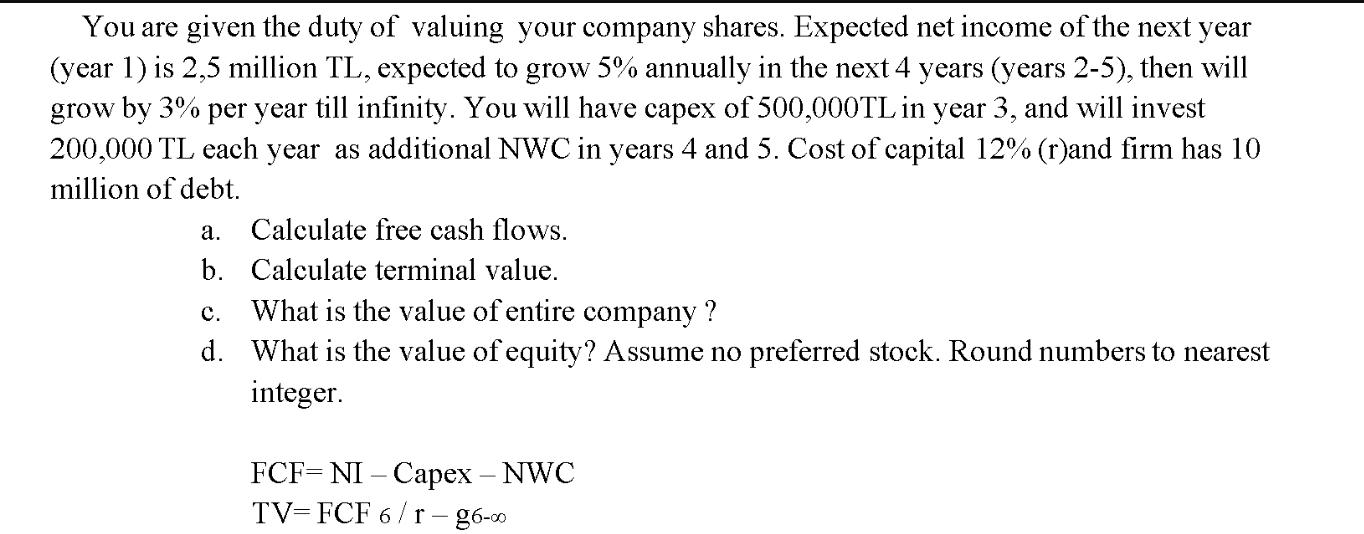

You are given the duty of valuing your company shares. Expected net income of the next year (year 1) is 2,5 million TL, expected to grow 5% annually in the next 4 years (years 2-5), then will grow by 3% per year till infinity. You will have capex of 500,000TL in year 3, and will invest 200,000 TL each year as additional NWC in years 4 and 5. Cost of capital 12% (r)and firm has 10 million of debt. a. Calculate free cash flows. b. Calculate terminal value. What is the value of entire company? C. d. What is the value of equity? Assume no preferred stock. Round numbers to nearest integer. FCF=NI - Capex - NWC TV FCF 6/r-g6-00

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the free cash flows we need to calculate net income depreciation capital expenditures ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis and Valuation

Authors: Clyde P. Stickney

6th edition

324302959, 978-0324302967, 324302967, 978-0324302950

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App