Answered step by step

Verified Expert Solution

Question

1 Approved Answer

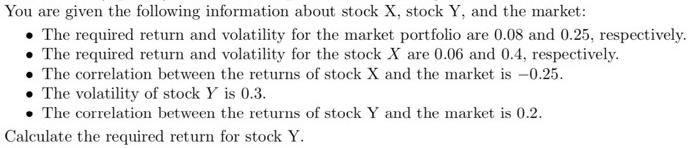

You are given the following information about stock X, stock Y, and the market: The required return and volatility for the market portfolio are

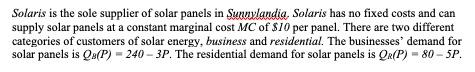

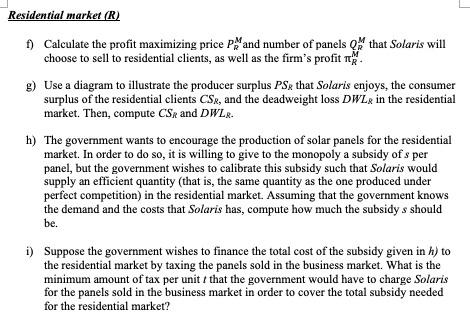

You are given the following information about stock X, stock Y, and the market: The required return and volatility for the market portfolio are 0.08 and 0.25, respectively. The required return and volatility for the stock X are 0.06 and 0.4, respectively. The correlation between the returns of stock X and the market is -0.25. The volatility of stock Y is 0.3. The correlation between the returns of stock Y and the market is 0.2. Calculate the required return for stock Y. Solaris is the sole supplier of solar panels in Sunnylandia, Solaris has no fixed costs and can supply solar panels at a constant marginal cost MC of $10 per panel. There are two different categories of customers of solar energy, business and residential. The businesses' demand for solar panels is Qs(P) = 240-3P. The residential demand for solar panels is QR(P) 80-5P. Residential market (R) f) Calculate the profit maximizing price PM and number of panels Q that Solaris will choose to sell to residential clients, as well as the firm's profit n g) Use a diagram to illustrate the producer surplus PSR that Solaris enjoys, the consumer surplus of the residential clients CSR, and the deadweight loss DWL& in the residential market. Then, compute CSR and DWLR. h) The government wants to encourage the production of solar panels for the residential market. In order to do so, it is willing to give to the monopoly a subsidy of s per panel, but the government wishes to calibrate this subsidy such that Solaris would supply an efficient quantity (that is, the same quantity as the one produced under perfect competition) in the residential market. Assuming that the government knows the demand and the costs that Solaris has, compute how much the subsidy s should be. i) Suppose the government wishes to finance the total cost of the subsidy given in h) to the residential market by taxing the panels sold in the business market. What is the minimum amount of tax per unit that the government would have to charge Solaris for the panels sold in the business market in order to cover the total subsidy needed for the residential market? The table below is part of a mortality table used by a life insurance company to calculate probabilities for a special type of life insurance policy. 3 (0) (ii) 51 52 53 54 55 4x3+1 4+2 +3 + 1,537 1,517 1,502 1,492 1,483 1,532 1,512 1,497 1,487 1,477 1,525 1,505 1,490 1,480 1,470 1,517 1,499 1,484 1,474 1,462 1,512 1,492 1,477 1,467 1,453 Calculate the probability that a policyholder who was accepted for insurance exactly 2 years ago and is now aged exactly 55 will die between age 56 and age 57. Calculate the corresponding probability for an individual of the same age who has been a policyholder for many years. Comment on your answers to (i) and (

Step by Step Solution

★★★★★

3.53 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Lets solve this stepbystep f For the residential market demand function QRP 80 5P Margin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started