Answered step by step

Verified Expert Solution

Question

1 Approved Answer

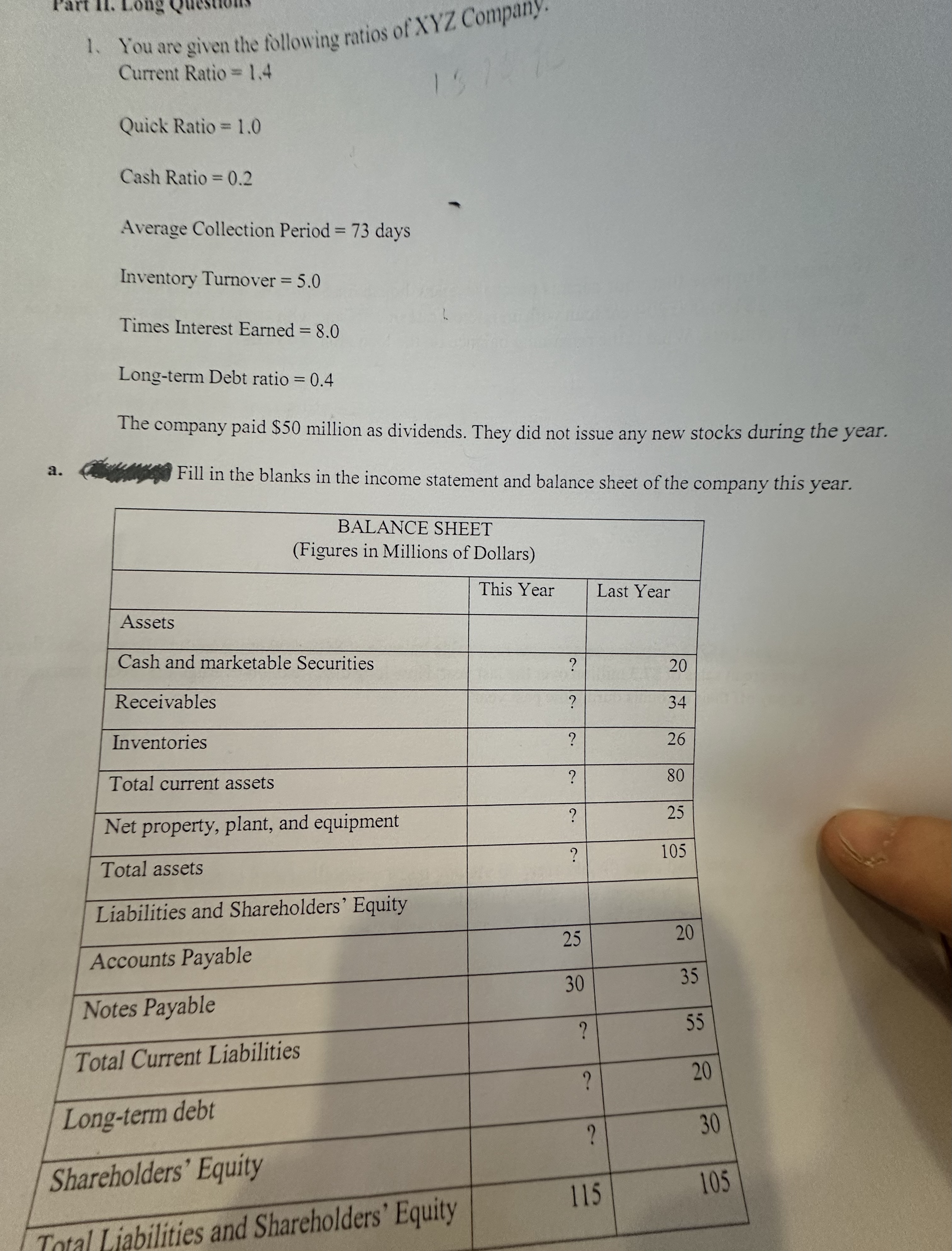

You are given the following ratios of XYZ Company. Current Ratio = 1 , 4 Quick Ratio = 1 . 0 Cash Ratio = 0

You are given the following ratios of XYZ Company.

Current Ratio

Quick Ratio

Cash Ratio

Average Collection Period days

Inventory Turnover

Times Interest Earned

Longterm Debt ratio

The company paid $ million as dividends. They did not issue any new stocks during the year.

a Fill in the blanks in the income statement and balance sheet of the company this year.

tableBALANCE SHEETFigures in Millions of DollarsAssetsThis Year,Last YearCash and marketable Securities,?,ReceivablesInventoriesTotal current assets,?,Net property, plant, and equipment,?,Total assets,?,Liabilities and Shareholders' Equity,,Accounts Payable,Notes Payable,Total Current Liabilities,?,Longterm debt,?,Shareholders Equity,,Tolal Liabilities and Shareholders' Equity,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started