Answered step by step

Verified Expert Solution

Question

1 Approved Answer

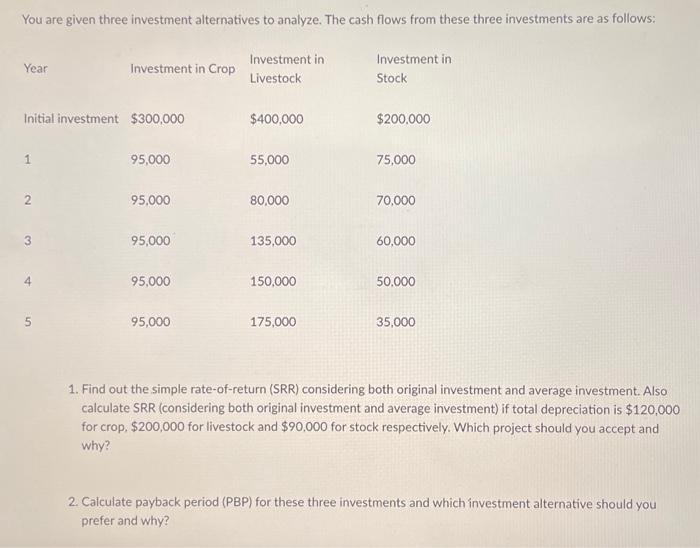

You are given three investment alternatives to analyze. The cash flows from these three investments are as follows: Investment in Livestock Investment in Stock

You are given three investment alternatives to analyze. The cash flows from these three investments are as follows: Investment in Livestock Investment in Stock Year Initial investment $300,000 1 2 Investment in Crop vi 95,000 95,000 95,000 95,000 95,000 $400,000 55,000 80,000 135,000 150,000 175,000 $200,000 75,000 70,000 60,000 50.000 35,000 1. Find out the simple rate-of-return (SRR) considering both original investment and average investment. Also calculate SRR (considering both original investment and average investment) if total depreciation is $120,000 for crop, $200,000 for livestock and $90,000 for stock respectively. Which project should you accept and why? 2. Calculate payback period (PBP) for these three investments and which investment alternative should you prefer and why? 3. Compute the Net Present Value (NPV) when discount rate is 10% for all investments alternatives. Which project should you choose and why? 4. Calculate the IRR of these three investments and draw a conclusion based on your results.

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

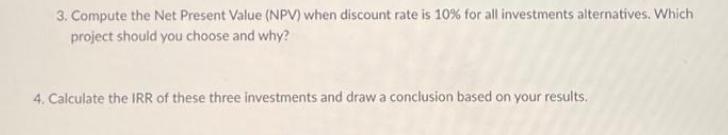

Solution To solve this problem we need to use the following formulas Simple Rate of Return SRR SRR Total Revenue Total Costs Average Investment Payback Period PBP PBP Total Costs Total Revenue Annual ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started