Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are going to make a substantial purchase. You have enough money to pay cash, but don't know if that's the way to make

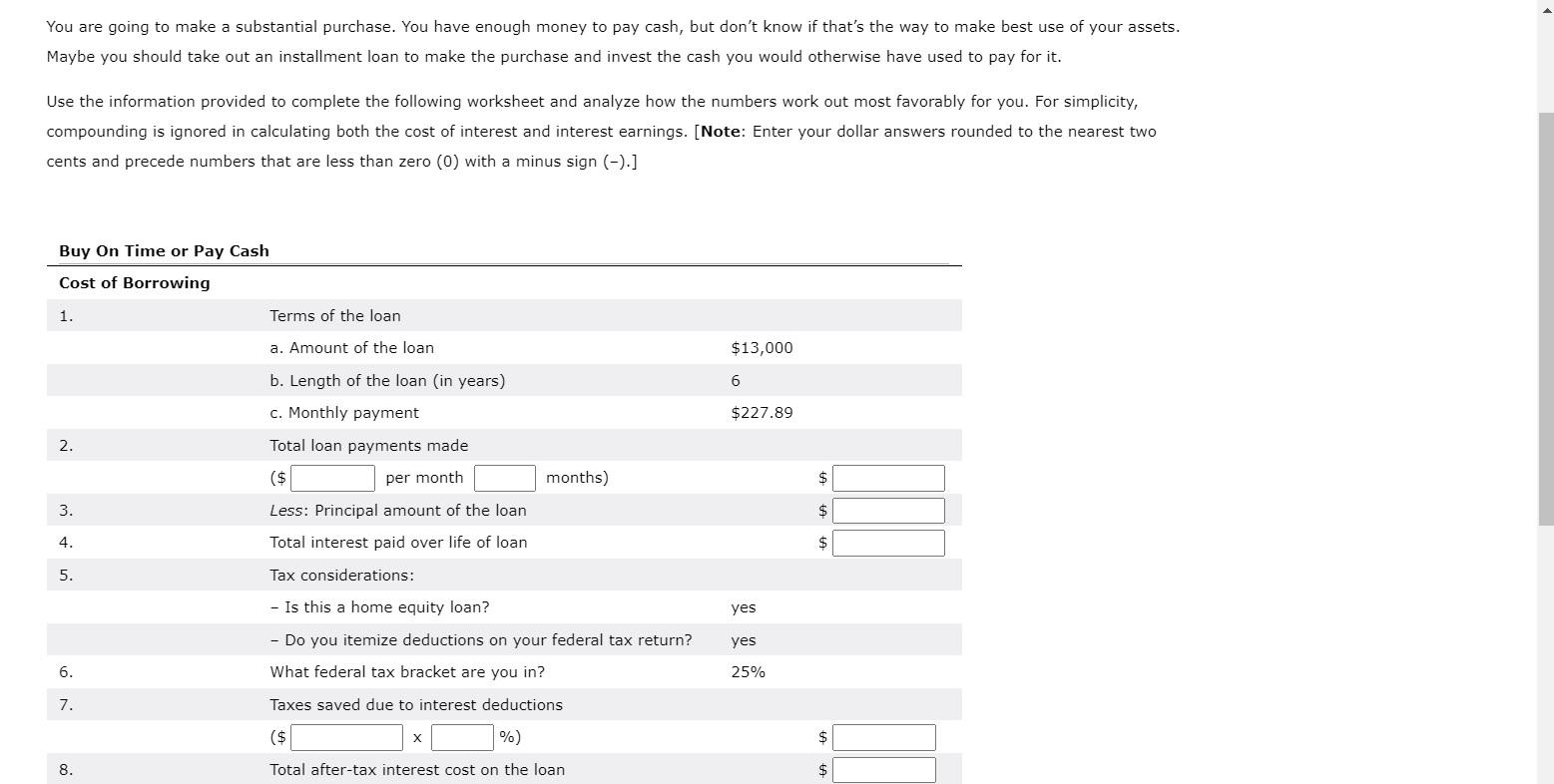

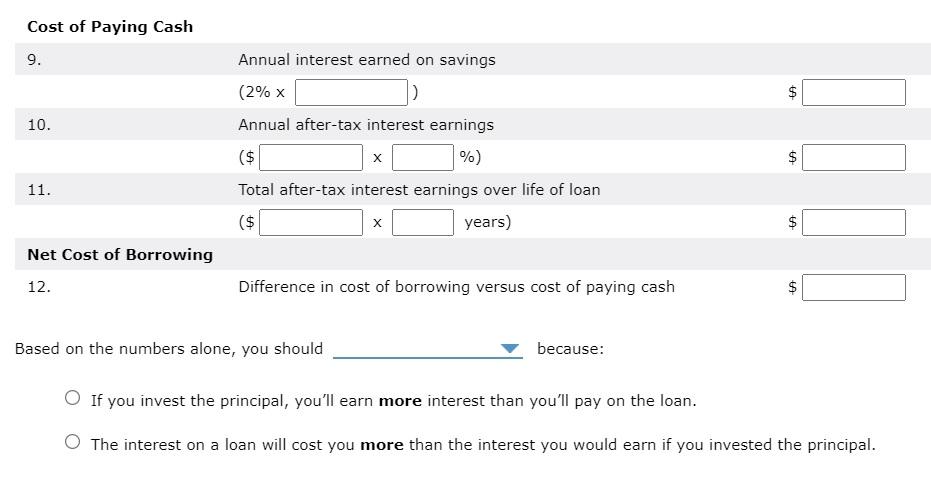

You are going to make a substantial purchase. You have enough money to pay cash, but don't know if that's the way to make best use of your assets. Maybe you should take out an installment loan to make the purchase and invest the cash you would otherwise have used to pay for it. Use the information provided to complete the following worksheet and analyze how the numbers work out most favorably for you. For simplicity, compounding is ignored in calculating both the cost of interest and interest earnings. [Note: Enter your dollar answers rounded to the nearest two cents and precede numbers that are less than zero (0) with a minus sign (-).] Buy On Time or Pay Cash Cost of Borrowing 1. 2. 3. 4. 5. 6. 7. 8. Terms of the loan a. Amount of the loan b. Length of the loan (in years) c. Monthly payment Total loan payments made ($ per month Less: Principal amount of the loan Total interest paid over life of loan Tax considerations: - Is this a home equity loan? - Do you itemize deductions on your federal tax return? What federal tax bracket are you in? Taxes saved due to interest deductions ($ %) Total after-tax interest cost on the loan X months) $13,000 6 $227.89 yes yes 25% $ $ $ $ $ Cost of Paying Cash 9. 10. 11. Net Cost of Borrowing 12. Annual interest earned on savings (2% x Annual after-tax interest earnings %) ($ Total after-tax interest earnings over life of loan ($ years) X Based on the numbers alone, you should x Difference in cost of borrowing versus cost of paying cash because: 1001 LA LA LA LA If you invest the principal, you'll earn more interest than you'll pay on the loan. O The interest on a loan will cost you more than the interest you would earn if you invested the principal.

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started