Question

You are hired by a large hedge fund based in Ontario as an equity researcher and are assigned to a team that covers the consumer

You are hired by a large hedge fund based in Ontario as an equity researcher and are assigned to a team that covers the consumer staples industry. As a rookie researcher, your boss asks you produce some analysis reports on some local small-cap stocks and make some recommendations. Among the list of stocks, Andrew Peller Limited caught your attention because you read that the company’s fundamentals have been decent and that the company recently announced an increase in dividend payment to its shareholders.

You asked your boss whether Andrew Peller could be a good starting point that fits the hedge fund’s investment vision. Your boss quickly scanned through the company’s financials and replied, “it looks like a company that has stable operations and pays its dividends, but our fund is really looking for those small-cap stocks that can have good growth potentials…… Also, this company only does alcoholic beverage products in Canada, seems like it can be risky too.”

Your boss continues,

“As a starting point, crunch some numbers and show me how the company has been doing over the last 3 years. In particular, please try to answer for yourself the following three questions.”

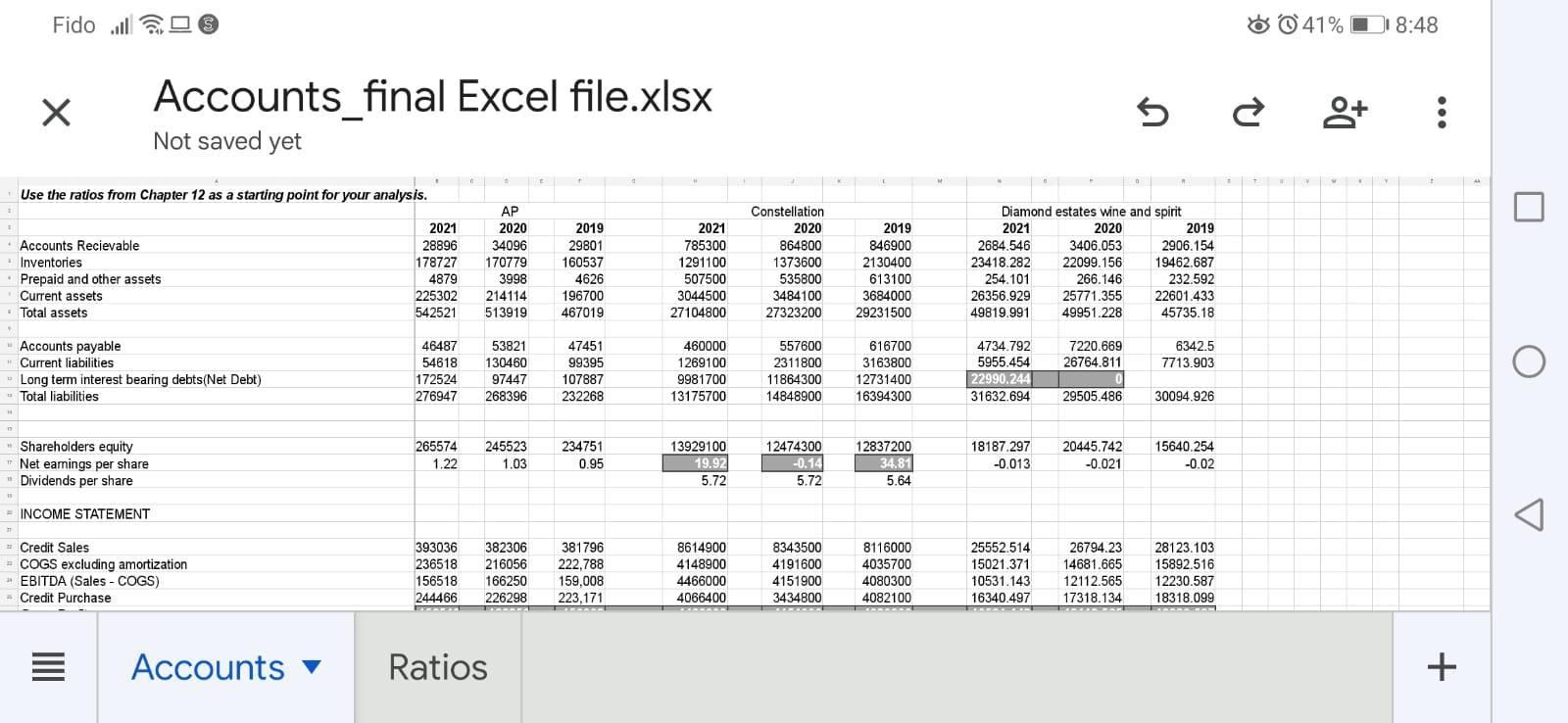

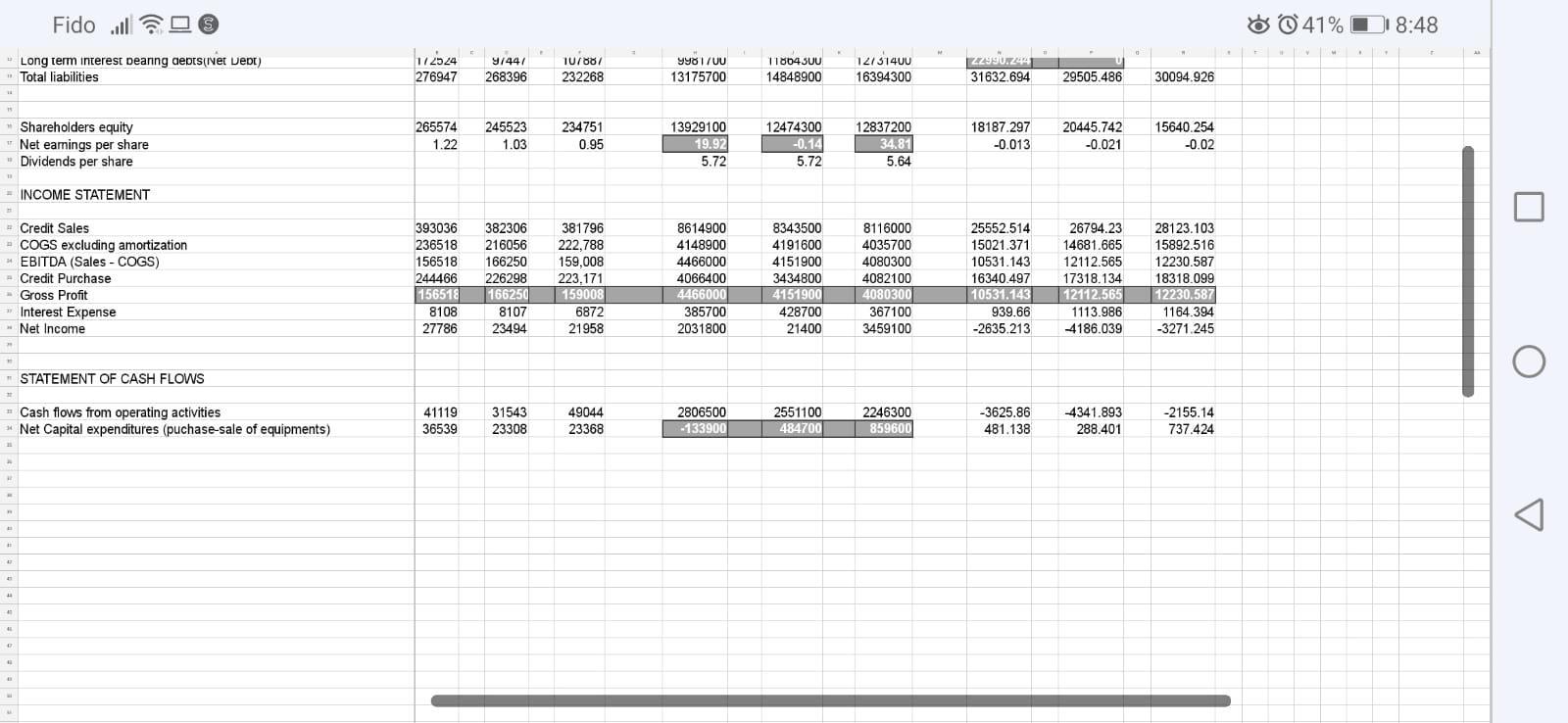

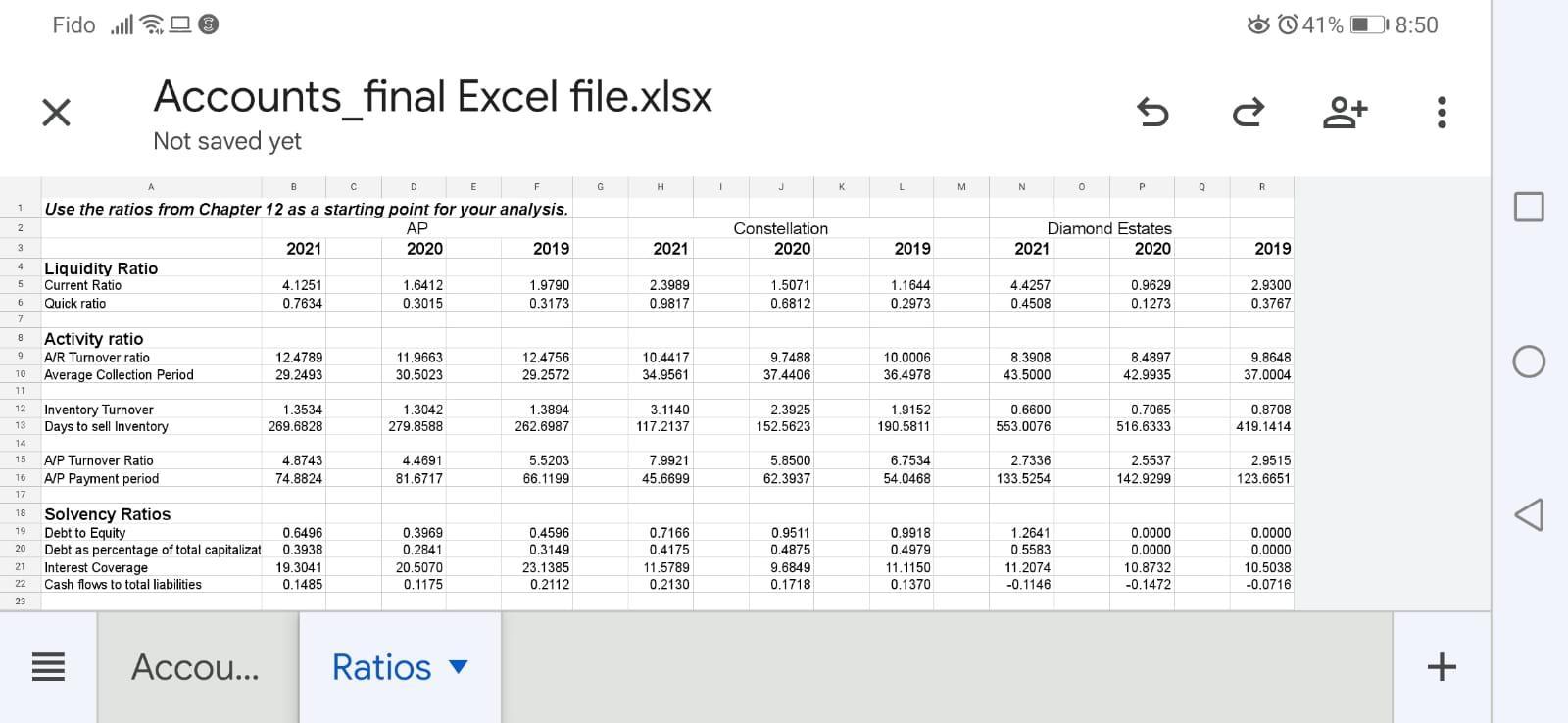

(1) How is the company’s financial performance over the last three fiscal years (i.e., FY2021, FY2020, FY2019)? Why has the company’s gross margin decreased in 2021, yet its EPS increased? (15 Marks)

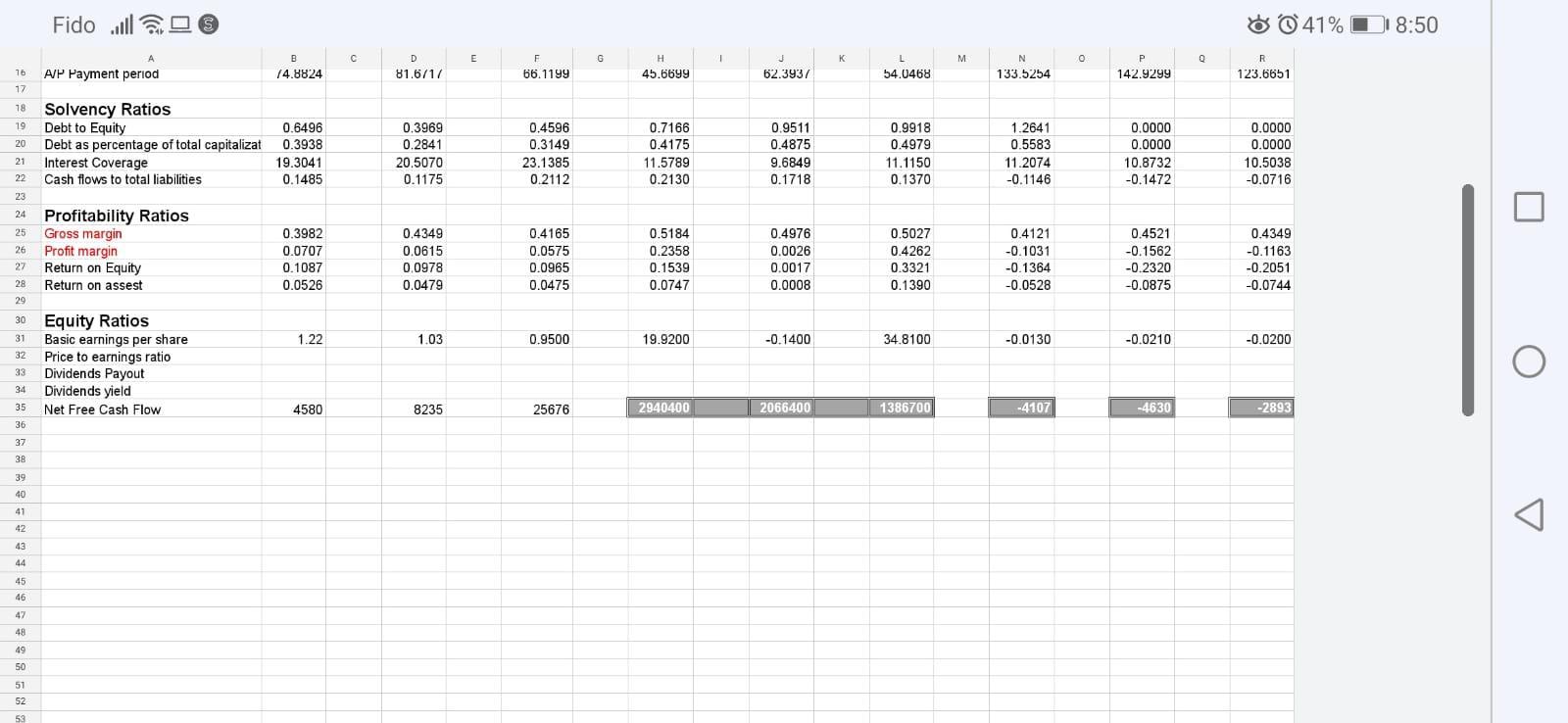

(2) What do the relevant ratios tell you about the most recent balance sheet as well as any changes over time? Are there any ratios that we should be worried about? (15 Marks)

(3) What do the cash flow patterns of the company tell you? Is there evidence that the company is stable and growing and why? Is the company’s plan to increase dividends justified (hint: check the free cash flows to shareholders)? (15 Marks)

1 1 9 ta Total assets 14 " Fido ill 11 X 31 12 Long term interest bearing debts (Net Debt) Total liabilities Use the ratios from Chapter 12 as a starting point for your analysis. Accounts Recievable Inventories Prepaid and other assets Current assets Accounts payable Current liabilities Accounts final Excel file.xlsx Not saved yet Shareholders equity Net earnings per share Dividends per share S INCOME STATEMENT Credit Sales COGS excluding amortization EBITDA (Sales - COGS) Credit Purchase Accounts AP 2020 2021 2019 34096 29801 28896 178727 170779 160537 4879 3998 4626 225302 214114 196700 542521 513919 467019 53821 46487 54618 172524 130460 97447 276947 268396 265574 245523 1.22 1.03 Ratios 47451 99395 107887 232268 234751 0.95 393036 382306 381796 236518 216056 222,788 156518 166250 159,008 244466 226298 223,171 2021 785300 1291100 507500 3044500 27104800 460000 1269100 9981700 13175700 13929100 19.92 5.72 8614900 4148900 4466000 4066400 ******* Constellation 2020 864800 1373600 535800 3484100 27323200 557600 2311800 11864300 14848900 12474300 -0.14 5.72 8343500 4191600 4151900 3434800 2019 846900 2130400 613100 3684000 29231500 616700 3163800 12731400 16394300 12837200 34.81 5.64 8116000 4035700 4080300 4082100 Diamond estates wine and spirit 2020 3406.053 22099.156 2021 2684.546 23418.282 254.101 26356.929 49819.991 49951.228 266.146 25771.355 18187.297 -0.013 4734.792 7220.669 5955.454 26764.811 22990.244 31632.694 29505.486 30094.926 0 20445.742 -0.021 5 2 8+ 25552.514 15021.371 26794.23 14681.665 10531.143 12112.565 16340,497 17318.134 2019 2906.154 19462.687 232.592 22601.433 45735.18 6342.5 7713.903 15640.254 -0.02 041%8:48 28123.103 15892.516 12230.587 18318,099 AAAA-BAN 8+: + A

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Detailed Explanation Answer 1 To analyze the financial performance of Andrew Peller Limited over the last three fiscal years FY2021 FY2020 FY2019 we will focus on key financial metrics and ratios prov...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started