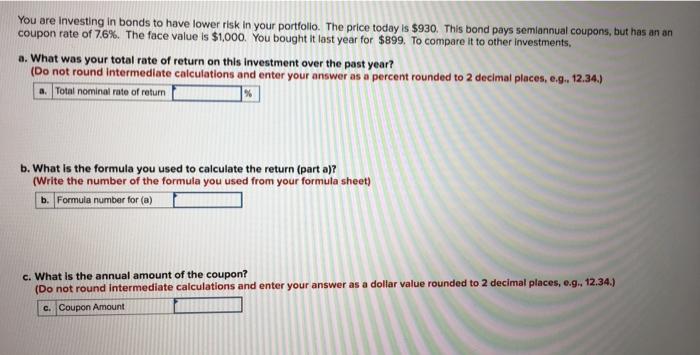

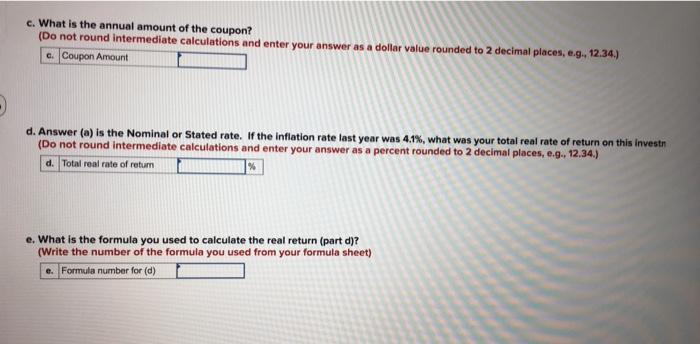

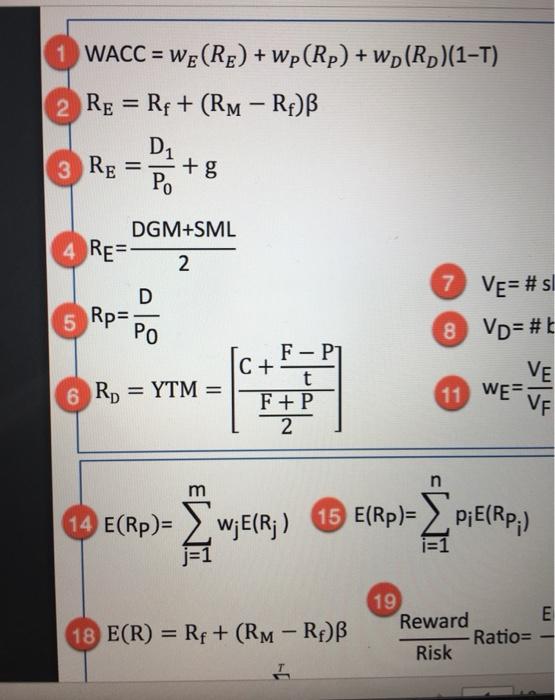

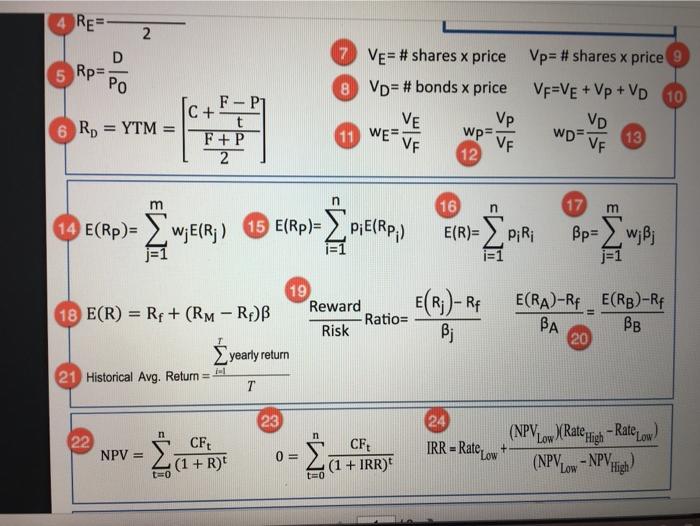

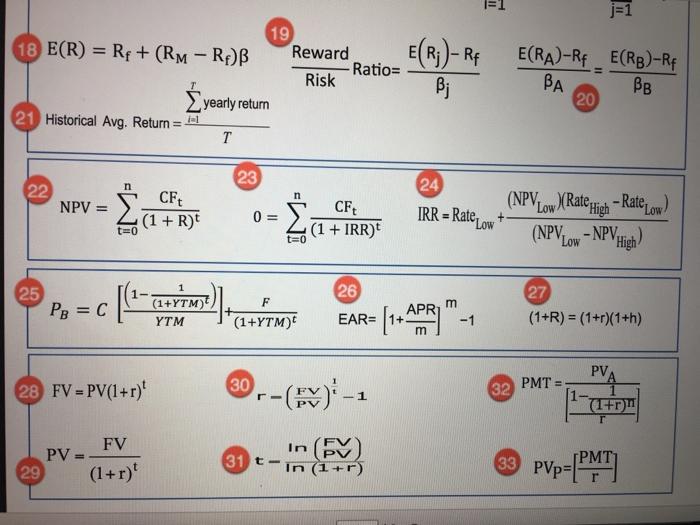

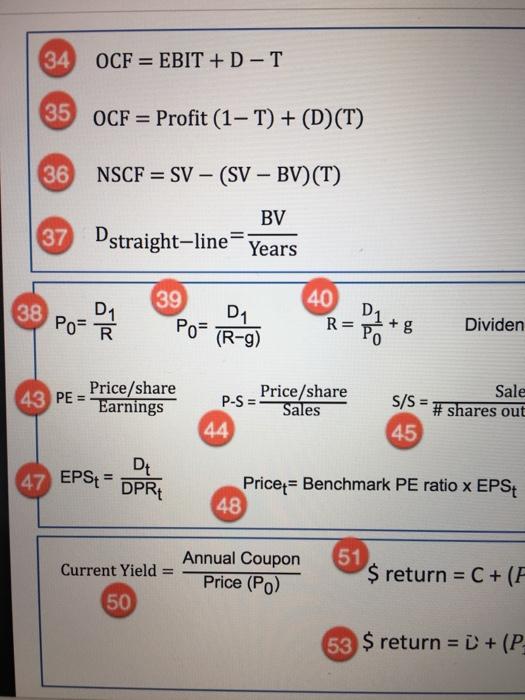

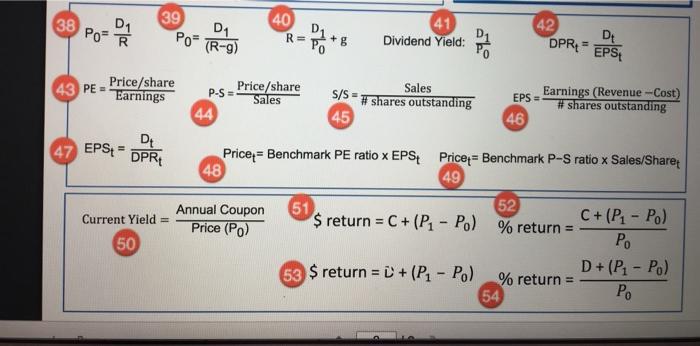

You are investing in bonds to have lower risk in your portfolio. The price today is $930. This bond pays semiannual coupons, but has an an coupon rate of 7.6%. The face value is $1,000. You bought it last year for $899. To compare it to other investments. a. What was your total rate of return on this investment over the past year? (Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g. 12.34.) a Total nominal rate of return b. What is the formula you used to calculate the return (part a)? (Write the number of the formula you used from your formula sheet) b. Formula number for (a) c. What is the annual amount of the coupon? (Do not round Intermediate calculations and enter your answer as a dollar value rounded to 2 decimal places, e.g., 12.34.) c. Coupon Amount c. What is the annual amount of the coupon? (Do not round intermediate calculations and enter your answer as a dollar value rounded to 2 decimal places, e.g. 12.34) c. Coupon Amount d. Answer (a) is the Nominal or Stated rate. If the inflation rate last year was 4.1%, what was your total real rate of return on this invest (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 12.34.) d. Total real rate of retum e. What is the formula you used to calculate the real return (part d)? (Write the number of the formula you used from your formula sheet) e. Formula number for (d) WACC = we(Re) + wp(Rp) +wp(RD)(1-T) Re = Rp + (RM - RPB 2 D1 3 RE +g Po 7 Ve=#sl Rp DGM+SML 4 RE= 2 D 5 F-P1 C+ t = YTM = F+P 2 8 Vo=# VE 11 WEVE 6 R, m 14 E(Rp)= W;E(R; ) 15 E(Rp)=P;E(RP;) i=1 18 E(R) = Rp + (RM - RAB 19 Reward Ratio= Risk RE N D Rp Ve= #shares x price Vp=# shares x price 8 Vp=# bonds x price Ve=VE + Vp + VD 10 Vp 13 12 F-P C + t F+P 2 6 Rp = YTM = VD WP-VE VE VE 11 WE= WD- VF m n 16 ECRP) = w;E(R;) 6 (Rp)=PIE(RP:) 17 = w E(R)= PiR i=1 j=1 j=1 19 18 E(R) = Rp + (RM - RAB Reward Ratio= Risk E(Ri)-RF B; E(RA)-Rf E(RB)-RF BA BB 20 yearly return 21 Historical Avg. Return = 23 n 22 CF CFt NPV = (1 + R) to 24 (NPV Rate rich - Rate Low) / IRR = Rate ow+ 0 = (1 + IRR) (NPV. - NPV to F1 j=1 E(R;) - Rf 19 18 E(R) = Rp + (RM - RAB Reward Ratio= Risk yearly return 21 Historical Avg. Return = 11 T E(RA)-Rf E(RB)-RF BA BB 20 B; 23 22 n n NPV = CFt (1 + R) 0= LuffRRE 24 (NPVLow }(Rate High - RateLow) IRR = Rate Low + (NPVLow - NPVA " - NPV High t=0 25 PB=0 (1+YTM) YTM F (1+YTM) 26 EAR= [1+ APARI APRI m -1 m 27 (1+R) = (1+r)(1+h) PV 30 28 FV = PV(1+r) PMT = 32 (v)! - 1 (1+r) r In (FV PV 29 FV (1+r) 31 t-in (1+1) 23 Vp=(PMT) 34 OCF = EBIT + D-T 35 OCF = Profit (1-T) + (D)(T) 36 NSCF = SV - (SV - BV)(T) BV 37 Dstraight-line Years 39 38 D1 Po- R 40 R= D1 (R-g) Pos + g Dividen Price/share 43 PE = Earnings Sale Price/share P-S = Sales 44 S/S = # shares out 45 47 EPSt = D DPRD Price = Benchmark PE ratio x EPS 48 Current Yield = Annual Coupon Price (PO) 51 $ return = C + (F 50 53 $ return = + (P 38 D1 39 40 Po- D1 Po- (R-9) R= 8 Dividend Yield: 42 DPR - EPS Price/share 43 PE - Earnings P-S = Price/share Sales 44 S/S Sales #shares outstanding 45 EPS 46 Earnings (Revenue -Cost) # shares outstanding D 47 EPS4= DPR Price = Benchmark PE ratio x EPS Price = Benchmark P-S ratio x Sales/Share 48 49 Annual Coupon Current Yield = Price (PO) 50 51 (52) $ return = C + (P1 - Po) % return = C+(P1 - Po) D+ (P1 - Po) 53 $ return = l + (P1-P) % return = 54