Question

You are offered the following investment opportunities. Calculate the present value of each opportunity (to the nearest dollar) if the interest rate is 5%. (i)

You are offered the following investment opportunities. Calculate the present value of each opportunity (to the nearest dollar) if the interest rate is 5%.

(i) A perpetuity that pays $12,000 forever if the first cash flow starts now.

(ii) An annuity that pays $10,000 annually for ten years where the first cash flow begins one year from now.

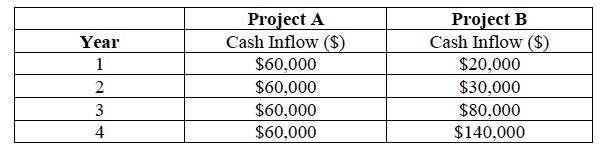

(b) Great Investment Ltd is currently evaluating two projects, each costing $200,000. The projected cash inflows from the projects are shown below:

(i) Compute the payback periods for the two projects (to 2 decimal places).

(ii) If the firm can only invest in one project, which project should the firm accept based on the payback periods? Explain.

(iii) State ONE (1) advantage and ONE (1) disadvantage of using the Payback Period method to evaluate investments.

(c) Spice Kitchen is considering whether to invest in a new machine that costs $200,000. With this machine, the firm projects that it will be able to receive $50,000 at the end of each year for the next 5 years. At the end of the 5th year, the firm will scrap the machine and will not receive any salvage value for it. The firm's cost of capital is 7%.

(i) What is the Net Present Value (NPV) of this investment (to the nearest dollar)? Should the firm purchase this machine base on the NPV method? Why?

(ii) What is the Internal Rate of Return (IRR) of this investment (to 2 decimal places)? Based on the IRR method, should the firm purchase this machine? Why?

Year 1 2 3 4 Project A Cash Inflow ($) $60,000 $60,000 $60,000 $60,000 Project B Cash Inflow ($) $20,000 $30,000 $80,000 $140,000

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

i The present value of a perpetuity that pays 12000 forever is calculated using the formula PV CF r where CF is the cash flow and r is the discount ra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started