Question

You are preparing for your CFE final exams and your wonderful instructor, William that taught ACCT 1510 is helping you prepare for the exam. He

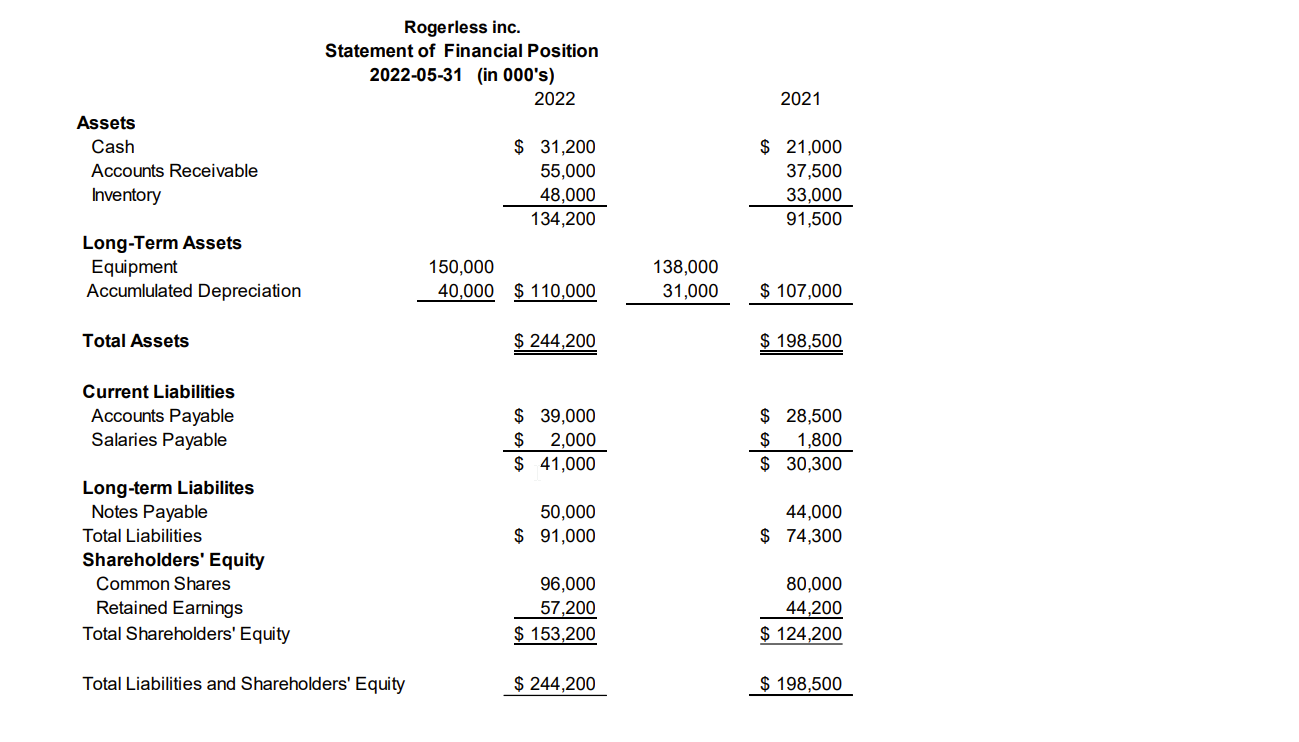

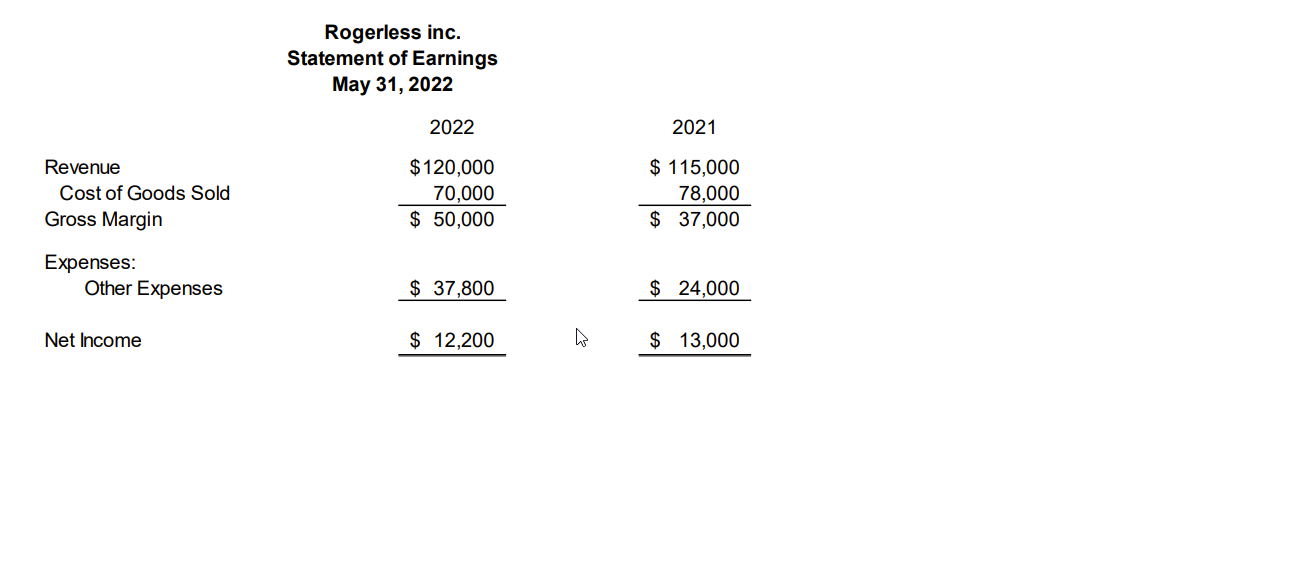

You are preparing for your CFE final exams and your wonderful instructor, William that taught ACCT 1510 is helping you prepare for the exam. He wants you to review the Statement of Financial Position and Statement of Earnings of Rogerless Inc. as of May 31, 2022 (Exhibit 1 and 2). and prepare a Statement of Cash Flows using the indirect method. The company is a private enterprise and chooses to follow ASPE. William also wants you as part of the preparation process to evaluate the results from the Statement of Cash Flows, specifically identify the changes that occurred, if any. In addition, he wants you to also do an analysis using the analytical tools you have learned in the past. They include the following: Current Ratio Debt to Equity Ratio Accounts Receivable Turnover Ratio Inventory Turnover Ratio ROE Additional Data: a. Bought equipment for cash $12,000 b. Paid $6,000 on Long Term Debt c. Issued new shares for $16,000 cash d. No dividends were declared e. Other expenses included depreciation, $5,000; wages, $20,000; taxes $6,000; other, $$6,800 f. Accounts Payable includes only inventory purchases made on credit. Because there are no liability accounts relating to taxes or other expenses, assume these expenses were fully paid in cash. g. Accounts Receivable for 2020 is $35,750, and total shareholders' equity for 2020 is $111,100.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started