Answered step by step

Verified Expert Solution

Question

1 Approved Answer

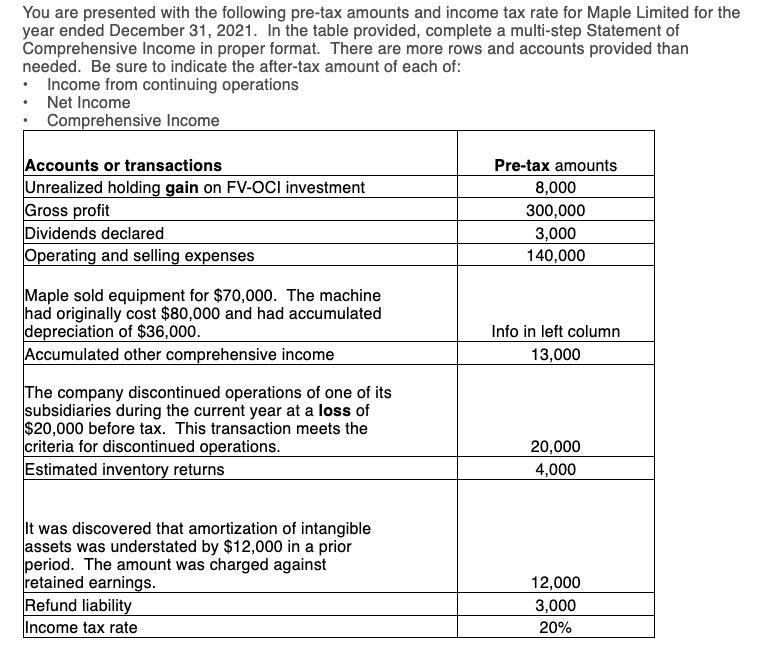

You are presented with the following pre-tax amounts and income tax rate for Maple Limited for the year ended December 31, 2021. In the

You are presented with the following pre-tax amounts and income tax rate for Maple Limited for the year ended December 31, 2021. In the table provided, complete a multi-step Statement of Comprehensive Income in proper format. There are more rows and accounts provided than needed. Be sure to indicate the after-tax amount of each of: Income from continuing operations Net Income Comprehensive Income Accounts or transactions Unrealized holding gain on FV-OCI investment Gross profit Dividends declared Operating and selling expenses Maple sold equipment for $70,000. The machine had originally cost $80,000 and had accumulated depreciation of $36,000. Accumulated other comprehensive income The company discontinued operations of one of its subsidiaries during the current year at a loss of $20,000 before tax. This transaction meets the criteria for discontinued operations. Estimated inventory returns It was discovered that amortization of intangible assets was understated by $12,000 in a prior period. The amount was charged against retained earnings. Refund liability Income tax rate Pre-tax amounts 8,000 300,000 3,000 140,000 Info in left column 13,000 20,000 4,000 12,000 3,000 20%

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a income from continuing operations Maple Limited Statement of Comprehensive Income For the Year Ended December 31 2021 Income from continuing operati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started