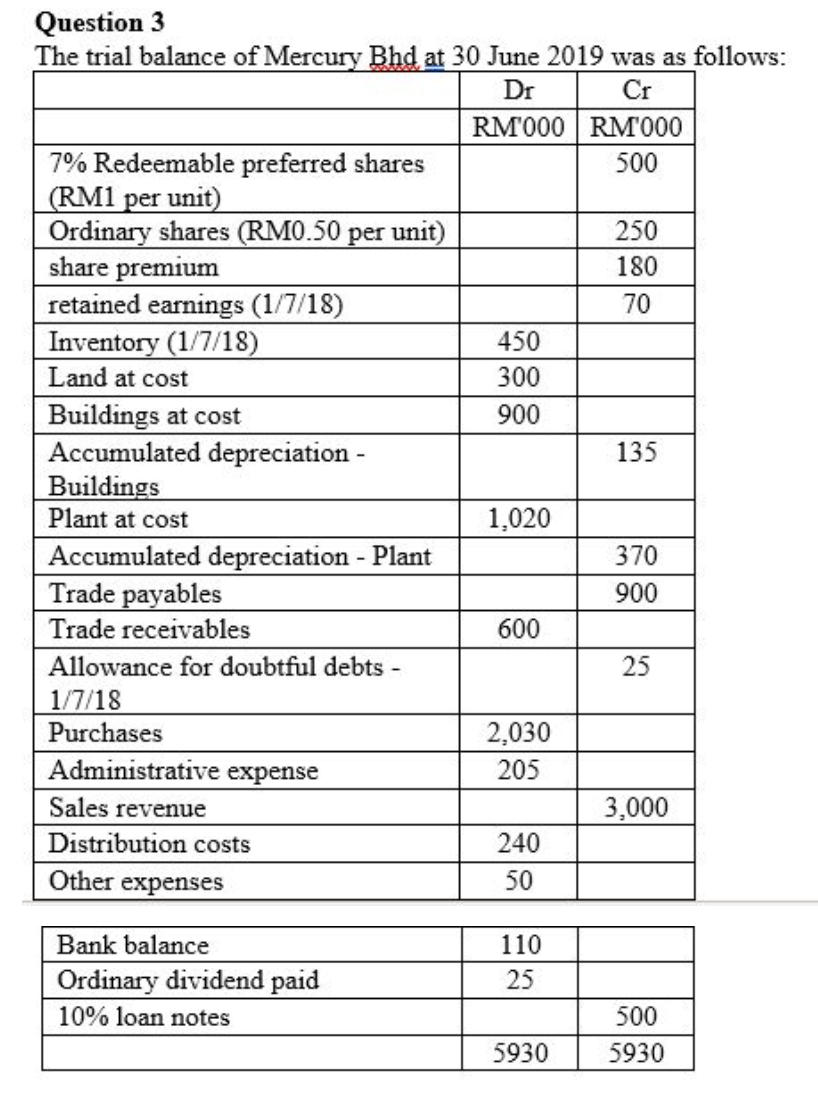

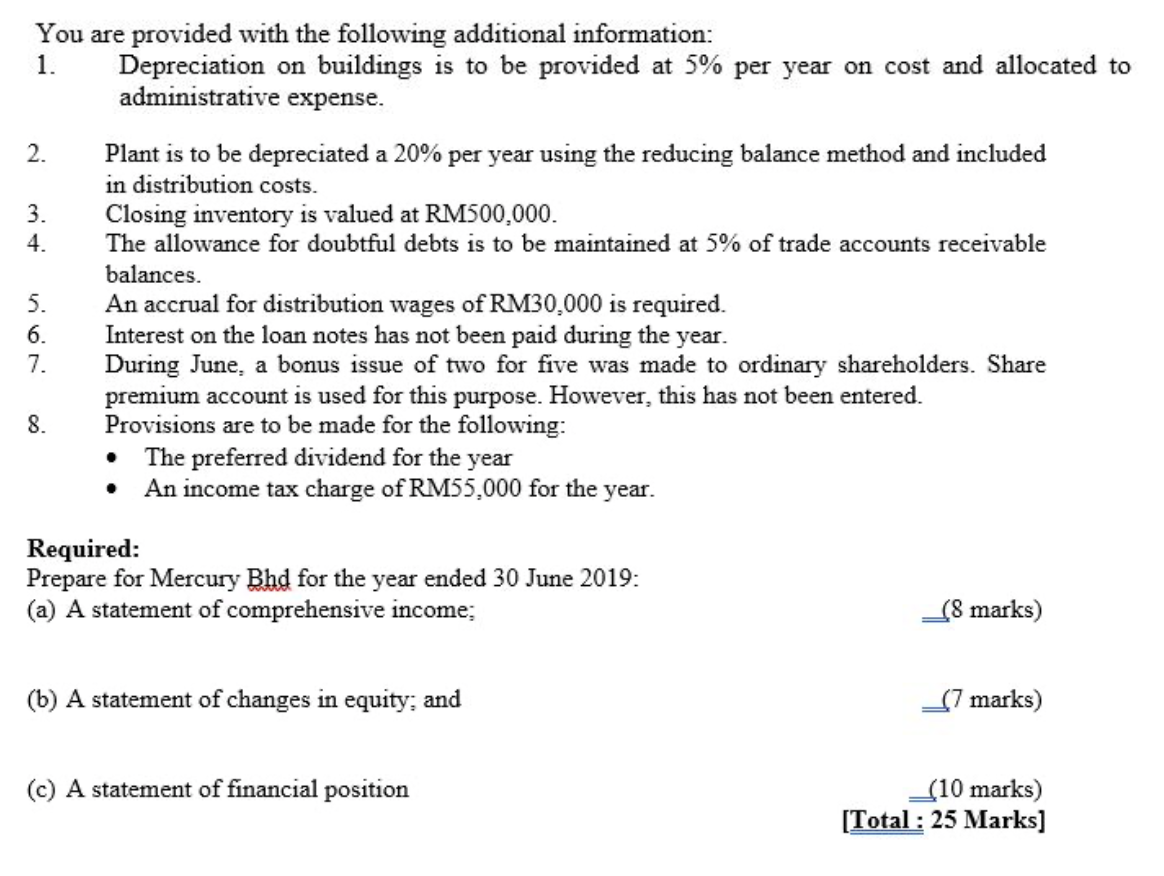

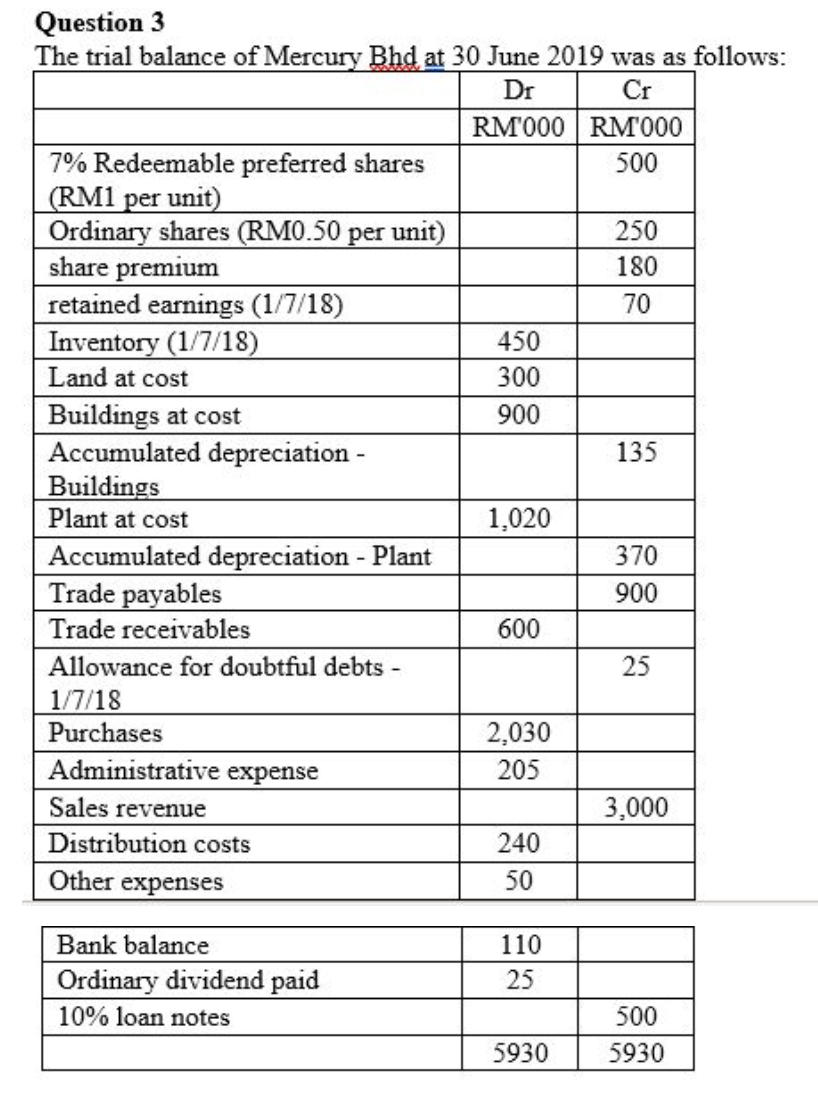

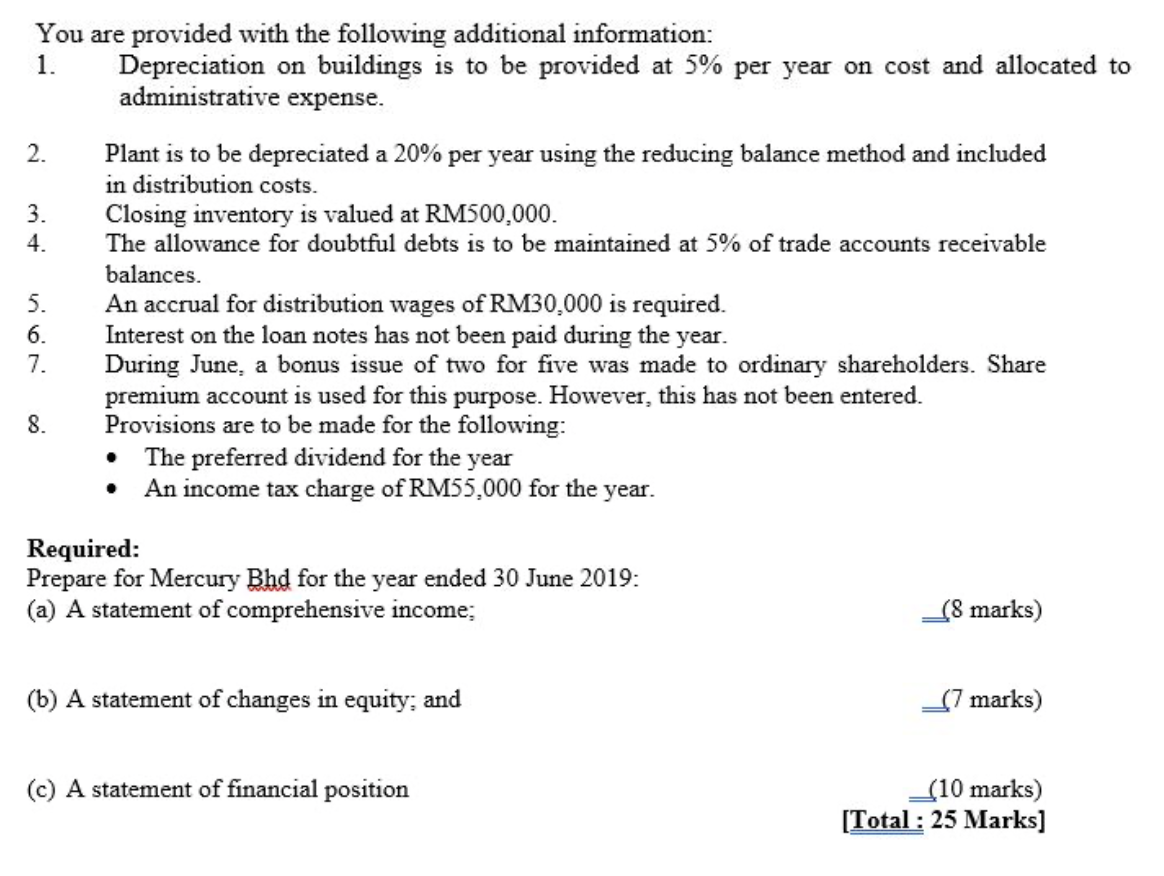

You are provided with the following additional information: 1. Depreciation on buildings is to be provided at 5% per year on cost and allocated to administrative expense. 2. Plant is to be depreciated a 20% per year using the reducing balance method and included in distribution costs. 3. Closing inventory is valued at RM500,000. 4. The allowance for doubtful debts is to be maintained at 5% of trade accounts receivable balances. 5. An accrual for distribution wages of RM30.000 is required. 6. Interest on the loan notes has not been paid during the year. 7. During June, a bonus issue of two for five was made to ordinary shareholders. Share premium account is used for this purpose. However, this has not been entered. 8. Provisions are to be made for the following: The preferred dividend for the year An income tax charge of RM55.000 for the year. Required: Prepare for Mercury Bhd for the year ended 30 June 2019: (a) A statement of comprehensive income: (8 marks) (b) A statement of changes in equity; and _(7 marks) (c) A statement of financial position _(10 marks) [Total : 25 Marks] You are provided with the following additional information: 1. Depreciation on buildings is to be provided at 5% per year on cost and allocated to administrative expense. 2. Plant is to be depreciated a 20% per year using the reducing balance method and included in distribution costs. 3. Closing inventory is valued at RM500,000. 4. The allowance for doubtful debts is to be maintained at 5% of trade accounts receivable balances. 5. An accrual for distribution wages of RM30.000 is required. 6. Interest on the loan notes has not been paid during the year. 7. During June, a bonus issue of two for five was made to ordinary shareholders. Share premium account is used for this purpose. However, this has not been entered. 8. Provisions are to be made for the following: The preferred dividend for the year An income tax charge of RM55.000 for the year. Required: Prepare for Mercury Bhd for the year ended 30 June 2019: (a) A statement of comprehensive income: (8 marks) (b) A statement of changes in equity; and _(7 marks) (c) A statement of financial position _(10 marks) [Total : 25 Marks]