Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how to fill out form 4562 with following info? HAZELIS ACCOUNTING BUSINESS Hazel is a self-employed accountant with an office at 1500 Washington Ave., Atlanta,

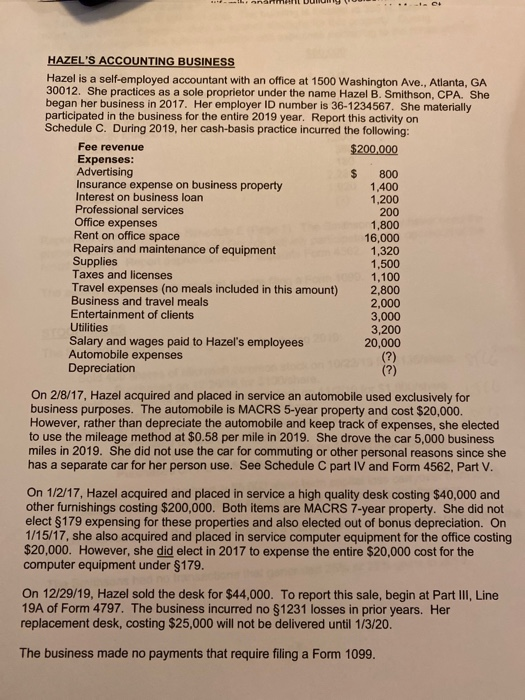

how to fill out form 4562 with following info?

HAZELIS ACCOUNTING BUSINESS Hazel is a self-employed accountant with an office at 1500 Washington Ave., Atlanta, GA 30012. She practices as a sole proprietor under the name Hazel B. Smithson, CPA. She began her business in 2017. Her employer ID number is 36-1234567. She materially participated in the business for the entire 2019 year. Report this activity on Schedule C. During 2019, her cash-basis practice incurred the following: Fee revenue $200,000 Expenses: Advertising $ 800 Insurance expense on business property 1,400 Interest on business loan 1,200 Professional services 200 Office expenses 1,800 Rent on office space 16,000 Repairs and maintenance of equipment 1,320 Supplies 1,500 Taxes and licenses 1,100 Travel expenses (no meals included in this amount) 2,800 Business and travel meals 2,000 Entertainment of clients 3,000 Utilities 3,200 Salary and wages paid to Hazel's employees 20,000 Automobile expenses Depreciation On 2/8/17, Hazel acquired and placed in service an automobile used exclusively for business purposes. The automobile is MACRS 5-year property and cost $20,000. However, rather than depreciate the automobile and keep track of expenses, she elected to use the mileage method at $0.58 per mile in 2019. She drove the car 5,000 business miles in 2019. She did not use the car for commuting or other personal reasons since she has a separate car for her person use. See Schedule C part IV and Form 4562, Part V. On 1/2/17, Hazel acquired and placed in service a high quality desk costing $40,000 and other furnishings costing $200,000. Both items are MACRS 7-year property. She did not elect $179 expensing for these properties and also elected out of bonus depreciation. On 1/15/17, she also acquired and placed in service computer equipment for the office costing $20,000. However, she did elect in 2017 to expense the entire $20,000 cost for the computer equipment under $179. On 12/29/19, Hazel sold the desk for $44,000. To report this sale, begin at Part III, Line 19A of Form 4797. The business incurred no $1231 losses in prior years. Her replacement desk, costing $25,000 will not be delivered until 1/3/20. The business made no payments that require filing a Form 1099 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started