Answered step by step

Verified Expert Solution

Question

1 Approved Answer

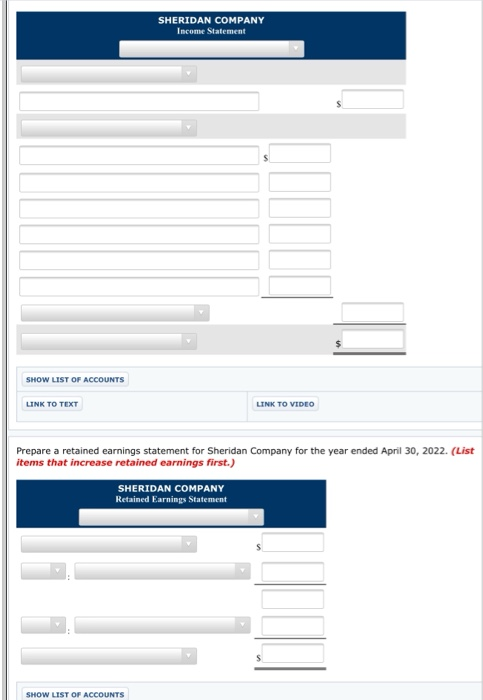

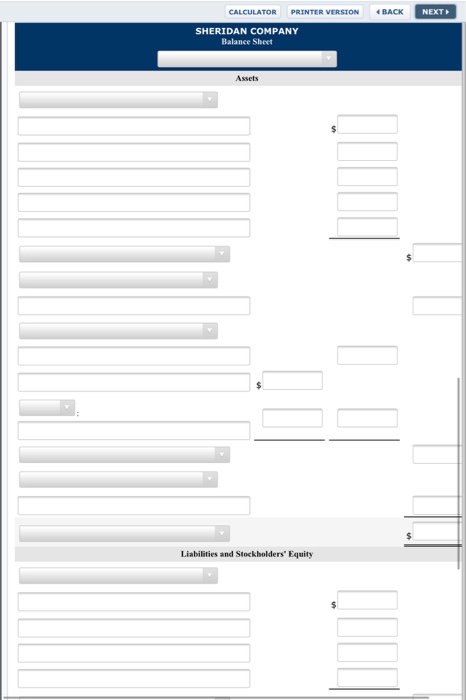

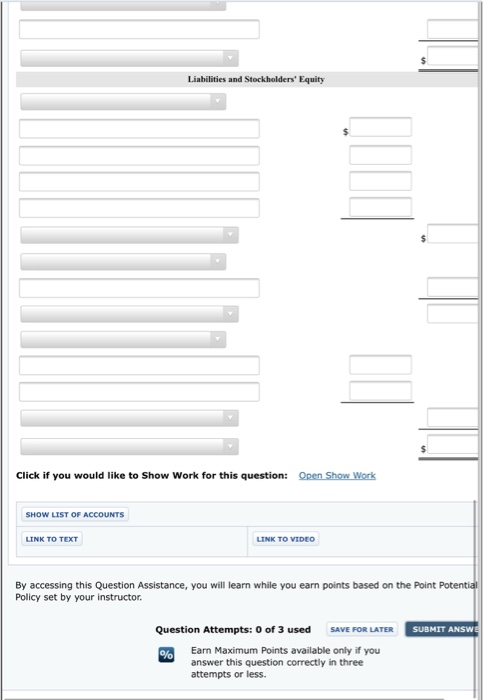

You are provided with the following information for Sheridan Company, effective as of its April 30, 2022, year-end. Accounts payable $ 878 Accounts receivable 910

You are provided with the following information for Sheridan Company, effective as of its April 30, 2022, year-end.

Accounts payable $ 878

Accounts receivable 910

Accumulated depreciationequipment 560

Cash 1,360

Common stock 16,400

Cost of goods sold 1,080

Depreciation expense 390

Dividends 320

Equipment 2,600

Goodwill 1,800

Income tax expense 170

Income taxes payable 125

Insurance expense 250

Interest expense 530

Inventory 940

Investment in land 13,795

Land 3,400

Mortgage payable (long-term) 4,300

Notes payable (short-term) 62

Prepaid insurance 60

Retained earnings (beginning) 1,800

Salaries and wages expense 850

Salaries and wages payable 230

Sales revenue 5,900

Stock investments (short-term) 1,800

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started