You are required to calculate the per-share value of the assigned companys equity using financial data from the Value Line Investment Survey provided.

2.You need to use the DDM models, RIM and select two more Price Ratio analysis methods to calculate the intrinsic value of a share.

3.You should review the approaches to the valuations and identify their strengths and weaknesses of your choices.

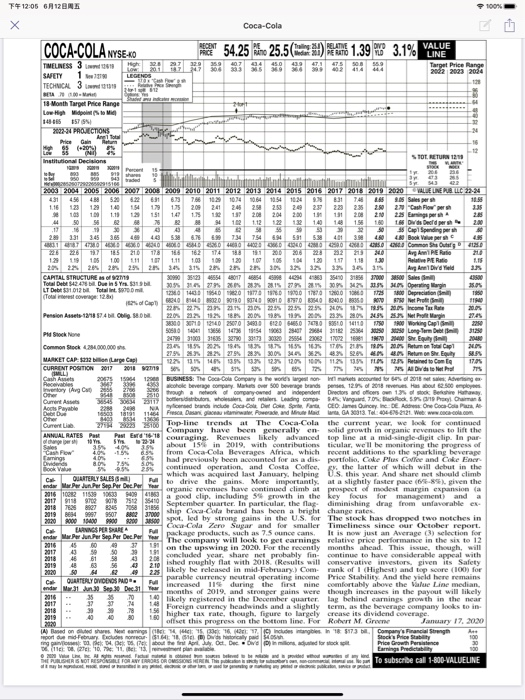

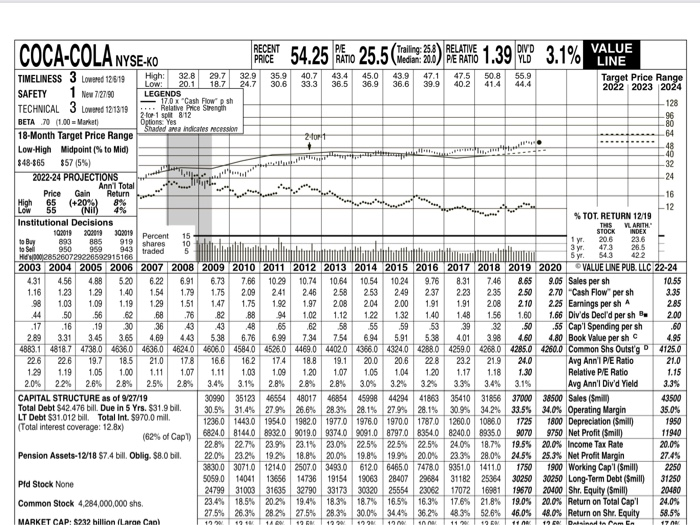

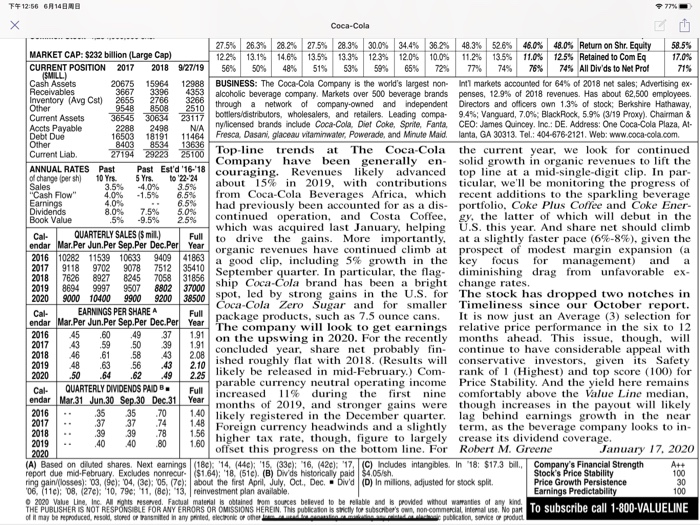

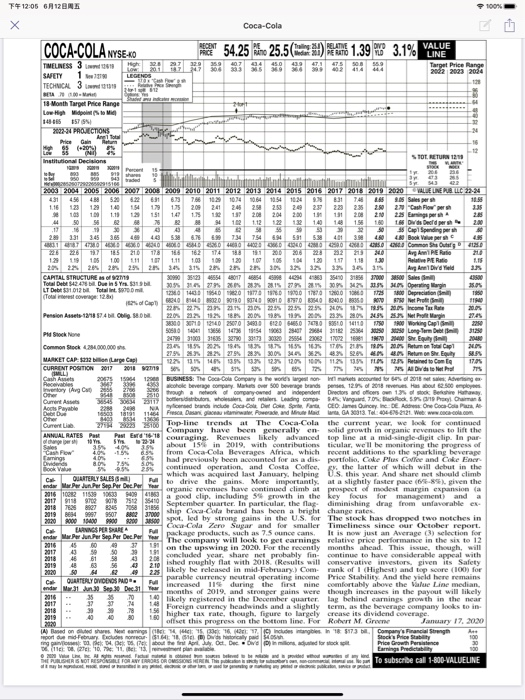

T#12:05 G12BAS 100% I X Coca-Cola RECENT COCA-COLA NYSE:40 54.25. 25.5(91.39 3.1% YAKE 45.0 MO 306 02 414 559 444 Target Price Range 2002 2023 2024 High A123 LEGENDS . ol TIMELINESS 3 SAFETY TECHNICAL 30 BELA 18 Month Tarpet Price Range Low High Midpoint to Me 143485 IST 15% 2022-9 PROJECTIONS Ang ito Price in 16 92 203 Institutional Decisions STOT. RETURN 1213 he 990 shares 043 raded OSOTROSSIGE m.hu 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 VALLE LIRE PUS LLC 22-24 431 7.66 1034 10.64 10.54 1024 9. 1.48 8.45 9.95 Sales 11.50 1.16 123 1.40 179 175 241 2.46 250 2.50 22 Chow 3:35 10 100 1.15 151 1.42 1.15 157 2.08 204 200 1 131 2.08 2.10 2.35 Eins 2.00 56 6 28 B2 94 112 140 156 16 Dds Deadpers 22 11 16 43 50 35 Cap Spending 30 131 3.66 49 539 67 754 591 5.30 411 3.92 40 Book Vape 22 72 18.5 1. 144 T. 151 200 2016 22 22 340 Arg APE Ratio 119 105 120 SOS 120 117 113 10 Relative ale 15 2014 20 20 2 25 3.45 315 2 39 3. 3 31 Avg Ann Did Yeld CAPTAL STRUCTURE 48654 48017 4624 483 3540 31856 37000 1500 Sales Total Debt $42.478. Due in Syr. 319 43500 LT Deb591012 Total 570 205 220 221 222 2023 Operating Wangi 15.00 (Totalmers coverage: 128 2010 DO 2000 178 Depreciation 18 12 Cat 38040 15:20 201909091 87970 000 NOVO Net Profit STAD Pension Assets-12/98 7.4 billig 8. 18 2322801.55 Neo Margin 27. 38300 307101254D 25070 34800 620 650 700 95014110 1799 1800 Working Capi Pet Stock More 56 1954 29401 20432 25354500 Long Term Debt Si te 24790 31000 3100 17072 1971 1970 20400 Se Equity Common Stock 4.284.000.000 sh. 3155 STAN U 20 Remon! 275 2328 2798 28 30 31 32 33 926 8. Return on She. Euly MARKET CAP: 1232 Large Capi 12219514% 13.95 1.3 123 120% 10 1125 1984 235 Retained to com CURRENT POSITION 2017 2011 son 4 $75 SM NS NS Al Didate Metal Cash Ads 208751544 1200 Receivables BUSINESS: The Coca-Cola Company the worlargest on was dores 2015 Sales Advertising 33 4953 for Avg Ost 2006 ook beverage company Malene 500 beverage and pense 121 of 2018 revenues Hasbou 2.500 employees 9541 to the company owned and dependent Directors and offers 1 stok Boristine Haany Current Assets 45 303 117 obowd Leading comp Vanguard 70 Block Plum Ats Payable 228924 NA pod brand include Coca-Colt Del Contra CEO de Ouncay :D. Add One Coca-Cola Pars De De 16500 101 1144 Fresc. Dasangan wanita, Powerade, and Minute Mad GA 30313. TeL: 04-675-2121. Web: www.com Current 2 23 Top-line trends at The Coca-Cola the current year, we look for continued Company have been generally on solid growth in organic revenues to lift the ANNUAL RATES PM 10 Yrs. Post EN 15 couraging Revenues likely advanced top line at a mid-single-digit clip. In par SY 404 40 385 about 15% in 2019, with contributions ticular, we'll be monitoring the progress of from Coca-Cola Beverages Africa, which recent additions to the sparkling beverage aming 40 35 Divide had previously been accounted for as a dis portfolio, Coke Plus Colice and Coke Ener SON continued operation, and Costa Coffee is the latter of which will debut in the ca QUARTERLY SALES which was acquired last January, helping US this year. And share net should climb Full ende Mar Pe Jun. Persep. Per Dec. Per a to drive the gains. More importantly, at a slightly faster pace (6-8). given the 2016 10282 11539 99533 organic revenues have continued climb at prospect of modest margin expansion (a og a good clip, including 5% growth in the key focus for and a 2018 Mees September quarter. In particular, the flag diminishing drag from unfavorable 2019 8654 9987 9507 BR02 37000 ship Cesa. Coa brand has been a bright change rates 2000 12000 este spot, led by strong rains in the U.S. for The stock has dropped two notches in EARNINGSPERSAREA Coca-Cola Zero Sugar and for smaller Timeliness since our October report. ende Mar Pe Jun. Bert Sap. Per Dec. Per The company will look to get earnings relative price performance in the six to 12 package products, such as 7.5 ounce cans It is now just an Average (3) selection for 2016 00 2017 4 50 50 19 on the upswing in 2020. For the recently months ahead. This issue, though, will 39 2018 46 61 concluded year share net probably fin continue to have considerable appeal with 58 2.08 2019 48 63 Sd ished roughly flat with 2018. (Results will conservative investors. given its Safety 2120 SO 84 2 likely be released in mid-February.) Com rank of 1 (Highest) and top score (100) for QUARTERLY DIVIDENDS PAD. parable currency neutral operating income Price Stability. And the yield here remains andwww.31.20 Sep 30 Dec Increased during the first nine comfortably above the blue Line median 2016 months of 2019. and stronger gains were though increases in the payout will likely 35 35 70 2017 32 ST 190 likely registered in the December quarter lag behind earnings growth in the near .14 2018 33 .78 Foreign currency headwinds and a slightly term, as the beverage company looks to in 2019 40 80 higher tax rate, though, figure to largely crease its dividend coverage. 2020 offset this progress on the bottom line. For Robert M. Groene January 17, 20:20 I Bed out thens. Nesteaming : 16 17 19 Indices intangibles 18 $17.3 b. Comparis Francial Strength Po du mid Four Coludes 51.641 10. Deshistorically sh Shock Price 100 ng anak 4. pak sebou the Aprilly Od. Dec bave ih milions de for stockpit Price Growth Prince 30 11:08:10.79.11.15. plan Earnings Predictable OM V S Face pod who PULSES NOT RESPONSABLE FOR ANY ERRORS OR OMISSIONS RENT a.com To subscribe cal 1-800-VALUELINE EN 20 COCA-COLA NYSE 1.39 3.1% 36.6 919 shares 943 raded RECENT PE Trailing: 258) RELATIVE DIVD VALUE YLD LINE TIMELINESS 3 Lowered 12819 High: 32.8 29.7 32.9 35.9 40.7 43.4 45.0 439 47.1 47.5 50.8 55.9 Target Price Range Low: 20.1 18.7 24.7 30.6 33.3 36.5 36.9 39.9 40.2 41.4 44.4 SAFETY 1 New 72790 2022 2023 2024 LEGENDS 17.0% Cash Flowsh TECHNICAL 3 Lowered 121319 ... Relative Price Strength 128 2-for-1 split 812 BETA 70 (1.00 Market Options Yes 96 Shaded area indicates recession 80 18-Month Target Price Range 2 tort 64 Low-High Midpoint (% to Mid) 48 40 $48-865 $575%) 32 2022-24 PROJECTIONS 24 Anni Total Price Gain Return 16 High 65 (420) 8% Low 55 (NIC) 4% -12 Institutional Decisions % TOT. RETURN 12/19 THIS 200019 VLARITH 102019 302019 Percent 15 STOCK INDEX to Buy 893 885 10 1 yr. 20.6 23.6 to Sol 950 959 5 3 yr 473 265 H/000285260729226592915166 5 yr. 54.3 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 VALUE LINE PUB. LLC 22-24 431 4.56 4.88 5.20 6.22 6.91 6.73 7.66 10.29 10.74 10.64 10.54 10.24 9.76 8.31 7.46 8.65 9.05 Sales per sh 10.55 1.16 1.23 1.29 1.40 1.54 1.79 1.75 2.09 241 2.46 2.58 253 2.49 237 2.23 236 250 2.70 Cash Flow" per sh 3.35 1.03 1.09 1.19 1.29 1.51 1.47 1.75 1.92 1.97 2.08 204 2.00 1.91 1.91 2.08 2.10 2.25 Earnings per shA 285 44 ,50 .56 .68 .76 .82 88 94 1.02 1.12 1.22 1.32 1.40 1.48 1.56 1.60 1.66 Divds Decl'd per she 2.00 .17 .16 .19 36 .43 48 .65 .62 58 55 59 53 39 .55 Cap'l Spending per sh 2.89 3.31 3.45 3.66 4.69 5.38 6.76 6.99 7.34 7.54 6.94 5.91 5.38 4.01 3.98 4.60 4.80 Book Value per sh 4.95 4883.1 48187 47380 46360 4636.0 4624.0 4806.04584,0 4526.0 4469.0 4402.04366.0 43240 42880 4259.0 42680 4285.0 4260.0 Common Shs Outstg 4125.0 226 22.6 19.7 18.5 21.0 17.8 16.6 16.2 17.4 18.8 19.1 20.0 20.6 228 23.2 21.9 24.0 Avg Ann' P/E Ratio 21.0 1.29 1.19 1.05 1.00 1.11 1.07 1.11 1.03 1.09 1.20 1.07 1.05 1.04 1.20 1.17 1.18 1.30 Relative P/E Ratio 1.15 2.0% 22% 2.6% 2.8% 2.5% 2.8% 3.4% 3.1% 2.8% 28% 2.8% 3.0% 3.2% 32% 3.3% 3.4% 3.1% Avg Ann'l Div'd Yield 3.3% CAPITAL STRUCTURE as of 9/27/19 30990 35123 46554 48017 46854 45998 44294 41863 35410 31856 37000 38500 Sales (Smill) 43500 Total Debt $42.476 bill. Due in 5 Yrs. $31.9 bil. 30.5% 31.4% 27.9% 26.6% 28.3% 28.1% 27.9% 28.1% 30.9% 34.2% 33.5% 34.0% Operating Margin LT Debt $31.012 bill. Total Int. $970.0 mill. 35.0% 1236.0 1443.0 1954.0 1982.0 1977.0 1976.0 1970.0 1787.0 1260,0 10860 1725 (Total interest coverage: 12.8x) 1800 Depreciation (Smill) 1950 (62% of Cap1) 6824.0 81440 8932.0 9019.0 9374.0 9091.0 8797.0 8354.0 8240.0 8935.0 9070 9750 Net Profit (Smilt) 11940 22.8% 22.7% 23.9% 23.1% 23.0% 22.5% 22.5% 22.5% 24.0% 18.7% 19.5% 20.0% Income Tax Rate 20.0% Pension Assets-12/18 $74 bill. Oblig. $8.0 bil. 22.0% 23.2% 192% 18.8% 20,0% 19.8% 19.9% 20.0% 23.3% 28.0% 22.55 25.3% Net Profit Margin 27.4% 3830.0 3071.0 1214.0 2507.0 3493.0 612.0 6465.0 7478.0 9351.0 1411.0 1750 1900 Working Cap' (Smilly 2250 Pld Stock None 5059.0 14041 13656 14736 19154 19063 28407 29684 31182 25364 30250 30250 Long-Term Debt (Smill) 31250 24799 31003 31635 32790 33173 30020 25554 23062 17072 16981 19670 20400 Shr. Equity (Smill) 20480 Common Stock 4.284,000,000 shs. 23.4% 18.5% 20.2% 19.4% 18.3% 187% 16.5% 16.3% 17.6% 21.8% 19.0% 20.0% Return on Total Cap' 24.0% 27.5% 26.3% 28 2% 27.5% 28.3% 30.0% 34.4% 36.2% 48.3% 52.6% 46.0% MARKET CAP: $232 billion (Large Caol 48.0% Return on Shr. Equity 58.5% 12 1220 1920 52 14 12 120 SA 11 125 11 12 Delend trama 170 T#12:56 G14ME 77% X Coca-Cola 519 53% 2766 5% 27.5% 26.3% 28.2% 27.5% 28.3% 30.0% 34.4% 36.2% 48.3% 526% 46.0% 48.0% Return on Shr. Equity 58.5% MARKET CAP: $232 billion (Large Cap) 12.2% 13.1% 14.6% 13.5% 13.3% 12,3% 12.0% 10.0% 11.2% 13.5% 11.0% 12.5% Retained to Com Eq 17.0% CURRENT POSITION 2017 2018 9/27/19 56% 50% 48% 59% 65% 77% 76% 74% All Div'ds to Net Prof 71% SMILL) Cash Assets 20675 15964 12988 BUSINESS: The Coca-Cola Company is the world's largest non- intl markets accounted for 64% of 2018 net sales; Advertising ex- Receivables 3667 3396 4353 Inventory (Avg Cst) 2655 alcoholic beverage company. Markets over 500 beverage brands penses, 12.9% of 2018 revenues. Has about 62,500 employees. Other 9548 8508 2516 through a network of company-owned and independent Directors and officers own 1.3% of stock: Berkshire Hathaway, Current Assets 36545 30634 23117 bottlers/distributors, wholesalers, and retailers. Leading compa: 9.4% Vanguard, 7.0% BlackRock, 5.9% (3/19 Proxy). Chairman & Accts Payable 2288 2498 NA ny licensed brands include Coca-Cola, Diet Coke, Sprite, Fanta, CEO: James Quincey, Inc.: DE, Address: One Coca-Cola Plaza, At- Debt Duo 16503 18191 11464 Fresca, Dasani, glaceau vitaminwater, Powerade, and Minute Maid. lanta, GA 30313. Tel.: 404-676-2121. Web: www.coca-cola.com Other 8403 8534 13636 Current Liab 27194 29223 25100 Top-line trends at The Coca-Cola the current year, we look for continued Company have been generally en- ANNUAL RATES Past solid growth in organic revenues to lift the Past Est'd '16-'18 of change per shi 10 Yrs. couraging Revenues likely advanced top line at a mid-single-digit clip. In par- 5 Yrs. to '22-24 Sales 3.5% -4.0% 3.5% about 15% in 2019, with contributions ticular, we'll be monitoring the progress of "Cash Flow" 4.0% -1.5% 6.5% from Coca-Cola Beverages Africa, which Earnings recent additions to the sparkling beverage 4.0% 6.5% had previously been accounted for as a dis- portfolio, Coke Plus Coffee and Coke Ener- Dividends 8.0% 7.5% 5.0% Book Value -9.5% 2.5% continued operation, and Costa Coffee, gy, the latter of which will debut in the which was acquired last January, helping U.S. this year. And share net should climb Cal. QUARTERLY SALES (5 mil.) Full to drive the gains. More importantly, endar Mar.Per Jun.Per Sep.Per Dec.Per Year organic revenues have continued climb at prospect of modest margin expansion (a at a slightly faster pace (6%-8%), given the 2016 10282 11539 10633 9409 41863 a good clip, including 5% growth in the key focus 2017 9118 9702 9078 7512 35410 for management) and a 2018 7626 8927 8245 September quarter. In particular, the flag- diminishing drag from unfavorable ex- 2019 86949997 9507 8802 37000 ship Coca-Cola brand has been a bright change rates. 2020 9000 10400 9900 9200 38500 spot, led by strong gains in the U.S. for The stock has dropped two notches in Cal- EARNINGS PER SHARE A Coca-Cola Zero Sugar and for smaller Timeliness since our October report. Full endar Mar.Per Jun.Per Sep.Per Dec.Per Year The company will look to get earnings relative price performance in the six to 12 package products, such as 7.5 ounce cans. It is now just an Average (3) selection for 2016 45 .60 ,49 37 1.91 on the upswing in 2020. For the recently months ahead. This issue, though, will 2017 43 .59 -50 39 1.91 2018 .46 .61 .58 concluded year, share net probably fin- continue to have considerable appeal with 2.08 2019 48 .63 .56 .43 2.10 ished roughly flat with 2018. (Results will conservative investors, given its Safety 2020 .50 .64 .62 .49 2.25 likely be released in mid-February.) Com rank of 1 (Highest) and top score (100) for parable currency neutral operating income QUARTERLY DIVIDENDS PAID B. Price Stability. And the yield here remains Cal- Full endar Mar 31 Jun 30 Sep 30 Dec.31 increased 11% during the first nine comfortably above the Value Line median, Year months of 2019, and stronger gains were though increases in the payout will likely 2016 35 35 .70 1.40 2017 37 37 likely registered in the December quarter. lag behind earnings growth in the near 74 1.48 2018 39 Foreign currency headwinds and a slightly term, as the beverage company looks to in- 39 .78 1.56 2019 .40 40 .80 1.60 higher tax rate, though, figure to largely crease its dividend coverage. 2020 offset this progress on the bottom line. For Robert M. Greene January 17, 2020 (A) Based on diluted shares. Next earnings (Be): '14 (446): '15. (33c): "16, (420): 17. (C) Includes intangibles. In '18: $17.3 bill. Company's Financial Strength A++ report due mid-February. Excludes nonrecur($1.64): "18. (510). (B) Divds historically paid $4.05ish. Stock's Price Stability ring gain/flosses): 03, (ge): 04 (3e): 05, (76): about the first April, July, Oct., Dec. Div'd (D) In milions, adjusted for stock split. Price Growth Persistence 06. (110); 08 (270): '10, 790; 11, (c): 13. reinvestment plan available. Earnings Predictability 100 THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREN. This publication is snelly for subscribertown, non commercial Internal use. No part to subscribe call 1-800-VALUELINE of it may be reproduced, resold stored or Fansited in any printed.lectronic or other le publication, vice of product 100 30 T#12:05 G12BAS 100% I X Coca-Cola RECENT COCA-COLA NYSE:40 54.25. 25.5(91.39 3.1% YAKE 45.0 MO 306 02 414 559 444 Target Price Range 2002 2023 2024 High A123 LEGENDS . ol TIMELINESS 3 SAFETY TECHNICAL 30 BELA 18 Month Tarpet Price Range Low High Midpoint to Me 143485 IST 15% 2022-9 PROJECTIONS Ang ito Price in 16 92 203 Institutional Decisions STOT. RETURN 1213 he 990 shares 043 raded OSOTROSSIGE m.hu 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 VALLE LIRE PUS LLC 22-24 431 7.66 1034 10.64 10.54 1024 9. 1.48 8.45 9.95 Sales 11.50 1.16 123 1.40 179 175 241 2.46 250 2.50 22 Chow 3:35 10 100 1.15 151 1.42 1.15 157 2.08 204 200 1 131 2.08 2.10 2.35 Eins 2.00 56 6 28 B2 94 112 140 156 16 Dds Deadpers 22 11 16 43 50 35 Cap Spending 30 131 3.66 49 539 67 754 591 5.30 411 3.92 40 Book Vape 22 72 18.5 1. 144 T. 151 200 2016 22 22 340 Arg APE Ratio 119 105 120 SOS 120 117 113 10 Relative ale 15 2014 20 20 2 25 3.45 315 2 39 3. 3 31 Avg Ann Did Yeld CAPTAL STRUCTURE 48654 48017 4624 483 3540 31856 37000 1500 Sales Total Debt $42.478. Due in Syr. 319 43500 LT Deb591012 Total 570 205 220 221 222 2023 Operating Wangi 15.00 (Totalmers coverage: 128 2010 DO 2000 178 Depreciation 18 12 Cat 38040 15:20 201909091 87970 000 NOVO Net Profit STAD Pension Assets-12/98 7.4 billig 8. 18 2322801.55 Neo Margin 27. 38300 307101254D 25070 34800 620 650 700 95014110 1799 1800 Working Capi Pet Stock More 56 1954 29401 20432 25354500 Long Term Debt Si te 24790 31000 3100 17072 1971 1970 20400 Se Equity Common Stock 4.284.000.000 sh. 3155 STAN U 20 Remon! 275 2328 2798 28 30 31 32 33 926 8. Return on She. Euly MARKET CAP: 1232 Large Capi 12219514% 13.95 1.3 123 120% 10 1125 1984 235 Retained to com CURRENT POSITION 2017 2011 son 4 $75 SM NS NS Al Didate Metal Cash Ads 208751544 1200 Receivables BUSINESS: The Coca-Cola Company the worlargest on was dores 2015 Sales Advertising 33 4953 for Avg Ost 2006 ook beverage company Malene 500 beverage and pense 121 of 2018 revenues Hasbou 2.500 employees 9541 to the company owned and dependent Directors and offers 1 stok Boristine Haany Current Assets 45 303 117 obowd Leading comp Vanguard 70 Block Plum Ats Payable 228924 NA pod brand include Coca-Colt Del Contra CEO de Ouncay :D. Add One Coca-Cola Pars De De 16500 101 1144 Fresc. Dasangan wanita, Powerade, and Minute Mad GA 30313. TeL: 04-675-2121. Web: www.com Current 2 23 Top-line trends at The Coca-Cola the current year, we look for continued Company have been generally on solid growth in organic revenues to lift the ANNUAL RATES PM 10 Yrs. Post EN 15 couraging Revenues likely advanced top line at a mid-single-digit clip. In par SY 404 40 385 about 15% in 2019, with contributions ticular, we'll be monitoring the progress of from Coca-Cola Beverages Africa, which recent additions to the sparkling beverage aming 40 35 Divide had previously been accounted for as a dis portfolio, Coke Plus Colice and Coke Ener SON continued operation, and Costa Coffee is the latter of which will debut in the ca QUARTERLY SALES which was acquired last January, helping US this year. And share net should climb Full ende Mar Pe Jun. Persep. Per Dec. Per a to drive the gains. More importantly, at a slightly faster pace (6-8). given the 2016 10282 11539 99533 organic revenues have continued climb at prospect of modest margin expansion (a og a good clip, including 5% growth in the key focus for and a 2018 Mees September quarter. In particular, the flag diminishing drag from unfavorable 2019 8654 9987 9507 BR02 37000 ship Cesa. Coa brand has been a bright change rates 2000 12000 este spot, led by strong rains in the U.S. for The stock has dropped two notches in EARNINGSPERSAREA Coca-Cola Zero Sugar and for smaller Timeliness since our October report. ende Mar Pe Jun. Bert Sap. Per Dec. Per The company will look to get earnings relative price performance in the six to 12 package products, such as 7.5 ounce cans It is now just an Average (3) selection for 2016 00 2017 4 50 50 19 on the upswing in 2020. For the recently months ahead. This issue, though, will 39 2018 46 61 concluded year share net probably fin continue to have considerable appeal with 58 2.08 2019 48 63 Sd ished roughly flat with 2018. (Results will conservative investors. given its Safety 2120 SO 84 2 likely be released in mid-February.) Com rank of 1 (Highest) and top score (100) for QUARTERLY DIVIDENDS PAD. parable currency neutral operating income Price Stability. And the yield here remains andwww.31.20 Sep 30 Dec Increased during the first nine comfortably above the blue Line median 2016 months of 2019. and stronger gains were though increases in the payout will likely 35 35 70 2017 32 ST 190 likely registered in the December quarter lag behind earnings growth in the near .14 2018 33 .78 Foreign currency headwinds and a slightly term, as the beverage company looks to in 2019 40 80 higher tax rate, though, figure to largely crease its dividend coverage. 2020 offset this progress on the bottom line. For Robert M. Groene January 17, 20:20 I Bed out thens. Nesteaming : 16 17 19 Indices intangibles 18 $17.3 b. Comparis Francial Strength Po du mid Four Coludes 51.641 10. Deshistorically sh Shock Price 100 ng anak 4. pak sebou the Aprilly Od. Dec bave ih milions de for stockpit Price Growth Prince 30 11:08:10.79.11.15. plan Earnings Predictable OM V S Face pod who PULSES NOT RESPONSABLE FOR ANY ERRORS OR OMISSIONS RENT a.com To subscribe cal 1-800-VALUELINE EN 20 COCA-COLA NYSE 1.39 3.1% 36.6 919 shares 943 raded RECENT PE Trailing: 258) RELATIVE DIVD VALUE YLD LINE TIMELINESS 3 Lowered 12819 High: 32.8 29.7 32.9 35.9 40.7 43.4 45.0 439 47.1 47.5 50.8 55.9 Target Price Range Low: 20.1 18.7 24.7 30.6 33.3 36.5 36.9 39.9 40.2 41.4 44.4 SAFETY 1 New 72790 2022 2023 2024 LEGENDS 17.0% Cash Flowsh TECHNICAL 3 Lowered 121319 ... Relative Price Strength 128 2-for-1 split 812 BETA 70 (1.00 Market Options Yes 96 Shaded area indicates recession 80 18-Month Target Price Range 2 tort 64 Low-High Midpoint (% to Mid) 48 40 $48-865 $575%) 32 2022-24 PROJECTIONS 24 Anni Total Price Gain Return 16 High 65 (420) 8% Low 55 (NIC) 4% -12 Institutional Decisions % TOT. RETURN 12/19 THIS 200019 VLARITH 102019 302019 Percent 15 STOCK INDEX to Buy 893 885 10 1 yr. 20.6 23.6 to Sol 950 959 5 3 yr 473 265 H/000285260729226592915166 5 yr. 54.3 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 VALUE LINE PUB. LLC 22-24 431 4.56 4.88 5.20 6.22 6.91 6.73 7.66 10.29 10.74 10.64 10.54 10.24 9.76 8.31 7.46 8.65 9.05 Sales per sh 10.55 1.16 1.23 1.29 1.40 1.54 1.79 1.75 2.09 241 2.46 2.58 253 2.49 237 2.23 236 250 2.70 Cash Flow" per sh 3.35 1.03 1.09 1.19 1.29 1.51 1.47 1.75 1.92 1.97 2.08 204 2.00 1.91 1.91 2.08 2.10 2.25 Earnings per shA 285 44 ,50 .56 .68 .76 .82 88 94 1.02 1.12 1.22 1.32 1.40 1.48 1.56 1.60 1.66 Divds Decl'd per she 2.00 .17 .16 .19 36 .43 48 .65 .62 58 55 59 53 39 .55 Cap'l Spending per sh 2.89 3.31 3.45 3.66 4.69 5.38 6.76 6.99 7.34 7.54 6.94 5.91 5.38 4.01 3.98 4.60 4.80 Book Value per sh 4.95 4883.1 48187 47380 46360 4636.0 4624.0 4806.04584,0 4526.0 4469.0 4402.04366.0 43240 42880 4259.0 42680 4285.0 4260.0 Common Shs Outstg 4125.0 226 22.6 19.7 18.5 21.0 17.8 16.6 16.2 17.4 18.8 19.1 20.0 20.6 228 23.2 21.9 24.0 Avg Ann' P/E Ratio 21.0 1.29 1.19 1.05 1.00 1.11 1.07 1.11 1.03 1.09 1.20 1.07 1.05 1.04 1.20 1.17 1.18 1.30 Relative P/E Ratio 1.15 2.0% 22% 2.6% 2.8% 2.5% 2.8% 3.4% 3.1% 2.8% 28% 2.8% 3.0% 3.2% 32% 3.3% 3.4% 3.1% Avg Ann'l Div'd Yield 3.3% CAPITAL STRUCTURE as of 9/27/19 30990 35123 46554 48017 46854 45998 44294 41863 35410 31856 37000 38500 Sales (Smill) 43500 Total Debt $42.476 bill. Due in 5 Yrs. $31.9 bil. 30.5% 31.4% 27.9% 26.6% 28.3% 28.1% 27.9% 28.1% 30.9% 34.2% 33.5% 34.0% Operating Margin LT Debt $31.012 bill. Total Int. $970.0 mill. 35.0% 1236.0 1443.0 1954.0 1982.0 1977.0 1976.0 1970.0 1787.0 1260,0 10860 1725 (Total interest coverage: 12.8x) 1800 Depreciation (Smill) 1950 (62% of Cap1) 6824.0 81440 8932.0 9019.0 9374.0 9091.0 8797.0 8354.0 8240.0 8935.0 9070 9750 Net Profit (Smilt) 11940 22.8% 22.7% 23.9% 23.1% 23.0% 22.5% 22.5% 22.5% 24.0% 18.7% 19.5% 20.0% Income Tax Rate 20.0% Pension Assets-12/18 $74 bill. Oblig. $8.0 bil. 22.0% 23.2% 192% 18.8% 20,0% 19.8% 19.9% 20.0% 23.3% 28.0% 22.55 25.3% Net Profit Margin 27.4% 3830.0 3071.0 1214.0 2507.0 3493.0 612.0 6465.0 7478.0 9351.0 1411.0 1750 1900 Working Cap' (Smilly 2250 Pld Stock None 5059.0 14041 13656 14736 19154 19063 28407 29684 31182 25364 30250 30250 Long-Term Debt (Smill) 31250 24799 31003 31635 32790 33173 30020 25554 23062 17072 16981 19670 20400 Shr. Equity (Smill) 20480 Common Stock 4.284,000,000 shs. 23.4% 18.5% 20.2% 19.4% 18.3% 187% 16.5% 16.3% 17.6% 21.8% 19.0% 20.0% Return on Total Cap' 24.0% 27.5% 26.3% 28 2% 27.5% 28.3% 30.0% 34.4% 36.2% 48.3% 52.6% 46.0% MARKET CAP: $232 billion (Large Caol 48.0% Return on Shr. Equity 58.5% 12 1220 1920 52 14 12 120 SA 11 125 11 12 Delend trama 170 T#12:56 G14ME 77% X Coca-Cola 519 53% 2766 5% 27.5% 26.3% 28.2% 27.5% 28.3% 30.0% 34.4% 36.2% 48.3% 526% 46.0% 48.0% Return on Shr. Equity 58.5% MARKET CAP: $232 billion (Large Cap) 12.2% 13.1% 14.6% 13.5% 13.3% 12,3% 12.0% 10.0% 11.2% 13.5% 11.0% 12.5% Retained to Com Eq 17.0% CURRENT POSITION 2017 2018 9/27/19 56% 50% 48% 59% 65% 77% 76% 74% All Div'ds to Net Prof 71% SMILL) Cash Assets 20675 15964 12988 BUSINESS: The Coca-Cola Company is the world's largest non- intl markets accounted for 64% of 2018 net sales; Advertising ex- Receivables 3667 3396 4353 Inventory (Avg Cst) 2655 alcoholic beverage company. Markets over 500 beverage brands penses, 12.9% of 2018 revenues. Has about 62,500 employees. Other 9548 8508 2516 through a network of company-owned and independent Directors and officers own 1.3% of stock: Berkshire Hathaway, Current Assets 36545 30634 23117 bottlers/distributors, wholesalers, and retailers. Leading compa: 9.4% Vanguard, 7.0% BlackRock, 5.9% (3/19 Proxy). Chairman & Accts Payable 2288 2498 NA ny licensed brands include Coca-Cola, Diet Coke, Sprite, Fanta, CEO: James Quincey, Inc.: DE, Address: One Coca-Cola Plaza, At- Debt Duo 16503 18191 11464 Fresca, Dasani, glaceau vitaminwater, Powerade, and Minute Maid. lanta, GA 30313. Tel.: 404-676-2121. Web: www.coca-cola.com Other 8403 8534 13636 Current Liab 27194 29223 25100 Top-line trends at The Coca-Cola the current year, we look for continued Company have been generally en- ANNUAL RATES Past solid growth in organic revenues to lift the Past Est'd '16-'18 of change per shi 10 Yrs. couraging Revenues likely advanced top line at a mid-single-digit clip. In par- 5 Yrs. to '22-24 Sales 3.5% -4.0% 3.5% about 15% in 2019, with contributions ticular, we'll be monitoring the progress of "Cash Flow" 4.0% -1.5% 6.5% from Coca-Cola Beverages Africa, which Earnings recent additions to the sparkling beverage 4.0% 6.5% had previously been accounted for as a dis- portfolio, Coke Plus Coffee and Coke Ener- Dividends 8.0% 7.5% 5.0% Book Value -9.5% 2.5% continued operation, and Costa Coffee, gy, the latter of which will debut in the which was acquired last January, helping U.S. this year. And share net should climb Cal. QUARTERLY SALES (5 mil.) Full to drive the gains. More importantly, endar Mar.Per Jun.Per Sep.Per Dec.Per Year organic revenues have continued climb at prospect of modest margin expansion (a at a slightly faster pace (6%-8%), given the 2016 10282 11539 10633 9409 41863 a good clip, including 5% growth in the key focus 2017 9118 9702 9078 7512 35410 for management) and a 2018 7626 8927 8245 September quarter. In particular, the flag- diminishing drag from unfavorable ex- 2019 86949997 9507 8802 37000 ship Coca-Cola brand has been a bright change rates. 2020 9000 10400 9900 9200 38500 spot, led by strong gains in the U.S. for The stock has dropped two notches in Cal- EARNINGS PER SHARE A Coca-Cola Zero Sugar and for smaller Timeliness since our October report. Full endar Mar.Per Jun.Per Sep.Per Dec.Per Year The company will look to get earnings relative price performance in the six to 12 package products, such as 7.5 ounce cans. It is now just an Average (3) selection for 2016 45 .60 ,49 37 1.91 on the upswing in 2020. For the recently months ahead. This issue, though, will 2017 43 .59 -50 39 1.91 2018 .46 .61 .58 concluded year, share net probably fin- continue to have considerable appeal with 2.08 2019 48 .63 .56 .43 2.10 ished roughly flat with 2018. (Results will conservative investors, given its Safety 2020 .50 .64 .62 .49 2.25 likely be released in mid-February.) Com rank of 1 (Highest) and top score (100) for parable currency neutral operating income QUARTERLY DIVIDENDS PAID B. Price Stability. And the yield here remains Cal- Full endar Mar 31 Jun 30 Sep 30 Dec.31 increased 11% during the first nine comfortably above the Value Line median, Year months of 2019, and stronger gains were though increases in the payout will likely 2016 35 35 .70 1.40 2017 37 37 likely registered in the December quarter. lag behind earnings growth in the near 74 1.48 2018 39 Foreign currency headwinds and a slightly term, as the beverage company looks to in- 39 .78 1.56 2019 .40 40 .80 1.60 higher tax rate, though, figure to largely crease its dividend coverage. 2020 offset this progress on the bottom line. For Robert M. Greene January 17, 2020 (A) Based on diluted shares. Next earnings (Be): '14 (446): '15. (33c): "16, (420): 17. (C) Includes intangibles. In '18: $17.3 bill. Company's Financial Strength A++ report due mid-February. Excludes nonrecur($1.64): "18. (510). (B) Divds historically paid $4.05ish. Stock's Price Stability ring gain/flosses): 03, (ge): 04 (3e): 05, (76): about the first April, July, Oct., Dec. Div'd (D) In milions, adjusted for stock split. Price Growth Persistence 06. (110); 08 (270): '10, 790; 11, (c): 13. reinvestment plan available. Earnings Predictability 100 THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREN. This publication is snelly for subscribertown, non commercial Internal use. No part to subscribe call 1-800-VALUELINE of it may be reproduced, resold stored or Fansited in any printed.lectronic or other le publication, vice of product 100 30