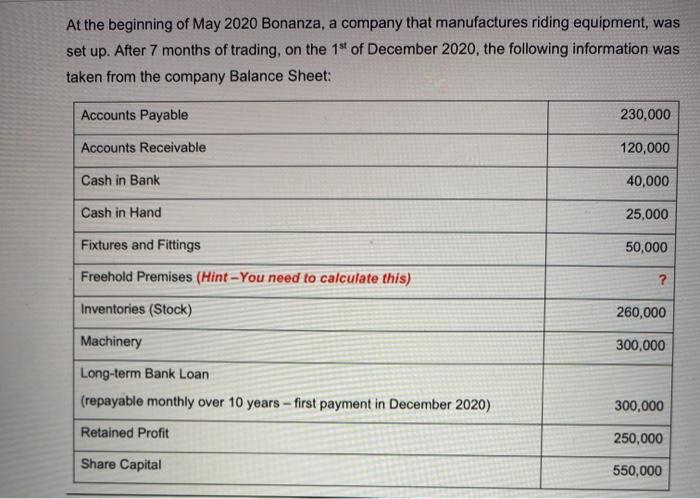

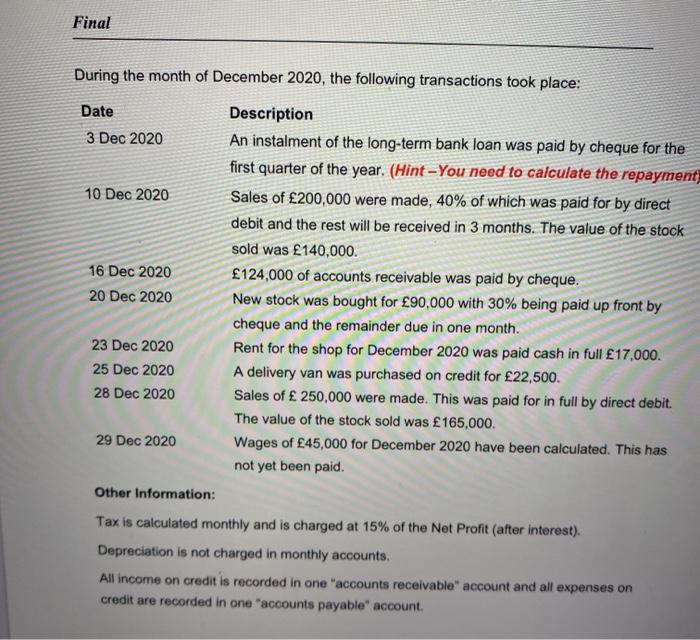

You are required to: In the first worksheet of the downloaded Excel file, using data provided in the table below create a Balance Sheet as at 1st December 2020. Using accounting equation you need to calculate the value of Freehold Premises At the beginning of May 2020 Bonanza, a company that manufactures riding equipment, was set up. After 7 months of trading, on the 1st of December 2020, the following information was taken from the company Balance Sheet: Accounts Payable 230,000 Accounts Receivable 120,000 Cash in Bank 40,000 Cash in Hand 25,000 Fixtures and Fittings 50,000 Freehold Premises (Hint-You need to calculate this) ? Inventories (Stock) 260,000 Machinery 300,000 Long-term Bank Loan (repayable monthly over 10 years - first payment in December 2020) 300,000 Retained Profit 250,000 Share Capital 550,000 Final During the month of December 2020, the following transactions took place: Date Description 3 Dec 2020 An instalment of the long-term bank loan was paid by cheque for the first quarter of the year. (Hint-You need to calculate the repayment) 10 Dec 2020 Sales of 200,000 were made, 40% of which was paid for by direct debit and the rest will be received in 3 months. The value of the stock sold was 140,000 16 Dec 2020 124,000 of accounts receivable was paid by cheque. 20 Dec 2020 New stock was bought for 90,000 with 30% being paid up front by cheque and the remainder due in one month. 23 Dec 2020 Rent for the shop for December 2020 was paid cash in full 17,000. 25 Dec 2020 A delivery van was purchased on credit for 22,500. 28 Dec 2020 Sales of 250,000 were made. This was paid for in full by direct debit. The value of the stock sold was 165,000. 29 Dec 2020 Wages of 45,000 for December 2020 have been calculated. This has not yet been paid. Other Information: Tax is calculated monthly and is charged at 15% of the Net Profit (after interest). Depreciation is not charged in monthly accounts. All income on credit is recorded in one "accounts receivable account and all expenses on credit are recorded in one "accounts payable" account