Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are scheduled to receive annual payments of $ 1 0 m l n per year, forever. If the appropriate interest rate is 9 %

You are scheduled to receive annual payments of $ per year, forever. If the appropriate interest

rate is what is the present value of the payments?

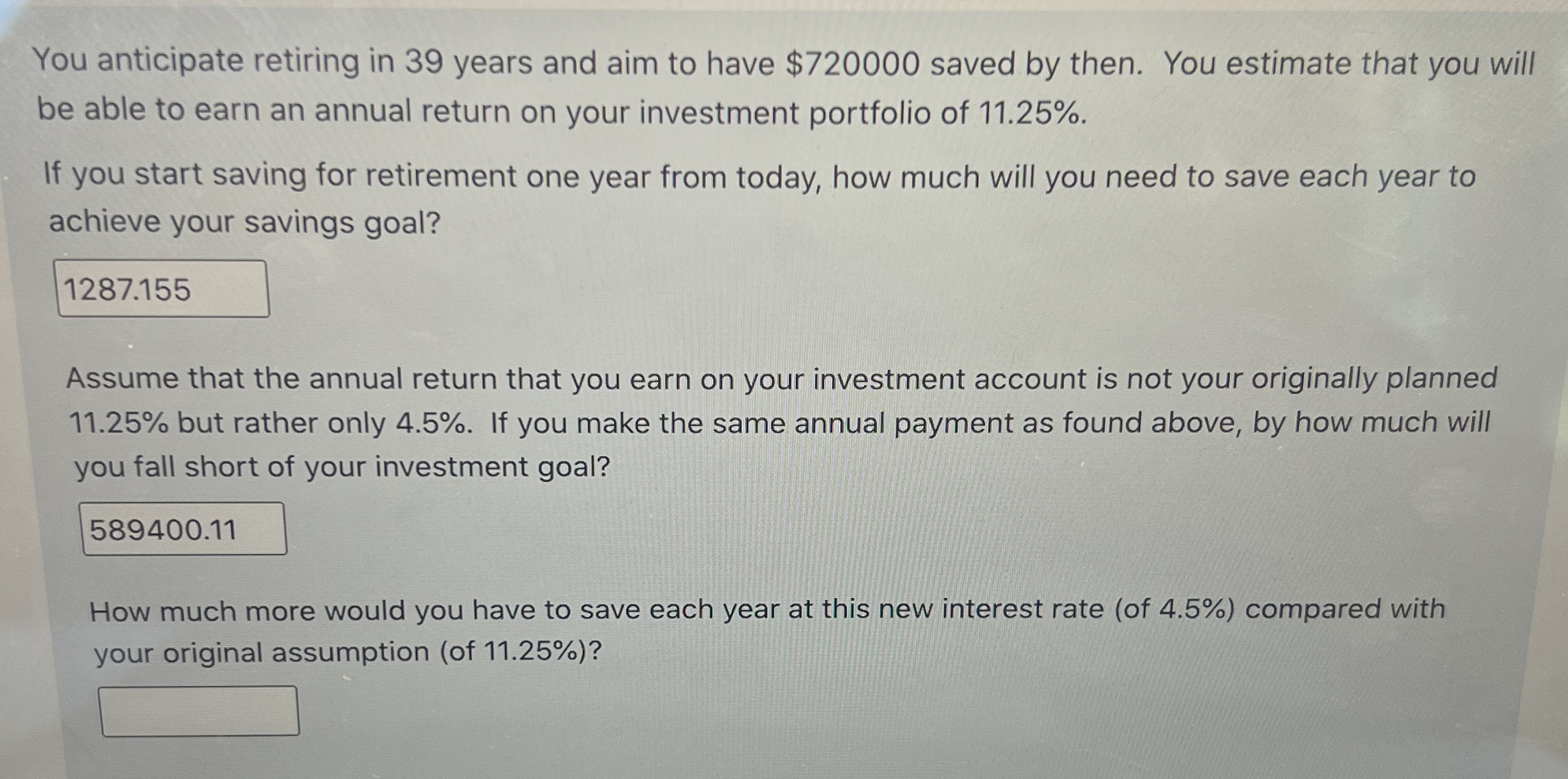

You anticipate retiring in years and aim to have $ saved by then. You estimate that you will

be able to earn an annual return on your investment portfolio of

If you start saving for retirement one year from today, how much will you need to save each year to

achieve your savings goal?

Assume that the annual return that you earn on your investment account is not your originally planned

but rather only If you make the same annual payment as found above, by how much will

you fall short of your investment goal?

How much more would you have to save each year at this new interest rate of compared with

your original assumption of

Please answer with calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started