Question

You are the audit manager of Biotech Ltd (Biotech), a listed company on ASX (Australian Securities Exchange). As part of its business strategies, Biotech intends

You are the audit manager of Biotech Ltd (Biotech), a listed company on ASX (Australian Securities Exchange). As part of its business strategies, Biotech intends to use its patented DNA analysis technologies to exploit the molecular diagnostics market. Biotech is currently developing various molecular diagnostics testing products. There has been a gradual increase in demand for the entitys product in the market. Sales have increased from $615,000 in 2020 to $800,000 in 2021, and it is expected that the sales will keep growing in 2022. Biotech currently has only one key customer, Nova Diagnostics Ltd. In 2021, the Australian government approved that Biotechs DNA testing products can be used in laboratories across the country. Biotech therefore increased its marketing expenditure and received positive publicity. Biotech predicts that the demand for its products will increase soon. Also, Biotech wishes to increase its market shares in molecular diagnostic products. However, the increase in sales is only expected to increase gradually. The molecular diagnostic market is highly competitive and constantly changing. This is because similar new products are developed by many competitor companies. Because of this competition, Biotechs business struggled in the past few years to obtain more market share. Biotech has an overdraft from Bank West to maintain its day-to-day operations. To fund its future expansion, Biotech increased its bank overdraft in 2021. Biotech is also planning to raise additional fund from existing shareholders in the form of a long-term loan in 2022. Biotech expected that it can obtain approximately $12 million long-term loan from the existing shareholders. You have had a discussion with the CEO Bill Musk, who has stated that the likelihood of the capital raising eventuating is high. However, during the audit, there was not sufficient evidence to support this claim from the CEO. You are aware that the entity had difficulty in raising funds in the past. According to audit documentation and evidence collected in the previous financial year, the CEO had positively claimed that a cash injection was due to take place during the 2021 financial year, which didnt materialize. Further, the board of directors has proposed a capital injection by issuing 250,000 shares to the public in 2022 financial year. Biotechs share price of has seen a sharp decline from $2.00 in 2015 to $0.20 in 2021. Even though there has been a sharp decline in the share price, Biotech still holds on to investor confidence and has a current market capitalization of $20 million by the end of the 2021 financial year. Total number of shares on issue have remained constant at 100,000,000 shares in the 2020 and 2021 financial years.

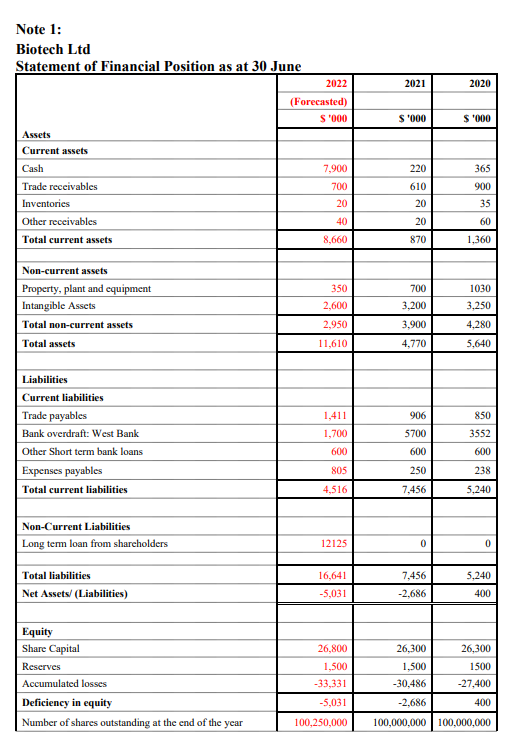

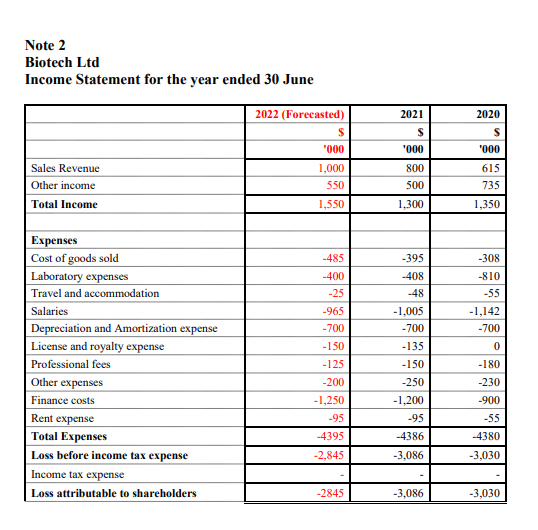

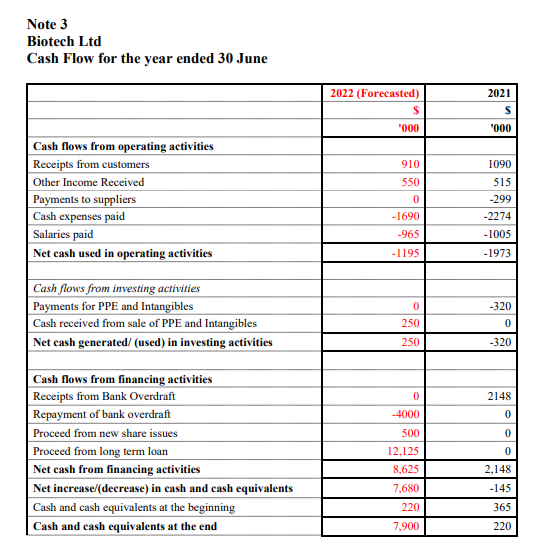

You are provided the historical financial statements of 2020, 2021 and forecasted financial statements of 2022 in notes 1-3 below.

Required:

1. ASA 315 requires auditors to understand the client for the purpose of assessing the risk of material misstatements in financial reports. Based on the provided information in this case, please write down three major inherent risks, and explain why you believe they are inherent risks.

2. Perform and document an analytical review comparing the Biotech financial statements for 2022 and 2021, using the financial information, context information and notes provided above.

3. Based on the results of your analytical review above and with reference to the case study context and additional information:

(a) identify the key financial ratios that audit team should pay greater attention to. Explain why.

(b) identify two accounts (one from the balance sheet and the other one from the income statement) that has a high risk of material misstatement. For the chosen accounts, identify the key assertion(s) that would be at risk.

(c) Based on the risky accounts you identified, write down internal controls that you would expect management to implement.

(d) Discuss what would be appropriate audit strategies for these risky accounts.

4. Based on the results of the analytical review, perform an assessment of the ability of the company to continue as a going concern in the future. Justify your answer. If there are indicators of going concern issue, identify any mitigating factors.

Hints: Use ratio analysis technique and horizontal analysis to perform analytical review, including, but not limited to ratios given below. Assume all sales and purchases are on credit. When calculating averages where previous years figure is not given, use the current years figure. Feel free to consider audit observations and make necessary adjustments to forecasted financial information when performing the analytical review.

Note 1: Biotech Ltd Statement of Financial Position as at 30 June 2022 2021 2020 (Forecasted) S '000 S 1000 $ 000 Assets Current assets Cash Trade receivables Inventories Other receivables Total current assets 7,900 700 20 220 610 365 900 35 20 40 60 20 870 8,660 1,360 1030 Non-current assets Property, plant and equipment Intangible Assets Total non-current assets Total assets 350 2,600 700 3,200 3,250 2,950 4,280 3,900 4,770 11,610 5,640 1,411 906 850 Liabilities Current liabilities Trade payables Bank overdraft: West Bank Other Short term bank loans Expenses payables Total current liabilities 1,700 3552 5700 600 600 600 805 250 238 4,516 7,456 5,240 Non-Current Liabilities Long term loan from shareholders 12125 0 0 5.240 Total liabilities Net Assets/(Liabilities) 16,641 -5,031 7,456 -2.686 400 Equity Share Capital Reserves Accumulated losses Deficiency in equity Number of shares outstanding at the end of the year 26,800 1,500 -33,331 -5,031 100,250,000 26,300 26,300 1,500 1500 -30,486 -27,400 -2,686 100,000,000 100,000,000 400 Note 2 Biotech Ltd Income Statement for the year ended 30 June 2021 2020 S 2022 (Forecasted) $ "000 1,000 550 '000 '000 Sales Revenue Other income Total Income 800 500 615 735 1,550 1,300 1,350 -485 -400 -25 -395 -408 -48 -308 -810 -55 -1,142 -700 Expenses Cost of goods sold Laboratory expenses Travel and accommodation Salaries Depreciation and Amortization expense License and royalty expense Professional fees Other expenses Finance costs Rent expense Total Expenses Loss before income tax expense Income tax expense Loss attributable to shareholders -965 -700 - 150 -125 -200 -1,250 -95 -4395 -2,845 - 1,005 -700 -135 -150 -250 - 1.200 -95 -4386 -3.086 0 -180 -230 -900 -55 -4380 -3,030 -2845 -3,086 -3,030 Note 3 Biotech Ltd Cash Flow for the year ended 30 June 2022 (Forecasted) $ "000 2021 s "000 910 S50 Cash flows from operating activities Receipts from customers Other Income Received Payments to suppliers Cash expenses paid Salaries paid Net cash used in operating activities 0 - 1690 -965 -1195 1090 515 -299 -2274 -1005 -1973 0 -320 Cash flows from investing activities Payments for PPE and Intangibles Cash received from sale of PPE and Intangibles Net cash generated (used) in investing activities 0 250 250 -320 0 2148 0 0 Cash flows from financing activities Receipts from Bank Overdraft Repayment of bank overdraft Proceed from new share issues Proceed from long term loan Net cash from financing activities Net increase/(decrease) in cash and cash equivalents Cash and cash equivalents at the beginning Cash and cash equivalents at the end -4000 500 12.125 8,625 7,680 0 2.148 -145 365 220 7.900 220

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started