Question

You are the CFO of Termination, Inc. Your company has 40 employees, each earning a salary of $40,000/year. Employee salaries grow at 4% per year.

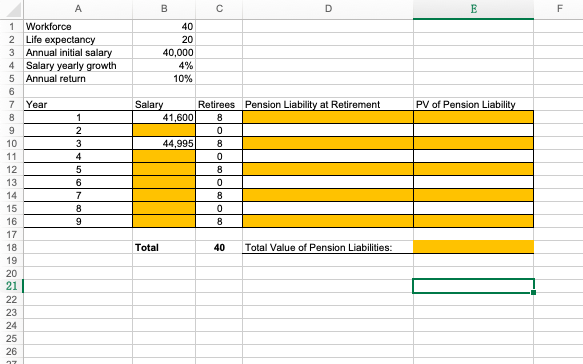

You are the CFO of Termination, Inc. Your company has 40 employees, each earning a salary of $40,000/year. Employee salaries grow at 4% per year. Starting from next year, and every second year thereafter, 8 employees retire and no new employees are recruited. Your company has in place a pension plan that entitles retired workers to an annual pension which is equal to their annual salary at the moment of retirement. Life expectancy is 20 years after retirement, and the annual pension is paid at year-end. The return on investment is 10% per year. What is the total value of your pension liabilities as of now?

Hint: The total value of your pension liabilities will be the sum of the PV of pension liability of each retirement cohort. Please Foll out the following Excel worksheet, please show all the formula and method!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started