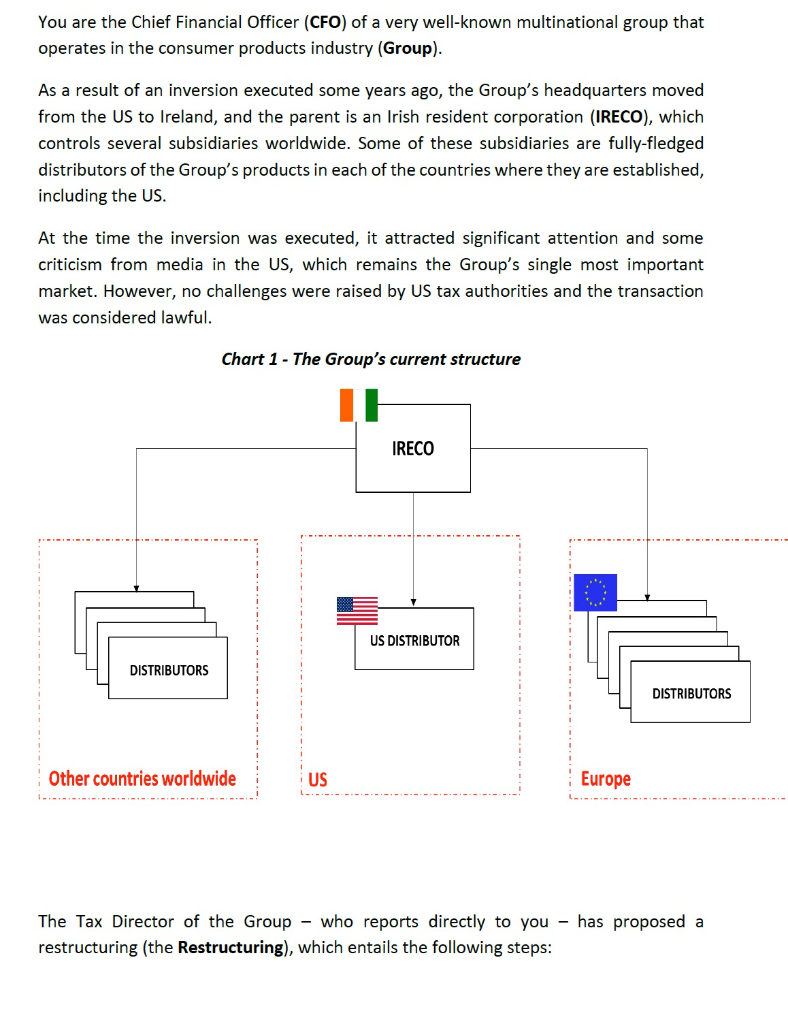

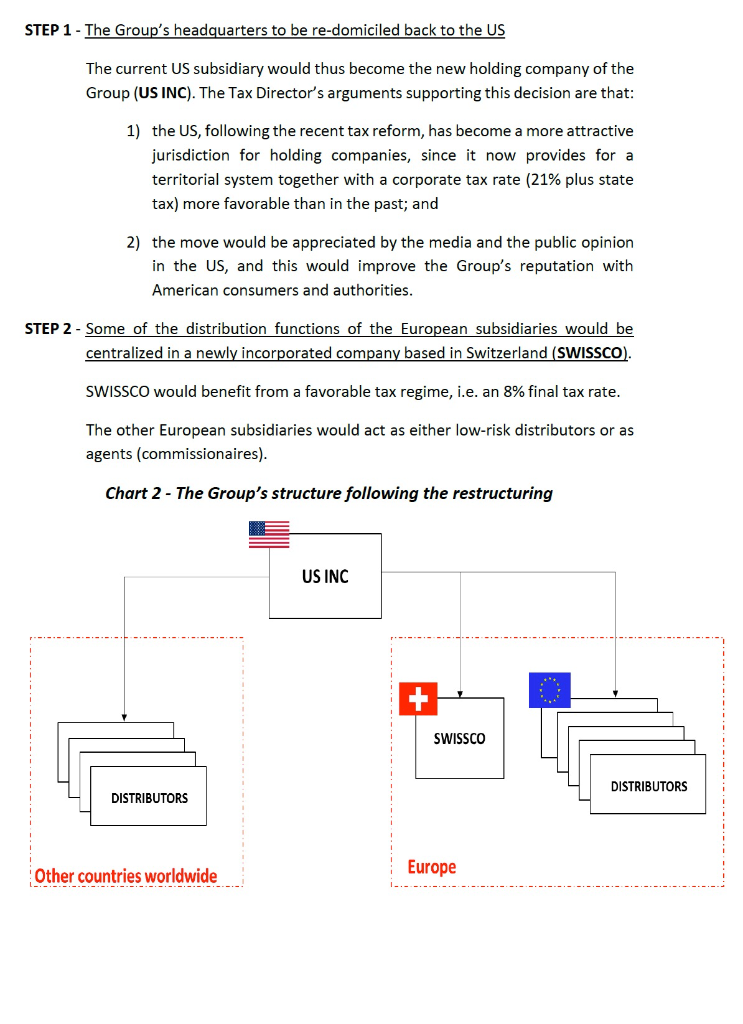

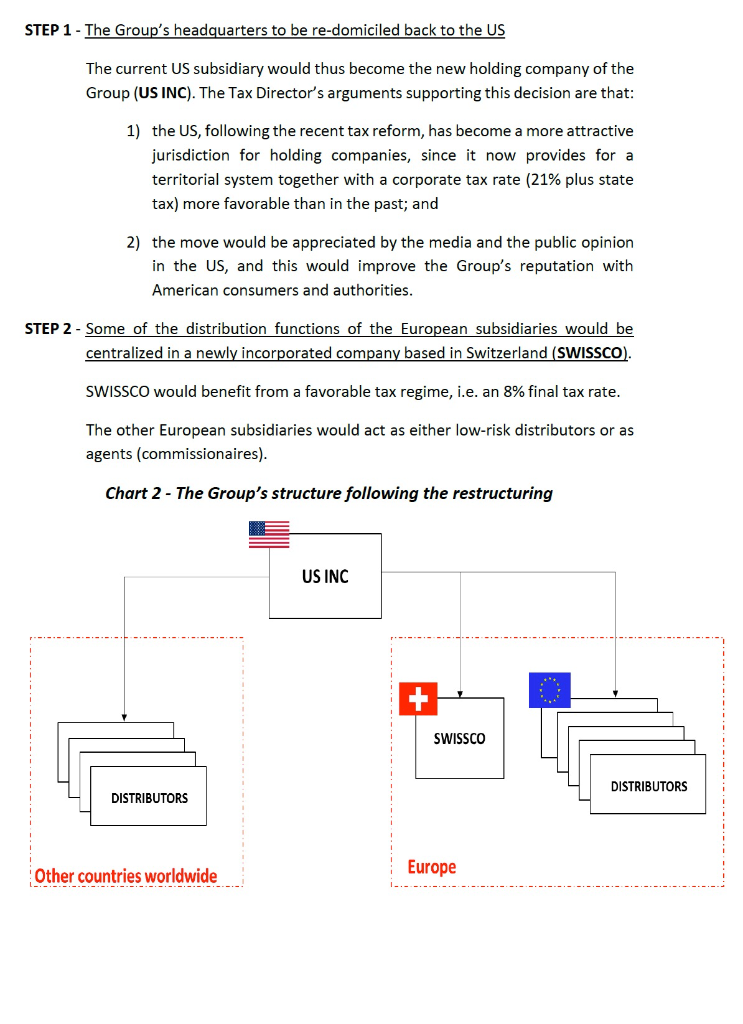

You are the Chief Financial Officer (CFO) of a very well-known multinational group that operates in the consumer products industry (Group). As a result of an inversion executed some years ago, the Group's headquarters moved from the US to Ireland, and the parent is an Irish resident corporation (IRECO), which controls several subsidiaries worldwide. Some of these subsidiaries are fully-fledged distributors of the Group's products in each of the countries where they are established, including the US. At the time the inversion was executed, it attracted significant attention and some criticism from media in the US, which remains the Group's single most important market. However, no challenges were raised by US tax authorities and the transaction was considered lawful. Chart 1 - The Group's current structure IRECO US DISTRIBUTOR DISTRIBUTORS DISTRIBUTORS Other countries worldwide US Europe The Tax Director of the Group - who reports directly to you - has proposed a restructuring (the Restructuring), which entails the following steps: STEP 1 - The Group's headquarters to be re-domiciled back to the US The current US subsidiary would thus become the new holding company of the Group (US INC). The Tax Director's arguments supporting this decision are that: 1) the US, following the recent tax reform, has become a more attractive jurisdiction for holding companies, since it now provides for a territorial system together with a corporate tax rate (21% plus state tax) more favorable than in the past; and 2) the move would be appreciated by the media and the public opinion in the US, and this would improve the Group's reputation with American consumers and authorities. STEP 2 - Some of the distribution functions of the European subsidiaries would be centralized in a newly incorporated company based in Switzerland (SWISSCO). SWISSCO would benefit from a favorable tax regime, i.e. an 8% final tax rate. The other European subsidiaries would act as either low-risk distributors or as agents (commissionaires). Chart 2 - The Group's structure following the restructuring US INC SWISSCO DISTRIBUTORS DISTRIBUTORS Other countries worldwid Europe The Group has not adopted any tax risks management policy. The Tax Director feels confident about the Restructuring, but you do not have a high reputation of him because you think he is quite superficial. Considering all the above: 1) How would you handle the case? 2) What aspects would you consider in the evaluation of the Restructuring? 3) Would you implement the entire Restructuring (STEP 1 and STEP 2), only one step, or would you suggest to your CEO not to execute the Restructuring at all? Please explain the reasons supporting your position. You are the Chief Financial Officer (CFO) of a very well-known multinational group that operates in the consumer products industry (Group). As a result of an inversion executed some years ago, the Group's headquarters moved from the US to Ireland, and the parent is an Irish resident corporation (IRECO), which controls several subsidiaries worldwide. Some of these subsidiaries are fully-fledged distributors of the Group's products in each of the countries where they are established, including the US. At the time the inversion was executed, it attracted significant attention and some criticism from media in the US, which remains the Group's single most important market. However, no challenges were raised by US tax authorities and the transaction was considered lawful. Chart 1 - The Group's current structure IRECO US DISTRIBUTOR DISTRIBUTORS DISTRIBUTORS Other countries worldwide US Europe The Tax Director of the Group - who reports directly to you - has proposed a restructuring (the Restructuring), which entails the following steps: STEP 1 - The Group's headquarters to be re-domiciled back to the US The current US subsidiary would thus become the new holding company of the Group (US INC). The Tax Director's arguments supporting this decision are that: 1) the US, following the recent tax reform, has become a more attractive jurisdiction for holding companies, since it now provides for a territorial system together with a corporate tax rate (21% plus state tax) more favorable than in the past; and 2) the move would be appreciated by the media and the public opinion in the US, and this would improve the Group's reputation with American consumers and authorities. STEP 2 - Some of the distribution functions of the European subsidiaries would be centralized in a newly incorporated company based in Switzerland (SWISSCO). SWISSCO would benefit from a favorable tax regime, i.e. an 8% final tax rate. The other European subsidiaries would act as either low-risk distributors or as agents (commissionaires). Chart 2 - The Group's structure following the restructuring US INC SWISSCO DISTRIBUTORS DISTRIBUTORS Other countries worldwid Europe The Group has not adopted any tax risks management policy. The Tax Director feels confident about the Restructuring, but you do not have a high reputation of him because you think he is quite superficial. Considering all the above: 1) How would you handle the case? 2) What aspects would you consider in the evaluation of the Restructuring? 3) Would you implement the entire Restructuring (STEP 1 and STEP 2), only one step, or would you suggest to your CEO not to execute the Restructuring at all? Please explain the reasons supporting your position