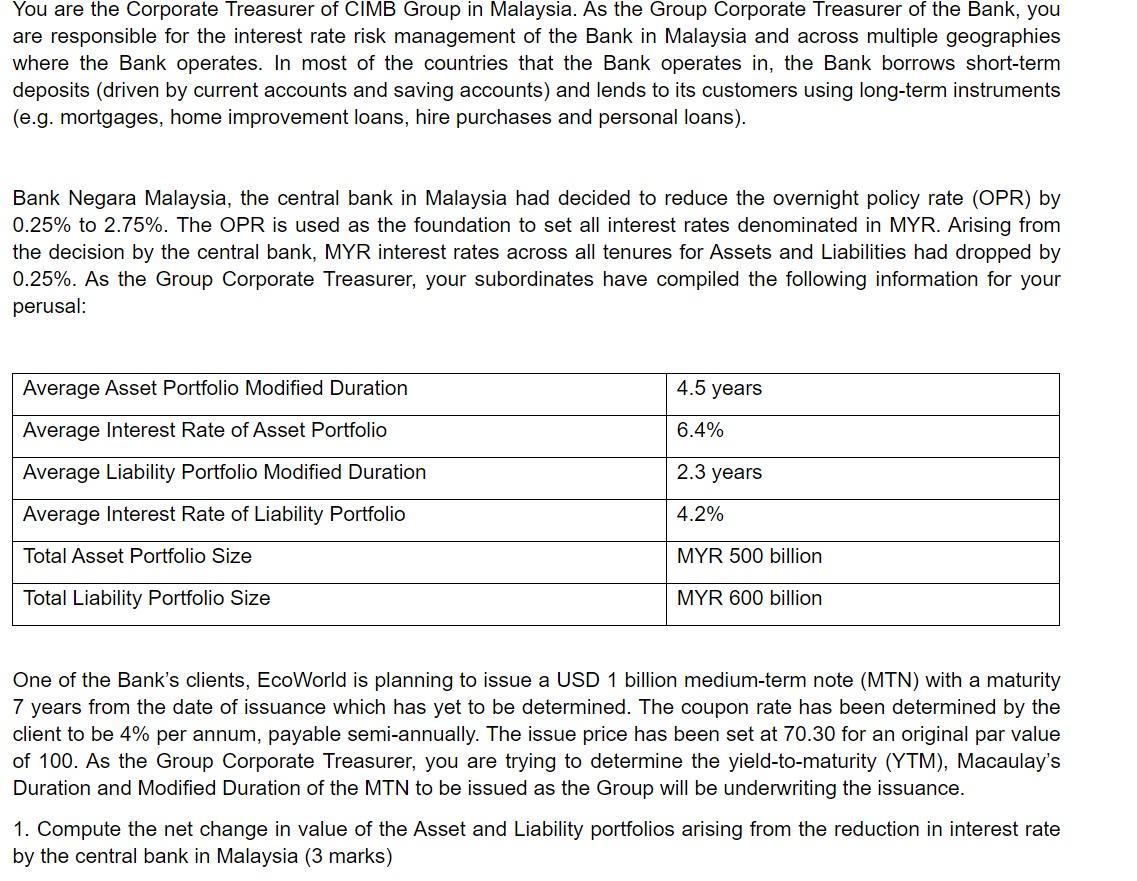

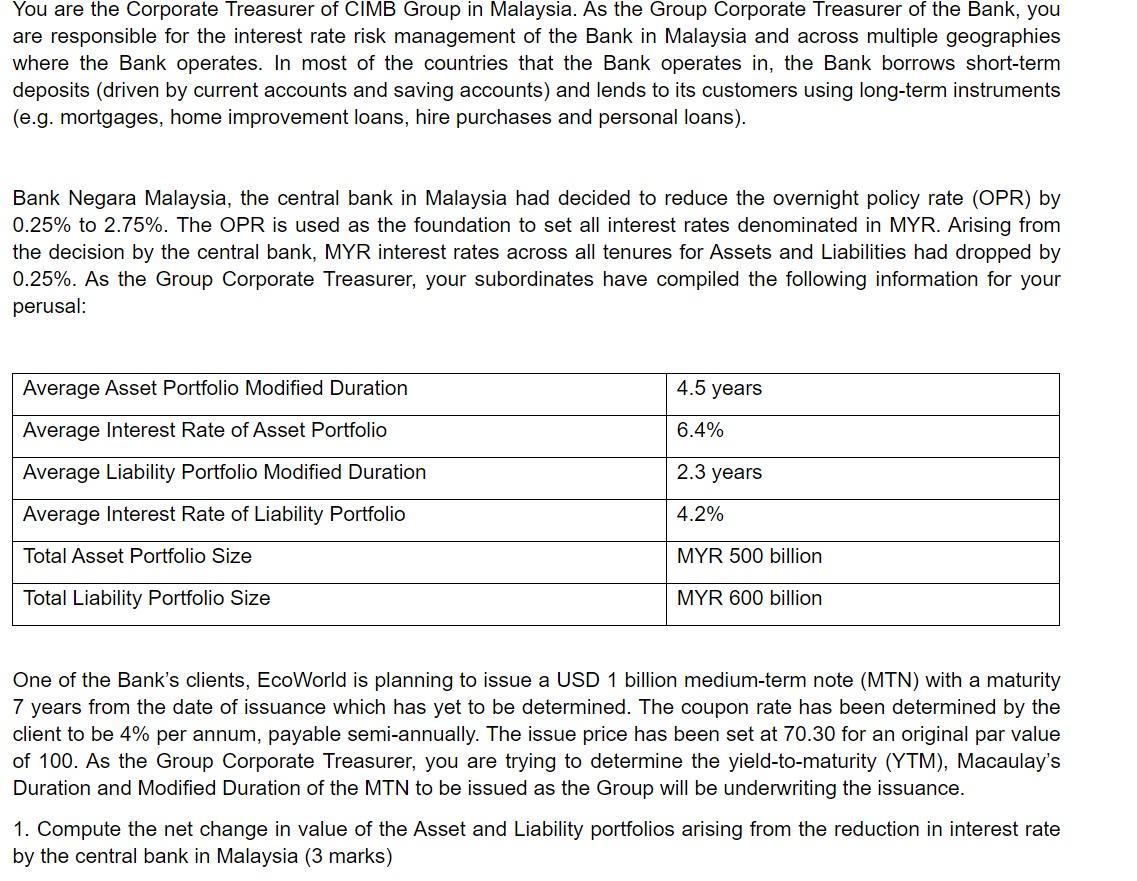

You are the Corporate Treasurer of CIMB Group in Malaysia. As the Group Corporate Treasurer of the Bank, you are responsible for the interest rate risk management of the Bank in Malaysia and across multiple geographies where the Bank operates. In most of the countries that the Bank operates in, the Bank borrows short-term deposits (driven by current accounts and saving accounts) and lends to its customers using long-term instruments (e.g. mortgages, home improvement loans, hire purchases and personal loans). Bank Negara Malaysia, the central bank in Malaysia had decided to reduce the overnight policy rate (OPR) by 0.25% to 2.75%. The OPR is used as the foundation to set all interest rates denominated in MYR. Arising from the decision by the central bank, MYR interest rates across all tenures for Assets and Liabilities had dropped by 0.25%. As the Group Corporate Treasurer, your subordinates have compiled the following information for your perusal: Average Asset Portfolio Modified Duration 4.5 years Average Interest Rate of Asset Portfolio 6.4% Average Liability Portfolio Modified Duration 2.3 years Average Interest Rate of Liability Portfolio 4.2% Total Asset Portfolio Size MYR 500 billion Total Liability Portfolio Size MYR 600 billion One of the Bank's clients, EcoWorld is planning to issue a USD 1 billion medium-term note (MTN) with a maturity 7 years from the date of issuance which has yet to be determined. The coupon rate has been determined by the client to be 4% per annum, payable semi-annually. The issue price has been set at 70.30 for an original par value of 100. As the Group Corporate Treasurer, you are trying to determine the yield-to-maturity (YTM), Macaulay's Duration and Modified Duration of the MTN to be issued as the Group will be underwriting the issuance. 1. Compute the net change in value of the Asset and Liability portfolios arising from the reduction in interest rate by the central bank in Malaysia (3 marks) You are the Corporate Treasurer of CIMB Group in Malaysia. As the Group Corporate Treasurer of the Bank, you are responsible for the interest rate risk management of the Bank in Malaysia and across multiple geographies where the Bank operates. In most of the countries that the Bank operates in, the Bank borrows short-term deposits (driven by current accounts and saving accounts) and lends to its customers using long-term instruments (e.g. mortgages, home improvement loans, hire purchases and personal loans). Bank Negara Malaysia, the central bank in Malaysia had decided to reduce the overnight policy rate (OPR) by 0.25% to 2.75%. The OPR is used as the foundation to set all interest rates denominated in MYR. Arising from the decision by the central bank, MYR interest rates across all tenures for Assets and Liabilities had dropped by 0.25%. As the Group Corporate Treasurer, your subordinates have compiled the following information for your perusal: Average Asset Portfolio Modified Duration 4.5 years Average Interest Rate of Asset Portfolio 6.4% Average Liability Portfolio Modified Duration 2.3 years Average Interest Rate of Liability Portfolio 4.2% Total Asset Portfolio Size MYR 500 billion Total Liability Portfolio Size MYR 600 billion One of the Bank's clients, EcoWorld is planning to issue a USD 1 billion medium-term note (MTN) with a maturity 7 years from the date of issuance which has yet to be determined. The coupon rate has been determined by the client to be 4% per annum, payable semi-annually. The issue price has been set at 70.30 for an original par value of 100. As the Group Corporate Treasurer, you are trying to determine the yield-to-maturity (YTM), Macaulay's Duration and Modified Duration of the MTN to be issued as the Group will be underwriting the issuance. 1. Compute the net change in value of the Asset and Liability portfolios arising from the reduction in interest rate by the central bank in Malaysia