Answered step by step

Verified Expert Solution

Question

1 Approved Answer

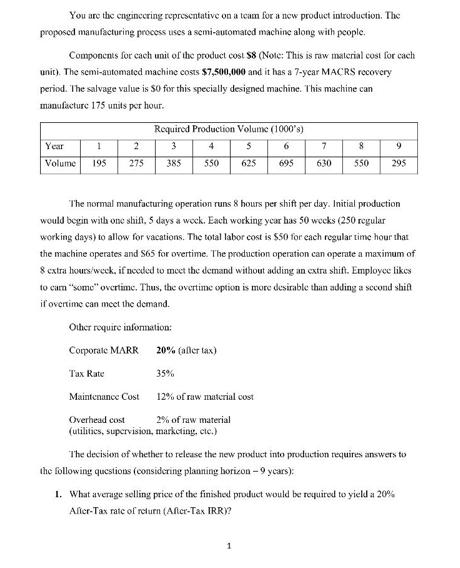

You are the engineering representative on a team for a new product introduction. The proposed manufacturing process uses a semi-automated machine along with people.

You are the engineering representative on a team for a new product introduction. The proposed manufacturing process uses a semi-automated machine along with people. Components for cach unit of the product cost $8 (Note: This is raw material cost for cach unit). The semi-automated machine costs $7,500,000 and it has a 7-year MACRS recovery period. The salvage value is $0 for this specially designed machine. This machine can manufacture 175 units per hour. Required Production Volume (1000's) Year 1 2 3 4 6 7 8 9 Volume 195 275 385 550 625 695 630 550 295 The normal manufacturing operation runs 8 hours per shift per day. Initial production would begin with one shift, 5 days a week. Each working year has 50 weeks (250 regular working days) to allow for vacations. The total labor cost is $50 for each regular time hour that the machine operates and $65 for overtime. The production operation can operate a maximum of 8 extra hours/week, if needed to meet the demand without adding an extra shift. Employee likes to cam "some" overtime. Thus, the overtime option is more desirable than adding a second shift if overtime can meet the demand. Other require information: Corporate MARR 20% (aller tax) Tax Rate 35% Maintenance Cost 12% of raw material cost 2% of raw material Overhead cost (utilities, supervision, marketing, etc.) The decision of whether to release the new product into production requires answers to the following questions (considering planning horizon - 9 years): 1. What average selling price of the finished product would be required to yield a 20% After-Tax rate of return (After-Tax IRR)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started