Question

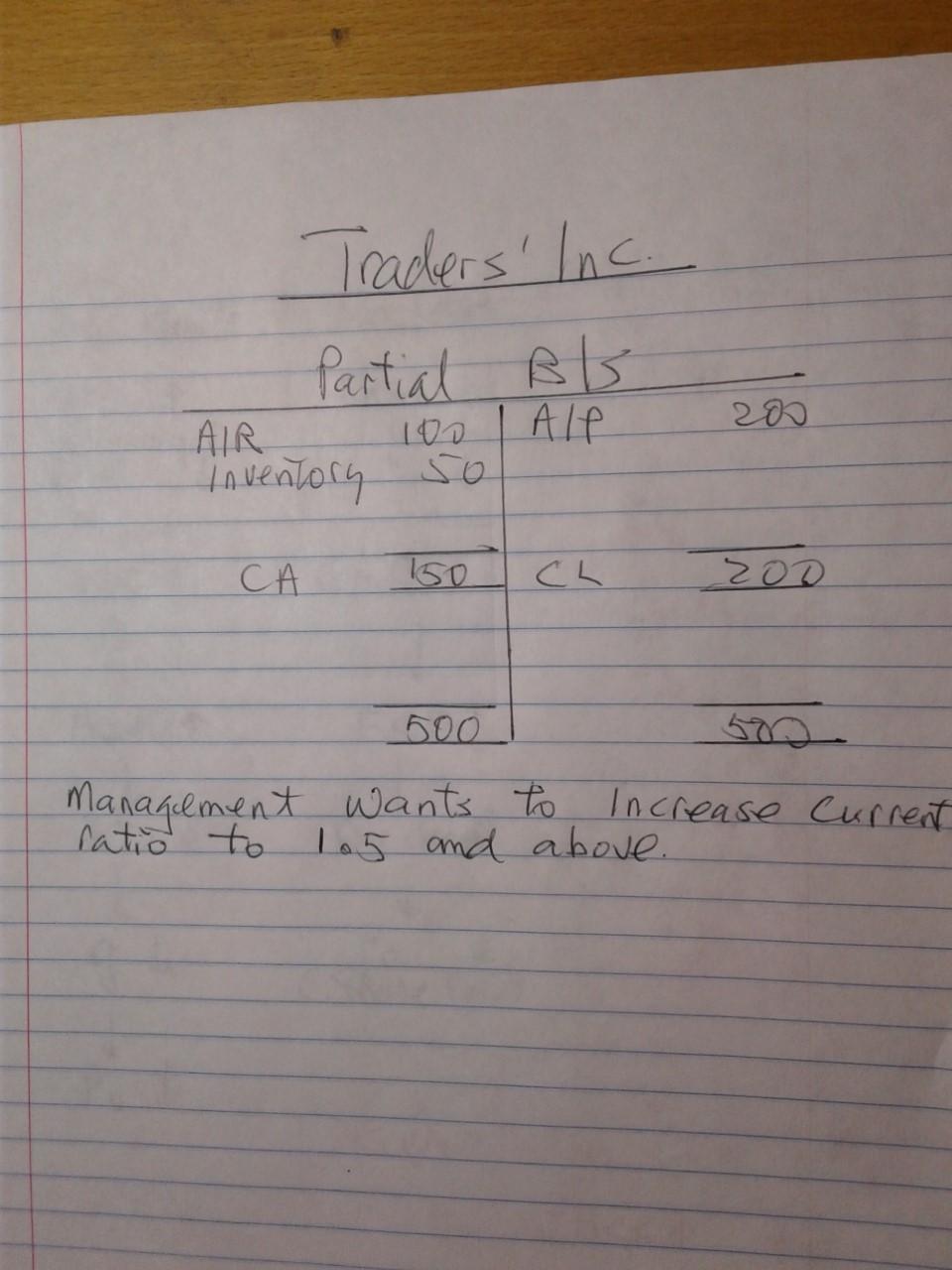

You are the Finance Manager of a corporation. The Board of Directors has noticed TIs current ratio is well below 1.5 industry average. You are

| You are the Finance Manager of a corporation. The Board of Directors has noticed TIs current ratio is well below 1.5 industry average. You are asked by the Board of Directors to evaluate the financial impacts of raising current ratio to 1.5 or higher. Specifically, you are asked to evaluate the impact of higher current ratio in the following areas (assuming everything else remain constant e.g., sales, profit margin etc). |

| Free Cash Flow (FCF): Likely increase / decrease / no change? [max 30 words]

|

| Sustainable Growth Rate: Any change (higher or lower) because of higher current ratio? [max 30 words] |

| Impact on Economic Value Added (EVA) with higher current ratio and in what direction higher or lower and why? [max 50 words] |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started