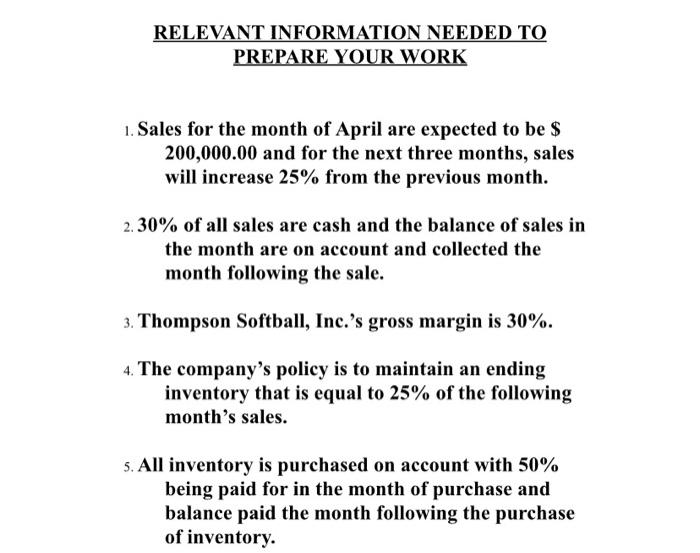

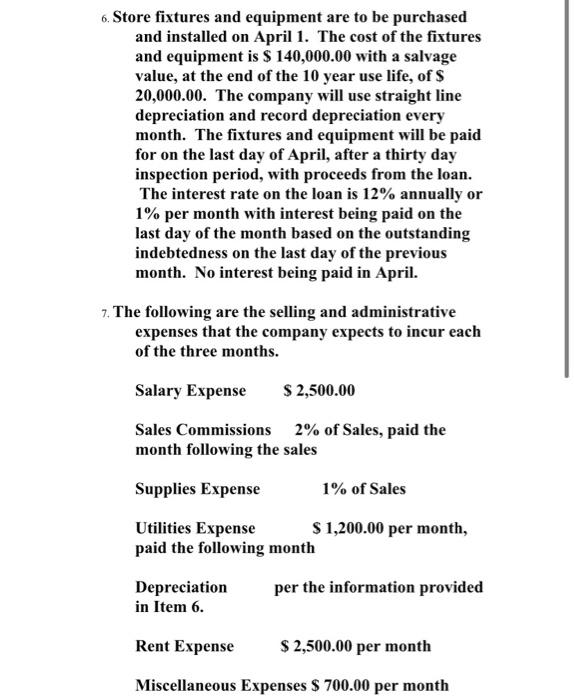

You are the newly appointed accounting manager for a new, startup business scheduled to open its doors and begin operations at its new retail location on April 1, 2021. The new company, Thompson Softball, Inc. will sell high end softball equipment. The owner of the company has gone to the local bank to borrow money for equipment and fixtures needed to run the business. The loan manager, at the bank, has requested that he, the owner, provide the following to the bank in order to allow the bank to make a credit approval decision: (i) sales budget; (ii) inventory purchases budget; (iii) a selling and administrative expense budget; and (iv)a cash budget for the months of April, May and June of 2021. In addition the company plans on having semi- annual pro forma financial statements prepared for the period ending June 30, 2021. The loan manager has also requested that owner provide the following pro forma financial statements for the period ending June 30, 2021: (i) income statement; (ii) balance sheet; and (iii) a statement of cash flows. The loan manager wants the various budgets and pro forma financial statements prepared using the correct format that you learned in your managerial accounting class while a Bethany College. The owner has asked you to prepare what was requested by the bank. RELEVANT INFORMATION NEEDED TO PREPARE YOUR WORK 1. Sales for the month of April are expected to be $ 200,000.00 and for the next three months, sales will increase 25% from the previous month. 2. 30% of all sales are cash and the balance of sales in the month are on account and collected the month following the sale. 3. Thompson Softball, Inc.'s gross margin is 30%. 4. The company's policy is to maintain an ending inventory that is equal to 25% of the following month's sales. 5. All inventory is purchased on account with 50% being paid for in the month of purchase and balance paid the month following the purchase of inventory. 6. Store fixtures and equipment are to be purchased and installed on April 1. The cost of the fixtures and equipment is $ 140,000.00 with a salvage value, at the end of the 10 year use life, of $ 20,000.00. The company will use straight line depreciation and record depreciation every month. The fixtures and equipment will be paid for on the last day of April, after a thirty day inspection period, with proceeds from the loan. The interest rate on the loan is 12% annually or 1% per month with interest being paid on the last day of the month based on the outstanding indebtedness on the last day of the previous month. No interest being paid in April. 7. The following are the selling and administrative expenses that the company expects to incur each of the three months. Salary Expense $ 2,500.00 Sales Commissions 2% of Sales, paid the month following the sales Supplies Expense 1% of Sales Utilities Expense $ 1,200.00 per month, paid the following month Depreciation in Item 6. per the information provided Rent Expense $ 2,500.00 per month Miscellaneous Expenses $ 700.00 per month 8. The company's beginning cash balance on April 1 is $ 00.00 and the company's policy is to maintain a month ending cash balance of $ 15,000.00. Any shortages are made up with borrowings from the local bank with the same terms as the original loan. Any surpluses at month end beyond the $ 15,000.00 is used to pay down the indebtedness. Any borrowings or repayment will be in even increments of $1000.00