Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the owner of a small business. An opportunity to expand into a new market niche arose. It requires an initial equipment investment

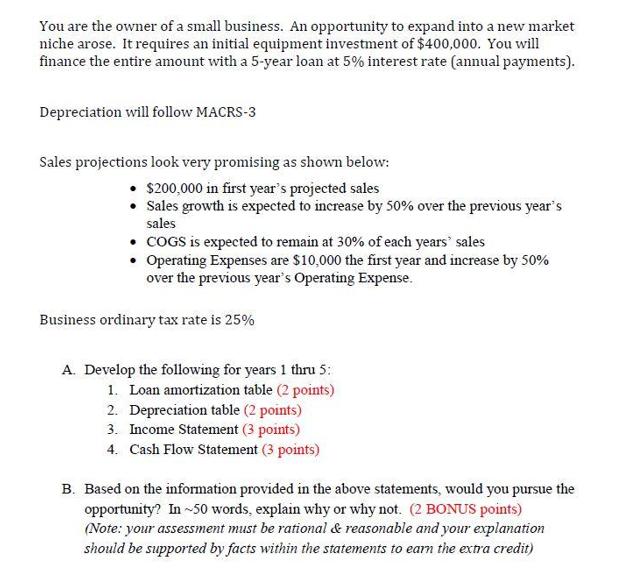

You are the owner of a small business. An opportunity to expand into a new market niche arose. It requires an initial equipment investment of $400,000. You will finance the entire amount with a 5-year loan at 5% interest rate (annual payments). Depreciation will follow MACRS-3 Sales projections look very promising as shown below: $200,000 in first year's projected sales Sales growth is expected to increase by 50% over the previous year's sales COGS is expected to remain at 30% of each years' sales Operating Expenses are $10,000 the first year and increase by 50% over the previous year's Operating Expense. Business ordinary tax rate is 25% A. Develop the following for years 1 thru 5: 1. Loan amortization table (2 points) 2. Depreciation table (2 points) 3. Income Statement (3 points) 4. Cash Flow Statement (3 points) B. Based on the information provided in the above statements, would you pursue the opportunity? In -50 words, explain why or why not. (2 BONUS points) (Note: your assessment must be rational & reasonable and your explanation should be supported by facts within the statements to earn the extra credit)

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Loan Ammrotisation table YEAR 1 INTEREST PAYMENT PRINCIPAL PAYMENT BALANCE 1 2000000 7238992 3276100...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started