Question

You are the owner of Paul's Guitar Shop, Inc and it is time to valuate the business. How do you find the selling price of

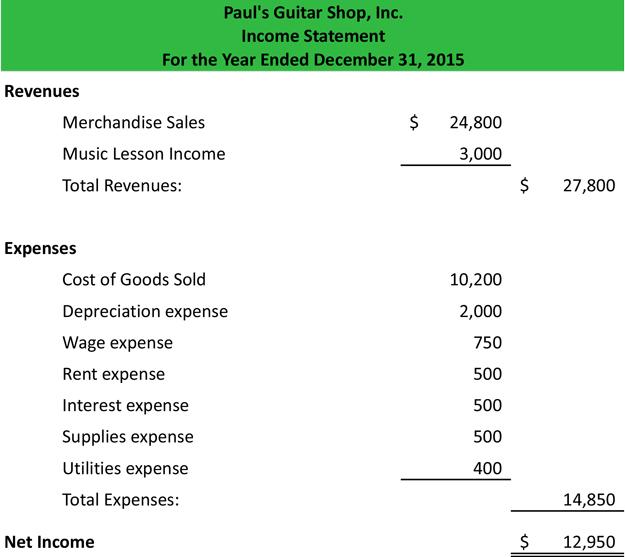

You are the owner of Paul's Guitar Shop, Inc and it is time to valuate the business. How do you find the selling price of the business based off of the income statement? (Be sure to find the selling price not the book value.) Explain calculations thoroughly.

Revenues Merchandise Sales Music Lesson Income Total Revenues: Expenses Paul's Guitar Shop, Inc. Income Statement For the Year Ended December 31, 2015 Cost of Goods Sold Depreciation expense Wage expense Rent expense Interest expense Supplies expense Utilities expense Total Expenses: Net Income $ 24,800 3,000 10,200 2,000 750 500 500 500 400 $ $ 27,800 14,850 12,950

Step by Step Solution

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

ANS WER The selling price of the business is based on the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management Mistakes and Successes

Authors: Robert F. Hartley

12th edition

978-1118078464, 1118078462, 978-0470530528

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App