You are the president of Campus Sweater, Inc.

Campus sweaters manufacturers wool pullover v-neck sweaters of various sizes and colors. You are preparing the budgets for the first quarter of 2021 (January, February, and March). You have the following historical and projected sales in units:

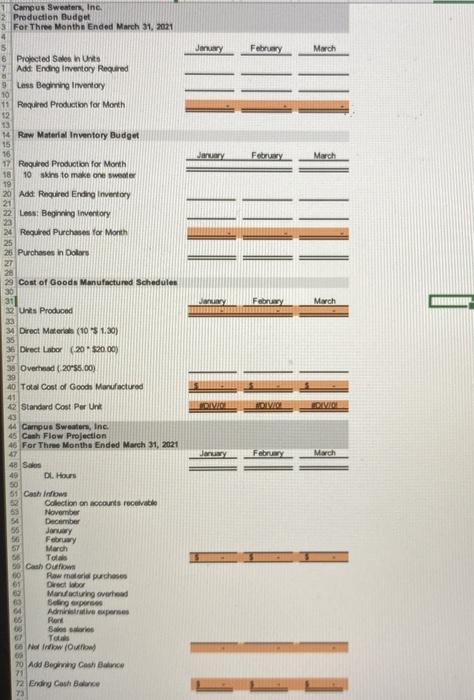

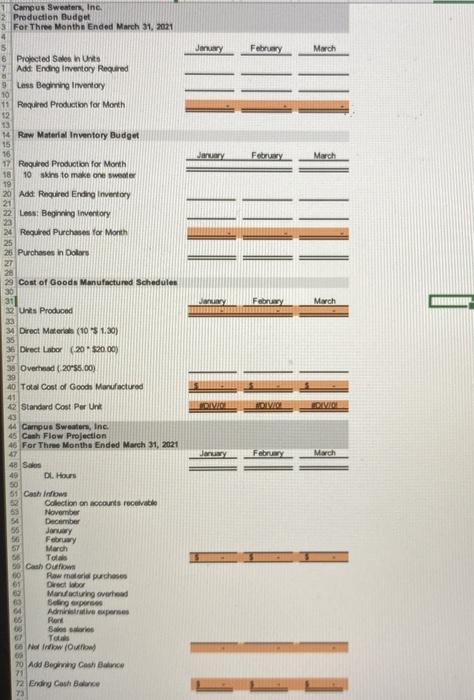

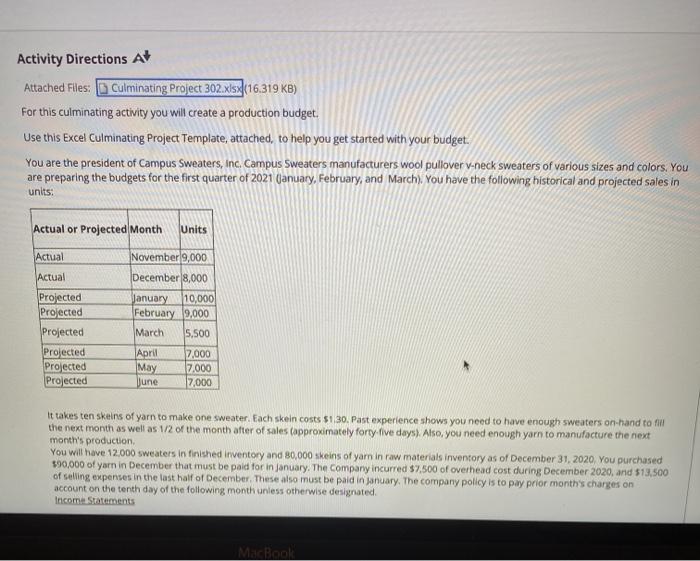

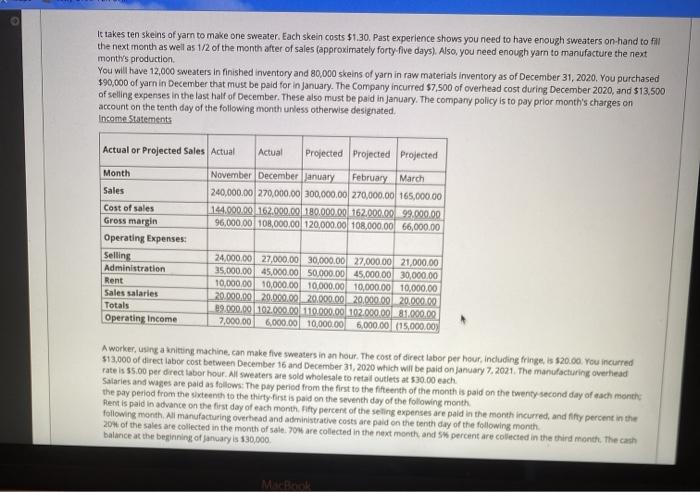

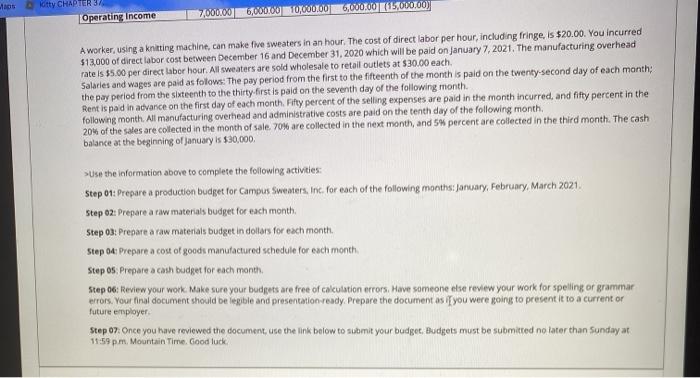

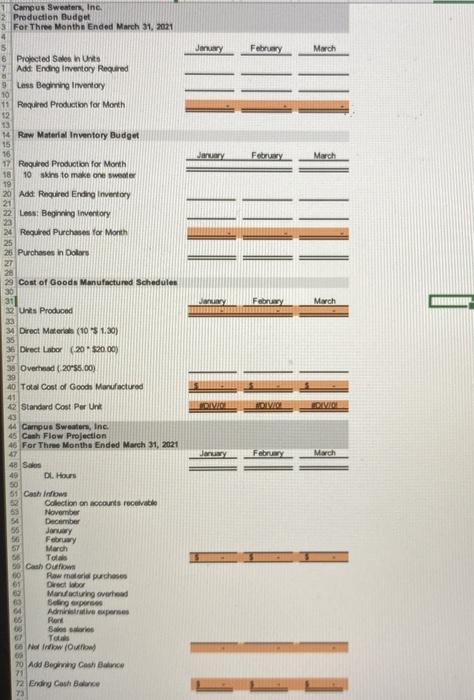

Campus Sweaters, Inc. 2 Production Budget 3 For Three Month Ended March 31, 2021 January Febrny March 6 Projected Sales In Units Add Ending Inventory Required 9 Loss Beginning Inventory 10 11 Required Production for Month 12 14 Raw Material Inventory Budget January March 16 17 Required Production for Month 10 is to make one week Add Required Ending Inventory Less: Beginning inventory Required Purchase for Morth Purchases in Dolar Cost of Goods Manufactured Schedules Fabry March Unts Produced 30 30 Direct Material (103 1.30) 36 Direct Labor (20 - $20.00) DIVA Jaru February March 38 Overhead (20155.00) 39 40 Total Cost of Goods Manufactured 41 42 Standard Cost Per Unit 46 Campus Sweaters, Inc. 45 Cash Flow Projection 46 For Three Months Ended March 31, 2021 47 48 Soos 49 DL Hours 50 51 Cash inflows Collection on accounts receivable November December 55 January February March Total 50 Cash Our 50 Raw material purchases 65 Orect labor Manufacturing verhoud Sing per CA Admitive perses Ron Seri 67 To 60 Wow Ourow 70 Add Being Go Balce 71 72 Ending Cash Bone 72 Activity Directions At Attached Files: Culminating Project 302.xls (16.319 KB) For this culminating activity you will create a production budget Use this Excel Culminating Project Template, attached to help you get started with your budget. You are the president of Campus Sweaters, Inc. Campus Sweaters manufacturers wool pullover v-neck sweaters of various sizes and colors. You are preparing the budgets for the first quarter of 2021 (January, February, and March). You have the following historical and projected sales in units: Actual or Projected Month Units Actual Actual Projected Projected Projected Projected Projected Projected November 9,000 December 8,000 January 10,000 February 9.000 March 5,500 April 7.000 May 7,000 June 7,000 It takes ten skeins of yarn to make one sweater. Each skeln costs $130. Past experience shows you need to have enough sweaters on hand to all the next month as well as 1/2 of the month after of sales (approximately forty-five days). Also, you need enough yarn to manufacture the next month's production You will have 12,000 sweaters in finished inventory and 80,000 skeins of yarn in raw materials inventory as of December 31, 2020 You purchased 390,000 of yarn in December that must be paid for in January. The company incurred $7,500 of overhead cost during December 2020, and $13,500 of selling expenses in the last half of December. These also must be paid in January. The company policy is to pay prior month's charges on account on the tenth day of the following month unless otherwise designated Income Statements MacBook It takes ten skeins of yarn to make one sweater. Each skein costs $1.30. Past experience shows you need to have enough sweaters on hand to fil the next month as well as 1/2 of the month after of sales (approximately forty-five days). Also, you need enough yarn to manufacture the next months production You will have 12,000 sweaters In finished inventory and 80,000 skeins of yarn in raw materials inventory as of December 31, 2020. You purchased $90,000 of yarn in December that must be paid for in January. The Company incurred $7,500 of overhead cost during December 2020, and $13.500 of selling expenses in the last half of December. These also must be paid in January. The company policy is to pay prior month's charges on account on the tenth day of the following month unless otherwise designated Income Statements Actual or Projected Sales Actual Actual Projected Projected Projected Month November December January February March Sales 240,000.00 270,000.00 300,000.00 270,000.00 165,000.00 Cost of sales 144.000,00 162,000.00 180.000,00 162,000.00 99.000,00 Gross margin 96,000.00 108,000,00 120,000.00 108,000,00 66,000.00 Operating Expenses Selling 24,000.00 27,000.00 30,000.00 27,000.00 21,000.00 Administration 35,000.00 45,000.00 50,000.00 45.000,00 30,000.00 Rent 10,000.00 10,000.00 10.000,00 10,000.00 10,000.00 Sales salaries 20.000,00 20.000.000.000,00 20,000.00 20.000.00 Totals 89.000,00 102.000,00 110.000.00 102.000.00 81.000.00 Operating Income 7.000.00 6,000.00 10,000.00 6,000.00 15,000.00 A worker, using a knitting machine, can make five sweaters in an hour. The cost of direct labor per hour, including fringe is $20.00. You incurred 513,000 of direct labor cost between December 16 and December 31, 2020 which will be paid on January 7, 2021. The manufacturing overhead rate is $5.00 per direct labor hour. All sweaters are sold wholesale to retail outlets at 530.00 each Sataries and wages are paid as follows: The pay period from the first to the fifteenth of the month is paid on the twenty second day of each month Rent is paid in advance on the first day of each month. fifty percent of the selling expenses are paid in the month incurred, and fifty percent in the following month. All manufacturing overhead and administrative costs are paid on the tenth day of the following month 20% of the sales are collected in the month of salt. 70% are collected in the next month and percent are collected in the third month. The cash balance at the beginning of January is $30,000 Boty CHAPTER 37 Operating Income 700000 6,000.00 10000.00 6,000.00 15.000.00) A worker, using a knitting machine, can make five sweaters in an hour. The cost of direct labor per hour, including fringe, is $20.00. You incurred $13,000 of direct labor cost between December 16 and December 31, 2020 which will be paid on January 7, 2021. The manufacturing overhead rate is $5.00 per direct labor hour. All sweaters are sold wholesale to retail outlets at $30.00 each Salaries and wages are paid as follows: The pay period from the first to the fifteenth of the month is paid on the twenty-second day of each month the pay period from the sixteenth to the thirty first is paid on the seventh day of the following month. Rent is paid in advance on the first day of each month. Fifty percent of the selling expenses are paid in the month incurred and fifty percent in the following month. All manufacturing overhead and administrative costs are paid on the tenth day of the following month 20% of the sales are collected in the month of sale. 70% are collected in the next month, and 5 percent are collected in the third month. The cash balance at the beginning of January is $30,000 >Use the information above to complete the following activities: Step 1: Prepare a production budget for Campus Sweaters, Int. for each of the following months: January, February, March 2021. Step 2: Prepare a raw materials budget for each month, Step 03: Prepare a raw materials budget in dollars for each month, Step 4: Prepare a cost of goods manufactured schedule for each month Step OsPrepare a cash budget for each month. Step 6: Review your work. Make sure your budgets are free of cakulation errors. Have someone else review your work for spelling or grammar errors. Your final document should be legible and presentation ready. Prepare the document as if you were going to present it to a current or future employer Step 07: Once you have reviewed the document, use the link below to submit your budget. Budgets must be submitted no later than Sunday at 11:59 pm Mountain Time. Good luck