Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are to create summary journal entries for the transacgions that have tajen place during the year 2019. Do not comvine entries for this portion.

You are to create summary journal entries for the transacgions that have tajen place during the year 2019. Do not comvine entries for this portion. Make a separate entry for each summary transaction. For instance, When you record expenses, make a separate entry for each expense. You do not need closing entries. You should have 14 entries (Each entry involves only 2 accounts)

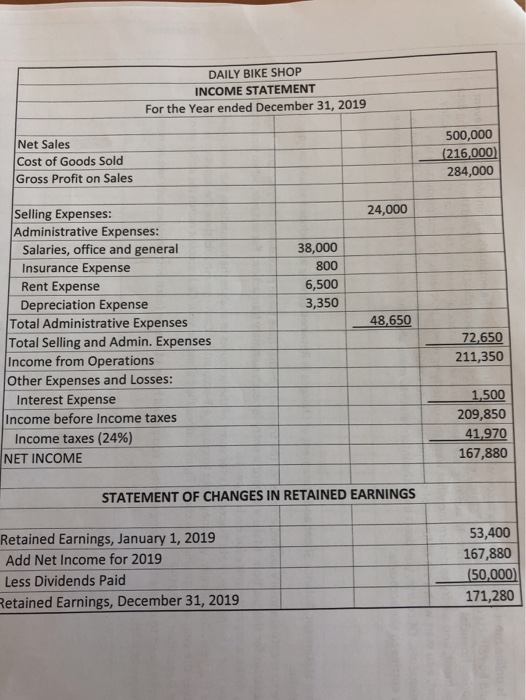

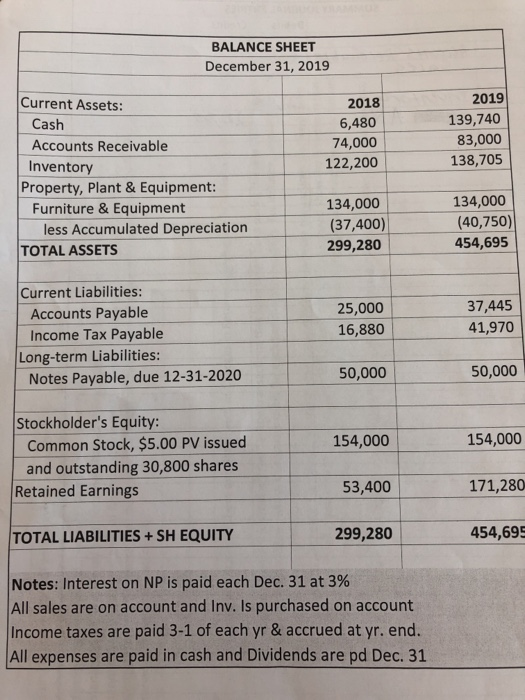

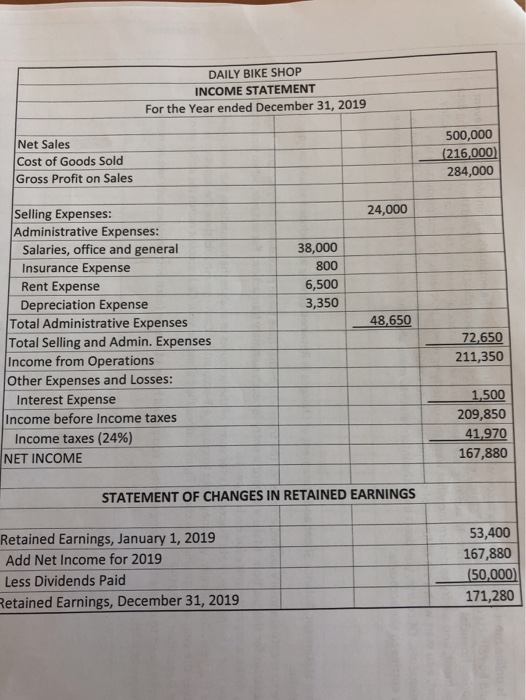

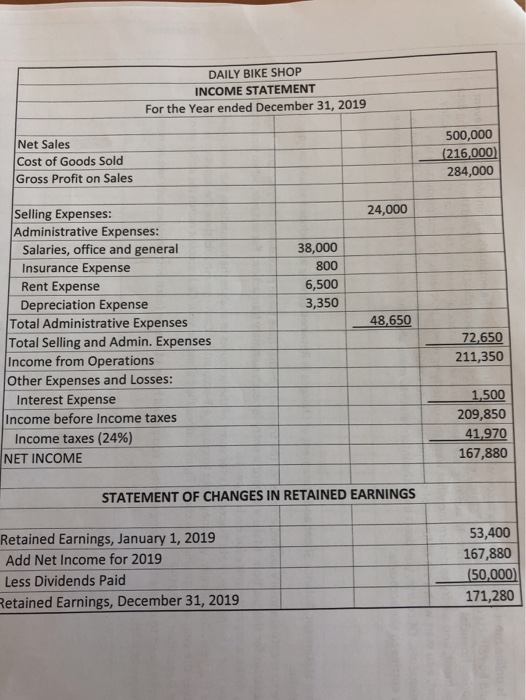

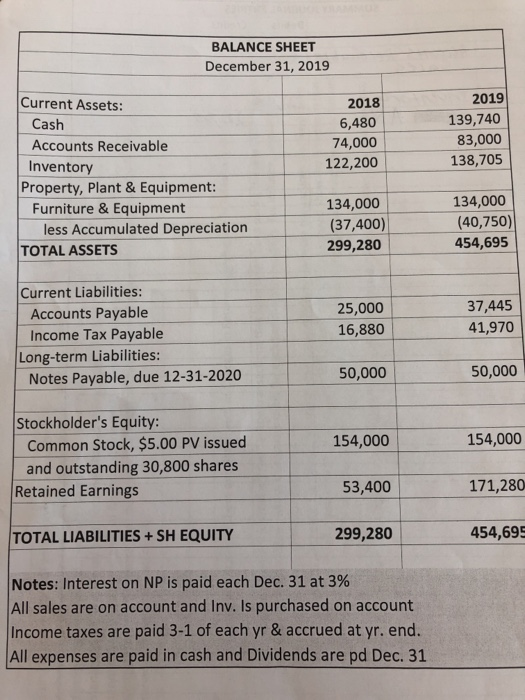

DAILY BIKE SHOP INCOME STATEMENT For the Year ended December 31, 2019 Net Sales Cost of Goods Sold Gross Profit on Sales 500,000 (216,000) 284,000 24,000 38,000 800 6,500 3,350 48,650 Selling Expenses: Administrative Expenses: Salaries, office and general Insurance Expense Rent Expense Depreciation Expense Total Administrative Expenses Total Selling and Admin. Expenses Income from Operations Other Expenses and Losses: Interest Expense Income before Income taxes Income taxes (24%) NET INCOME 72,650 211,350 1.500 209,850 41,970 167,880 STATEMENT OF CHANGES IN RETAINED EARNINGS Retained Earnings, January 1, 2019 Add Net Income for 2019 Less Dividends Paid Cetained Earnings, December 31, 2019 53,400 167,880 (50,000) 171,280 BALANCE SHEET December 31, 2019 2018 6,480 74,000 122,200 2019 139,740 83,000 138,705 Current Assets: Cash Accounts Receivable Inventory Property, Plant & Equipment: Furniture & Equipment less Accumulated Depreciation TOTAL ASSETS 134,000 (37,400) 299,280 134,000 (40,750) 454,695 Current Liabilities: Accounts Payable Income Tax Payable Long-term Liabilities: Notes Payable, due 12-31-2020 25,000 16,880 37,445 41,970 50,000 50,000 154,000 154,000 Stockholder's Equity: Common Stock, $5.00 PV issued and outstanding 30,800 shares Retained Earnings 53,400 171,280 TOTAL LIABILITIES + SH EQUITY 299,280 454,69 Notes: Interest on NP is paid each Dec. 31 at 3% All sales are on account and Inv. Is purchased on account Income taxes are paid 3-1 of each yr & accrued at yr. end. All expenses are paid in cash and Dividends are pd Dec. 31

DAILY BIKE SHOP INCOME STATEMENT For the Year ended December 31, 2019 Net Sales Cost of Goods Sold Gross Profit on Sales 500,000 (216,000) 284,000 24,000 38,000 800 6,500 3,350 48,650 Selling Expenses: Administrative Expenses: Salaries, office and general Insurance Expense Rent Expense Depreciation Expense Total Administrative Expenses Total Selling and Admin. Expenses Income from Operations Other Expenses and Losses: Interest Expense Income before Income taxes Income taxes (24%) NET INCOME 72,650 211,350 1.500 209,850 41,970 167,880 STATEMENT OF CHANGES IN RETAINED EARNINGS Retained Earnings, January 1, 2019 Add Net Income for 2019 Less Dividends Paid Cetained Earnings, December 31, 2019 53,400 167,880 (50,000) 171,280 BALANCE SHEET December 31, 2019 2018 6,480 74,000 122,200 2019 139,740 83,000 138,705 Current Assets: Cash Accounts Receivable Inventory Property, Plant & Equipment: Furniture & Equipment less Accumulated Depreciation TOTAL ASSETS 134,000 (37,400) 299,280 134,000 (40,750) 454,695 Current Liabilities: Accounts Payable Income Tax Payable Long-term Liabilities: Notes Payable, due 12-31-2020 25,000 16,880 37,445 41,970 50,000 50,000 154,000 154,000 Stockholder's Equity: Common Stock, $5.00 PV issued and outstanding 30,800 shares Retained Earnings 53,400 171,280 TOTAL LIABILITIES + SH EQUITY 299,280 454,69 Notes: Interest on NP is paid each Dec. 31 at 3% All sales are on account and Inv. Is purchased on account Income taxes are paid 3-1 of each yr & accrued at yr. end. All expenses are paid in cash and Dividends are pd Dec. 31

You are to create summary journal entries for the transacgions that have tajen place during the year 2019. Do not comvine entries for this portion. Make a separate entry for each summary transaction. For instance, When you record expenses, make a separate entry for each expense.

You do not need closing entries. You should have 14 entries (Each entry involves only 2 accounts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started